The initial fifty percent of 2022 marked a huge change for buyers and buyers, as inflation reared its unappealing head. It was the worst start off of the 12 months for U.S. stocks because 1970. William Watts appears to be like back again at prior initially-fifty percent bear markets and you may be stunned to see what happened afterward — each individual time.

Meanwhile, Joseph Adinolfi reminds traders to hold an eye on the bond industry, which is flashing a warning indication.

Right here are some more seems to be ahead now that we’re midway via 2022:

Roubini sees it obtaining a lot even worse

Nouriel Roubini argues that central bankers will not have the nerve to keep the class when battling inflation, main to this gloomy consequence.

Can you truly be a contrarian investor?

Getty Images/iStockphoto

Sometimes it would seem as if all people promises to be a contrarian. Mark Hulbert describes what it definitely usually means to go towards the grain and how that imagining can also provide a trace for when the bear current market will conclusion.

Extra from Mark Hulbert:

A contrarian expense contact

Getty Photographs

Typical wisdom is that a combination of increased demand and low money expense by oil producers supports an prolonged interval of high earnings for the electricity sector. But Zach Stein endorses investors promote Exxon Mobil

XOM,

and other oil stocks suitable now. Here’s why.

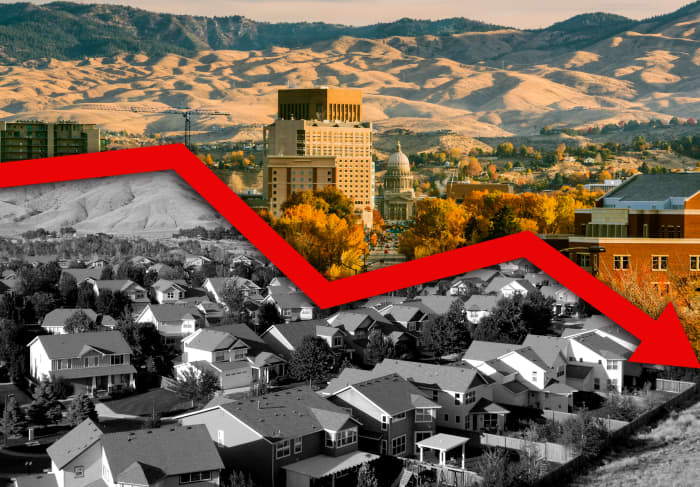

Do you imagine the housing market is cooling off?

MarketWatch image illustration/iStockphoto

Interest fees on 30-yr mortgage loan financial loans have approximately doubled during 2022, making households even a lot more tricky to afford. These housing markets are most at threat.

On the other hand: Serious-estate agents explain chaotic bidding wars in New York City’s crimson-hot rental industry

Dividend stocks screened by a quite professional investor

Getty Photos

Lewis Altfest has had a prolonged vocation running cash for personal shoppers. Right here are some of his text of wisdom and his strategies for a screen of dividend stocks for good quality.

This offer lack may perhaps lastly be coming to an stop

Therese Poletti reads across the semiconductor market in the wake of a dour forecast from Micron.

Take into consideration some unique financial commitment procedures

Common/Courtesy Everett Assortment

It is effortless and low-priced to use an index fund to track the performance of the S&P 500

SPX,

But it could not be the best strategy for you. Paul Merriman normally takes a excursion through time to see how the S&P 500 has stacked up with four other wide strategies.

An additional glance forward — for individuals on Social Stability

Here’s how much you can anticipate your Social Protection payments to go up in 2023.

Prepare yourself — study about Medicare ahead of you want it

Here’s what Medicare does not include.

How about 210 Huge Macs with your Tour de France?

This year’s Tour de France has begun.

Agence France-Presse/Getty Pictures

John Eric Goff, a sports activities physicist, breaks down some shocking numbers about how much electrical power — and how significantly food — it requires a world-class athlete to compete in the Tour de France.

Want more from MarketWatch? Indication up for this and other newsletters, and get the latest news, individual finance and investing information.