The Federal Reserve’s virtually $9 trillion portfolio is about to be diminished starting up on Wednesday, in a process meant to dietary supplement price hikes and buttress the central bank’s struggle versus inflation.

Even though the precise impression of “quantitative tightening” in economical markets is even now up for discussion, analysts at the Wells Fargo Financial investment Institute and Money Economics concur that it is possible to deliver yet another headwind for stocks. And which is a problem for traders struggling with many dangers to their portfolios at the minute, as governing administration bonds marketed off and shares nursed losses on Tuesday.

In a nutshell, “quantitative tightening” is the opposite of “quantitative easing”: It’s basically a way to lower the funds offer floating all around in the economy and, some say, will help to increase level hikes in a predictable method — although, by how much remains unclear. And it might change out to be everything but as uninteresting as “watching paint dry,” as Janet Yellen described it when she was Fed chair in 2017 — the final time when the central lender initiated a similar course of action.

QT’s major impact is in the monetary markets: It is observed as possible to generate up authentic or inflation-altered yields, which in change makes stocks relatively much less interesting. And it must put upward strain on Treasury time period premia, or the compensation investors have to have for bearing curiosity-amount pitfalls more than the daily life of a bond.

What’s much more, quantitative tightening comes at a time when traders are presently in a really foul mood: Optimism about the quick-phrase path of the stock industry is below 20{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} for the fourth time in 7 months, in accordance to the outcomes of a sentiment study produced Thursday by the American Association of Particular person Traders. Meanwhile, President Joe Biden met with Fed Chairman Jerome Powell Tuesday afternoon to deal with inflation, the subject matter at the forefront of lots of investors’ minds.

Browse: Biden pledges adherence to central-bank independence as he meets with Fed chief Powell and Biden’s assembly on inflation with Fed’s Powell found as ‘good for the president politically’

“I never consider we know the impacts of QT just however, in particular since we haven’t performed this slimming down of the stability sheet considerably in history,” stated Dan Eye, main financial commitment officer of Pittsburgh-centered Fort Pitt Funds Team. ”But it’s a safe and sound guess to say that it pulls liquidity out of the industry, and it is fair to consider that as liquidity is pulled out, it impacts multiples in valuations to some diploma.”

Beginning on Wednesday, the Fed will start out minimizing its holdings of Treasury securities, agency personal debt, and agency house loan-backed securities by a blended $47.5 billion for every thirty day period for the 1st a few months. Immediately after this, the full volume to be minimized goes up to $95 billion a thirty day period, with coverage makers well prepared to adjust their solution as the economic system and economic marketplaces evolve.

The reduction will come about as maturing securities roll off the Fed’s portfolio and proceeds are no for a longer time reinvested. As of September, the rolloffs will be happening at “a substantially faster and additional aggressive” tempo than the procedure which started out in 2017, in accordance to the Wells Fargo Expenditure Institute.

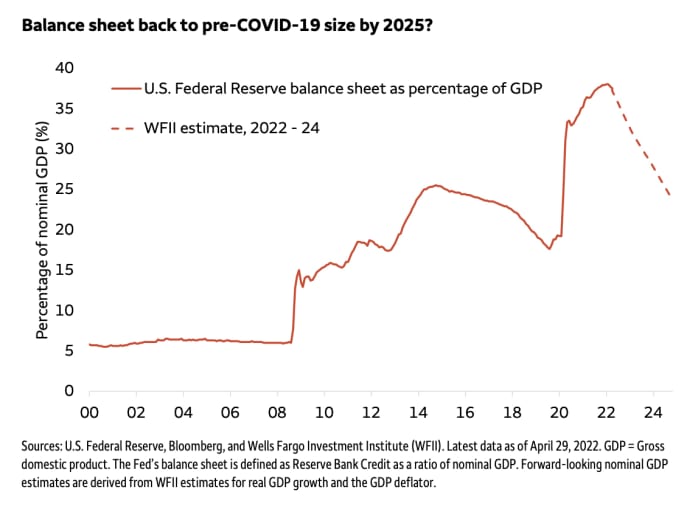

By the institute’s calculations, the Fed’s stability sheet could shrink by nearly $1.5 trillion by the conclusion of 2023, taking it down to close to $7.5 trillion. And if QT continues as predicted, “this $1.5 trillion reduction in the balance sheet could be equivalent to an additional 75 – 100 basis points of tightening,” at a time when the fed-resources charge is expected to be all-around 3.25{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} to 3.5{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996}, the institute claimed in a notice this month.

The goal selection of the fed-money level is at present concerning .75{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} and 1{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996}.

Resources: Federal Reserve, Bloomberg, Wells Fargo Expenditure Institute. Facts as of April 29.

“Quantitative tightening might include to upward force on serious yields,” the institute said. “Along with other forms of tightening in economic conditions, this represents a even more headwind for danger property.”

Andrew Hunter, a senior U.S. economist at Capital Economics, mentioned that “we hope the Fed to lessen its asset holdings by a lot more than $3 trillion over the upcoming few of decades, adequate to convey the balance sheet back again in line with its prepandemic level as a share of GDP.” Though that should not have a significant impression on the economy, the Fed may well quit QT prematurely if financial conditions “sour,” he claimed.

“The main influence will arrive indirectly by using the outcomes on economic conditions, with QT putting upward force on Treasury term rates which, alongside a more slowdown in economic expansion, will increase to the headwinds going through the inventory sector,” Hunter said in a observe. The essential uncertainty is how extended the Fed’s rundown will very last, he mentioned.

On Tuesday, all a few main U.S. inventory indexes completed decrease, with Dow industrials

DJIA,

sliding .7{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996}, the S&P 500

SPX,

down .6{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996}, and the Nasdaq Composite

COMP,

off by .4{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996}. Meanwhile, Treasury yields have been greater as bonds marketed off across the board.