(Bloomberg) — Investors are zeroing in on vital components of the current market for short-phrase greenback borrowing to identify if and how symptoms of systemic anxiety might be emerging after the major US bank collapse in above a decade.

Most Examine from Bloomberg

The failure of Silicon Valley Bank has stirred problem additional banks might also be in danger of a funding shortfall. Still whilst the shares of a range of purportedly at-threat firms these kinds of as To start with Republic Lender and Western Alliance Bancorp have taken a report beating and there have been some noteworthy movements in pieces of funding markets, the broader procedure seems to be holding company for now.

That may possibly alter even though.

Listed here are some of the funding-marketplace indicators to search at for probable indications of tension and locations to be thinking about for attainable knock-on results.

The New Backstop

This past weekend observed US authorities introduce a new backstop for banks that Fed officers explained was massive sufficient to defend the whole nation’s deposits. The Bank Phrase Funding Program lets banking institutions to monetize their underwater keep-to-maturity portfolio without the need of creating losses due to the fact it will offer funding for par worth of securities pledged.

Borrowing from the crisis lender facility will be disclosed weekly in the Fed’s frequent balance sheet update, but particular person borrowers will not be named for two a long time. Use of the Bank Phrase Funding Plan will be revealed every Thursday. Dollars-current market watchers and bank investors will be checking carefully in the coming weeks to see what the just take-up is like, and what that could possibly imply for the process.

The facility will present one-calendar year time period funding at 10 foundation factors over the 1-12 months right away index swap fee, which, in accordance to Wrightson ICAP, is more affordable than what is offered by Federal Home Bank loan Financial institutions, a further critical resource of funding for lenders. If banks migrate to the central financial institution facility, demand from customers for FHLB improvements may perhaps dwindle. Conversely, it’s but to be viewed if individuals regard this new facility as having a stigma, regardless of the comparatively advantageous phrases it presents.

The Discounted Window

1 facility that is typically explained to carry a stigma is the Fed’s so-referred to as price reduction window. Like the new backstop it provides expression funding, but for a shorter time period, furnishing pounds for up to 90 times. Unlike the new facility, the money that debtors have historically gotten is considerably less than 100{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} of the collateral they put up. This so-referred to as haircut is imposed by the Fed to insure alone in opposition to possibility. As part of its most the latest measures, the Fed has also eased terms on the window, though the reputational influence linked with it is likely to persist.

At the finish of 2022, balances at the Fed’s discounted window, commonly a past-vacation resort funding supply, had by now risen to the highest degree considering the fact that June 2020. Blended with an maximize in US banks’ borrowings through other channels, that prompt the deposit reduction was accelerating. Demand from customers did retreat right after that, but there’s a probability usage has given that rebounded on the again of regional lender strains, and all eyes will be on whether or not which is the case.

Standing Repo Facility

A single other facility the Fed has to supply financial institutions with dollars is its standing repo facility, an outlet that will allow approved counterparties to swap Treasuries right away in trade for dollars. The rub with this facility although is that there are only 16 banking institutions eligible to deal with it, none of which are regional ones. Unsurprisingly, with pressures focused on these more compact loan providers, the Fed facility received no bids on Monday.

This facility advanced after financial institution reserves shrank promptly during a earlier episode of Fed harmony-sheet reduction — also known as quantitative tightening. That imbalance in late 2019 sparked upheaval in repo markets and prompted the Fed to restart overnight operations for the initially time considering that the 2008 crisis. Those daily interventions morphed into the SRF, which was officially launched in July 2021 to stop small-expression price marketplaces from blowing up.

Some Wall Avenue strategists were being skeptical that these types of a facility would truly deal with any strains, and the most modern Senior Fiscal Officer survey showed SRF was rated the 2nd to the very least probably to be utilized, subsequent to the price cut window.

Federal Dwelling Personal loan Financial institution Developments

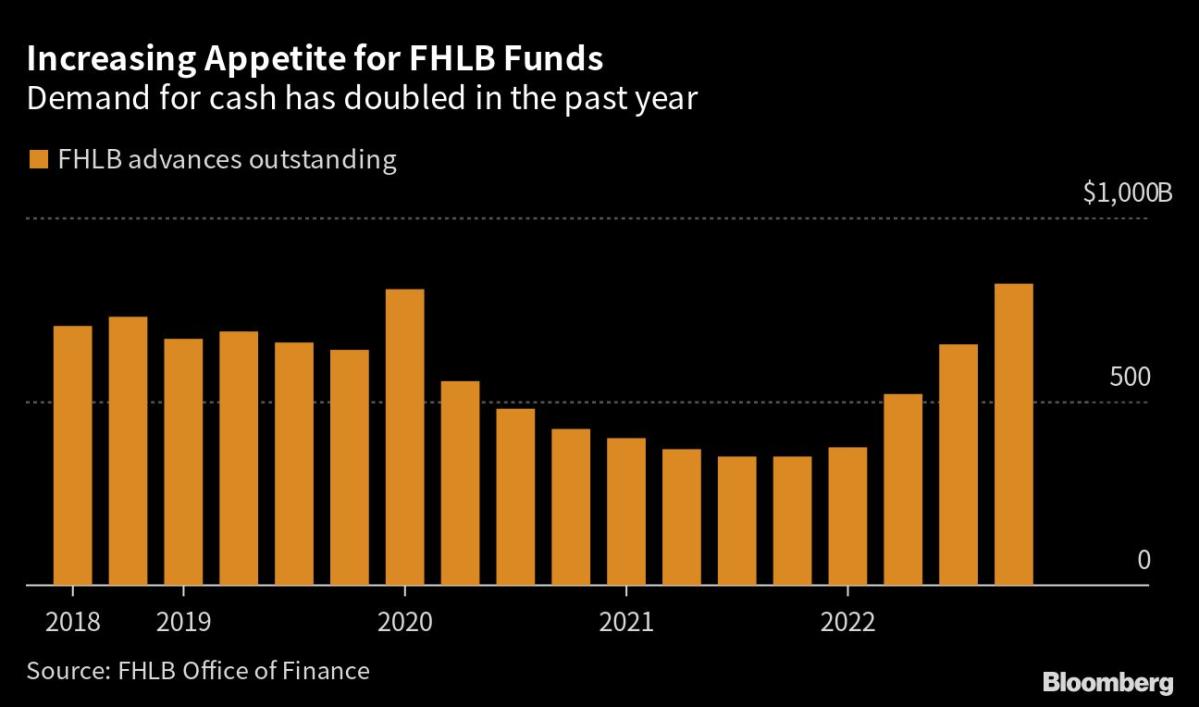

The Federal Household Loan Banking institutions supply funding to professional banking institutions and other members by using so-known as advancements. These are inclined to be small-phrase loans secured by home loans or other property. Banks had minor need to have to resort to this channel when they were flush with funds, but with larger interest charges putting a squeeze on cash, that has shifted. The most recent turmoil has the likely to turbocharge that desire.

In a very abnormal shift, FHLB financial institutions on Monday tapped the floating-rate be aware current market for an extra $88.7 billion to bolster their individual funds pile, suggesting users are now — or quickly will be — clamoring for funding from the institution. That sum came on major of its right away elevating of $67.55 billion, as properly as close to $22.87 billion in expression lower price notes issued by the establishment.

The overall amount of money of innovations to customers, which is revealed quarterly, experienced now more than doubled previous year as the Fed despatched desire rates spiraling better and deposit balances came under strain. They attained $819 billion at the finish of December, earlier mentioned their 2020 pandemic highs, and this newest episode might press them greater still.

Fed Money Industry

The official knowledge for FHLB advances is, regretably, only launched quarterly and with a delay, so on a a lot more serious-time basis traders can only estimate through proxies. A person way to possibly achieve insight is by means of the federal money current market, a person of quite a few avenues that banks can get hold of right away income.

The Federal Property Loan Financial institutions are the major creditors in that current market, allocating extra of their excessive cash into fed resources as opposed to solutions this kind of as the repurchase settlement sector. Lessened action in fed funds could hence be indicative of the establishment corralling cash — which in flip may possibly level to expectations for higher dollar desire by customers.

At the beginning of 2023, trading volumes in the fed resources current market experienced arrived at the optimum stage in at least seven a long time, and were being near to that once more in the middle of very last week. But Friday observed a substantial fall, meaning loan companies in the industry had less bucks to offer.

Bank Reserves

Financial institution reserve stages are one more critical indicator to watch. These have been declining in the course of much of the previous year as the Fed has lifted desire premiums and engaged in harmony-sheet reduction, or quantitative tightening.

The reduction in the Fed’s very own securities holdings has immediately drawn money out of the method, while boosting the attractiveness of income-market place rates relative to banking companies has sapped deposits. The latter is in component mirrored in the increased use of the Fed’s reverse repurchase arrangement facility, an attractive threat-free of charge position for dollars resources to park their pounds.

Recent turmoil all over financial institutions could have the outcome of pushing even a lot more money into income funds, not only for their generate but also their perceived safety, which in turn could exacerbate financial institution funding pressures. Some say that may well compel the Fed to deliver to an conclude its QT software earlier than it experienced intended — in particular if it intends to push on with inflation-busting price hikes.

Limited-Phrase Prices

One particular of the most eye-catching repercussions of the the latest turmoil has been the substantial shifts in prices of limited-time period devices, pushed by a mixture of haven flows and a repricing of expectations of financial policy. The one particular-working day decrease in Treasury two-yr yields for illustration was the greatest due to the fact Paul Volcker was in demand at the Fed, and the sector pricing of central bank policy has been thoroughly upended from the place it was considerably less than a week back.

A lower total level framework could of system reduce some pressures — albeit way too late for the likes of Silicon Valley Bank — but it is how the different styles of quick-term costs review with a person a further that offer an insight into funding strains.

As pointed out above, prices that stay rather significant vs . lender prices could keep on to place tension on deposit flows.

Other fees, in the meantime, are intriguing as likely pressure barometers. The level on overnight normal collateral repo has for now held comparatively constant as opposed with other gauges, suggesting strains continue to be in test, although cross currency foundation swaps have whipsawed to some degree additional. Premiums on professional paper, a variety of company IOUs, have basically been tightening relative to threat-absolutely free alternatives, showing investors nevertheless have pounds they want to set to function.

Broader Monetary Disorders

On leading of all of this is the backdrop of key market turmoil that’s fueled a massive tightening of financial conditions. Lender equity rates have plunged and money credit score spreads have flared wider. A Bloomberg index of money conditions on Monday showed its most important just one-day tightening given that the early months of the Covid pandemic in 2020. The expanding stricture in money marketplaces, in convert feeds again into the authentic financial state and is a main component driving the repricing of Fed expectations. As a end result, the prospect for more plan moves could pretty significantly hinge on whether or not this tightness — and the chance of economic strains — remains entrenched in the sector.

Most Go through from Bloomberg Businessweek

©2023 Bloomberg L.P.