Judging by the key indexes, it will take far more than the Federal Reserve boosting curiosity costs in the midst of the worst banking mess considering that the 2008 financial disaster for inventory-market place traders to get rid of their cool.

“Investors are broadly assuming that regulators are going to phase in and ringfence the sector if will need be, and that’s what retains it from spilling over to the broader current market,” stated Anastasia Amoroso, chief financial commitment strategist at iCapital, in a mobile phone interview.

There is also a second explanation. Investors see the banking woes forcing the Fed to pause the charge-hike cycle or even start chopping as early as June, she observed. An conclude to the yearlong increase in premiums will take out a source of stress on stock-current market valuations.

But gains last 7 days, which arrived amid volatile trading, aren’t sending an all-apparent sign, stock-marketplace analysts and buyers reported.

Banking worries have not absent away soon after the failure of a few U.S. institutions previously this month and UBS Team AG’s

UBS,

UBSG,

arrangement to obtain troubled Swiss rival Credit Suisse

CS,

CSGN,

in a merger compelled by regulators. Jitters were being on screen Friday when shares of German economic large Deutsche Bank

DB,

DBK,

received drubbed.

It’s the dread of runs on U.S. regional banks that continue to retain investors up at night. Markets could possibly confront a examination Monday if buyers react to Federal Reserve data introduced immediately after Friday’s closing bell showed deposits at compact U.S. financial institutions dropped by a report $119 billion in the weekly interval finished Wednesday, March 15, adhering to Silicon Valley Bank’s collapse the preceding Friday.

That sensitivity to deposits was on display past 7 days. U.S. Treasury Secretary Janet Yellen was blamed for a late Wednesday selloff that saw the Dow conclusion more than 500 factors lower right after she informed lawmakers that her division hadn’t deemed or talked about a blanket guarantee for deposits. On Thursday, she advised Property lawmakers that, “we would be organized to acquire supplemental actions if warranted.”

Deposits are “the epicenter of the crisis of confidence” in U.S. banking companies, said Kristina Hooper, chief worldwide industry strategist at Invesco, in a cell phone interview. Everything that suggests there won’t be complete security for deposits is bound to worry investors in a billed ecosystem.

See: Is the deposit insurance coverage process broken? 9 points you want to know.

Cascading operates on regional banking institutions would stoke fears of more bank failures and the probable for a complete-blown economic crisis, but brief of that, pressure on deposits also underline fears the U.S. financial state is headed for a credit crunch.

Speaking of a credit rating crunch. Deposits throughout banks have been below strain following the Federal Reserve started aggressively raising interest charges roughly a year back. Considering the fact that then, deposits at all domestic financial institutions have fallen by $663 billion, or 3.9{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996}, as dollars flowed into money-sector cash and bonds, observed Paul Ashworth, main North American economist at Money Economics, in a Friday note.

“Unless financial institutions are ready to jack up their deposit premiums to protect against that flight, they will ultimately have to rein in the dimension of their personal loan portfolios, with the ensuing squeeze on economic action yet another reason to count on a economic downturn is coming shortly,” he wrote.

Associated: Lender of The usa identifies the up coming bubble and states traders ought to provide stocks alternatively than purchase them just after the last level improve

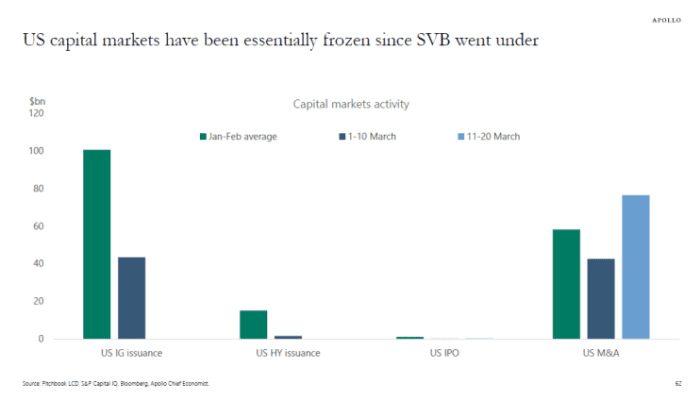

In the meantime, exercise in U.S. capital marketplaces has largely dried up considering the fact that Silicon Valley Bank’s collapse on March 10, noted Torsten Slok, main world wide economist at Apollo World Administration, in a modern take note.

Apollo Worldwide Administration

There was nearly no financial investment-quality or significant-generate debt issuance and no original public choices on U.S. exchanges, whilst merger and acquisition exercise considering the fact that then represents accomplished discounts that were initiated in advance of SVB’s collapse, he claimed (see chart higher than).

“The extended cash marketplaces are shut, and the for a longer time funding spreads for banking companies remain elevated, the more detrimental the affect will be on the broader economic climate,” Slok wrote.

The Dow Jones Industrial Average

DJIA,

rose 1.2{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} previous 7 days, ending a back again-to-again run of declines. The S&P 500

SPX,

rose 1.4{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996}, recouping the massive-cap benchmark’s March losses to transform flat on the month. The Nasdaq Composite

COMP,

noticed a 1.7{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} weekly increase, leaving the tech-large index up 3.2{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} for the thirty day period to day.

Regional lender stocks showed some signals of stability, but have still to begin a significant restoration from steep March losses. The SPDR S&P Regional Banking ETF

KRE,

eked out a .2{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} weekly attain but stays down 29.3{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} in March. KRE’s plunge has taken it back to concentrations past noticed in November 2020.

Glimpse beneath the area, and the stock market place appears “bifurcated,” said Austin Graff, chief investment decision officer and founder of Opal Money.

Much of the resilience in the broader industry is attributable to gains for megacap technology stocks, which have loved a flight-to-basic safety purpose, he said in a phone interview.

The megacap tech-large Nasdaq-100

NDX,

was up 6{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} in March by Friday’s shut, in accordance to FactSet, although regional lender shares dragged on the modest-cap Russell 2000

RUT,

down 8.5{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} more than the very same stretch.

For investors, “the expectation really should be for ongoing volatility for the reason that we do have a lot less money flowing by means of the financial state,” Graff explained. There is additional agony to be felt in highly levered pieces of the economic climate that weren’t ready for the velocity and scope of the Fed’s intense price improves, such as areas like business serious estate that are also having difficulties with the perform-from-residence phenomenon.

Graff has been obtaining businesses in traditionally defensive sectors, this kind of as utilities, purchaser staples and health care, that are anticipated to be resilient in the course of economic downturns.

Study: ‘Some losses’ in industrial serious estate and Treasurys may well continue to want to perform ‘through the banking sector,’ states Fed’s Kashkari

Invesco’s Hooper explained it makes feeling for tactical allocators to situation defensively correct now.

“But I feel there has to be a recognition that if the banking problems that we’re looking at do look to be fixed and the Fed has paused, we are possible to see a current market regime shift…to a extra risk-on ecosystem,” she claimed. That would favor “overweight” positions in equities, together with cyclical and smaller-cap stocks as well as going even more out on the chance spectrum on fastened earnings.

The challenge, she claimed, is the well-regarded issue in timing the sector.

Amoroso at iCapital mentioned a “barbell” technique would let buyers to “get compensated though they wait” by using edge of respectable yields in hard cash, brief- and extensive-expression Treasurys, company bonds and private credit score, when at the similar time using dollar-price tag averaging to consider benefit of possibilities where by valuations have been reset to the draw back.

“It does not experience fantastic for investors, but the actuality is that we’re likely trapped in a slim range for the S&P for a when,” Amoroso stated, “until possibly development breaks to the downside or inflation breaks to the draw back.”