A new report from Boston-dependent fiscal markets researcher Cerulli Associates discovered that allocations to specific substitute investment merchandise ticked up sharply this calendar year and that alternative techniques stay top of mind for extra advisors as equity and bond exposures are buffeted by inflation, increasing desire rates and geopolitical turmoil.

Advisor respondents mentioned they allocated an ordinary of 14.5{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} to choice investments in 2022, with plans to raise that allocation to 17.5{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} above two several years. This is up from 10.5{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} in 2021, but Cerulli scientists noted that the pool of respondents was most likely skewed in the two cases towards advisors who currently invest in options and that the real allocation to commodities and other possibilities is presently closer to 10{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} across the industry. Even so, the study still indicates considerable growth next many years of relative inertia.

“Cerulli sees the recent market place ecosystem as a Goldilocks minute for option financial commitment distribution,” the report claimed. “Demand for earnings, inflation security, improved returns, and volatility dampening is coinciding with an increase in supply of goods that can help direct to these respective outcomes.”

Produced in partnership with Blue Vault, an options schooling useful resource for advisors, the choices-concentrated financial investment study was based mostly on a survey of 100 advisors—primarily at unbiased broker/dealers—and interviews with business experts.

Virag Shah, portfolio strategist at Van Leeuwen and Co., a $317 million registered financial commitment advisor centered in Princeton, N.J., said his firm amplified alternate allocations previously this year. “We included commodities,” he stated. “Not just power or oil, but a lot more wide, standard commodities these as metals and agriculture. We added individuals to the portfolio combine along with other items that we previously had formerly.” Shah approximated that, under existing marketplace ailments, firms really should be allocating at minimum 15{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} of their portfolio to alternate tactics to see any significant gains.

The scenario is “getting stronger and much better,” he mentioned, to abandon the longstanding 60/40 portfolio allocation standard—one to which Van Leeuwen has under no circumstances adhered.

Minimizing exposure to public markets was advisors’ best purpose for making use of option financial investment merchandise in 2022, cited by 69{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} of respondents, with volatility dampening and downside hazard defense a near second with 66{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} of advisors. Other described targets contain money generation, portfolio diversification, increased returns, inflation hedging, demonstrating their own observe value propositions and responding to client requests.

“Wealth advisors are remaining reminded that it’s sensible to undertake an overall investment method of using broad diversification, which includes market place non-correlation techniques,” said Stacy Chitty, controlling husband or wife at Blue Vault.

“Advisors are increasingly knowledgeable of these product or service choices as a wave of the two classic and choice managers construct out capabilities and wholesalers access out to make clear the benefits of the exposures,” according to Cerulli Director Daniil Shapiro, who coauthored the report with Cerulli Analyst Wenyi Wei.

Across expense buildings, liquid choice mutual funds continue being the most well-liked, made use of by 68{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} of advisors, followed by nontraded REITs (61{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996}) and liquid choice ETFs (54{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996}). Extra than 50 {21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} of responding advisors stated that the illiquidity of other choice products is unsuitable for their purchasers, though also citing products complexity and high administration expenses as their best obstacles to investing in options with severely restricted liquidity. But curiosity in semiliquid selections saw a sharp increase in 2021.

“Liquid solutions will continue to be a welcoming entry level,” mentioned Shapiro. But, he added, “tremendous opportunity exists for a lot less liquid solutions.”

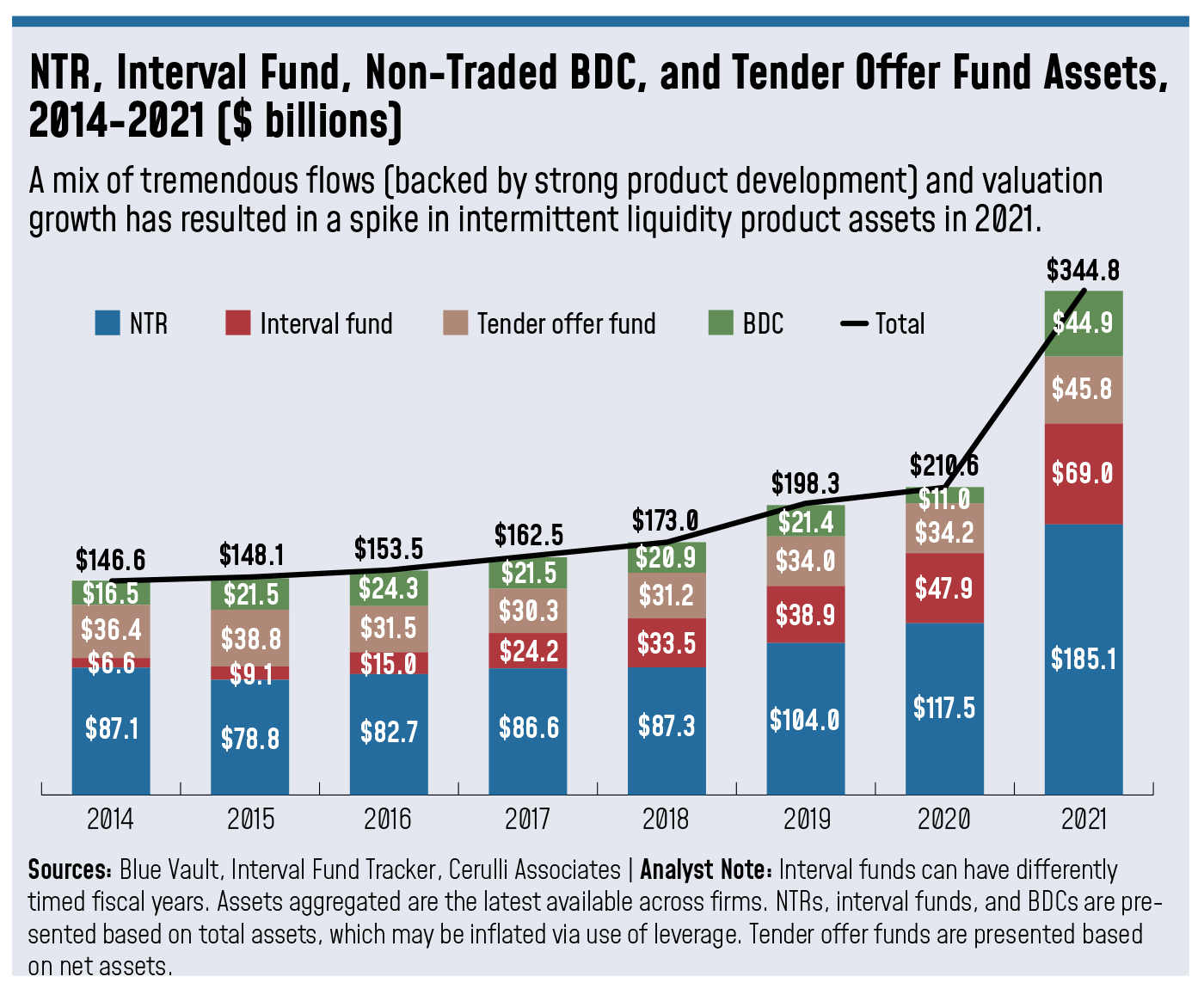

Intermittent liquidity product allocations—to nontraded REITs, interval cash, nontraded company development organizations and tender offer you fund property—saw a 63.7{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} calendar year-about-yr improve in 2021, rising from $210.6 billion to $344.8 billion immediately after remaining beneath $200 billion while the previous 10 years.

A new generation of intermittent liquidity products and solutions is proving additional palatable to advisors than an earlier crop that observed temporary growth next the very last sector crisis, according to the report. This is because of to a few major aspects: crucial M&A transactions (these types of as Franklin Templeton’s acquisitions of Benefit Avenue Companions and Alcentra and Apollo’s acquisition of Griffin Funds) product developments with enhanced consistency, performance and payment constructions and improvements in the distribution landscape, including the expansion of option financial commitment platforms these types of as CAIS and iCapital. Goods from trustworthy asset professionals these as Blackstone, KKR and Apollo are also lending to their escalating acceptance, Cerulli observed.

“Clearly, there is a marketplace prospect for products and solutions that present something concerning the extended-time period lockups of institutionally oriented constructions and the daily liquidity of most stock and bond funds,” stated Shapiro. “Cerulli believes there is a remarkable chance listed here.”

Van Leeuwen’s Shah agrees that intermittent liquidity items have been underrepresented in the industry and are established to see ongoing development above the subsequent five years. “A great deal of folks do not really know that market place that properly still,” he claimed. “I imagine there is a good deal of expansion prospect accessible down the highway.” He mentioned that he would individually like to see additional alternate options offer restricted liquidity, outside the house of the much more frequent real estate vehicles.

When the out there intermittent liquidity solutions have enhanced and “indeed show up to have strike their stride for investor portfolios,” Cerulli continue to suggests watchful analysis of all choice expenditure opportunities to establish suitability and insists that they not be viewed “as a panacea.”

“Firms looking to allocate much more to possibilities will require to be well prepared for special distribution challenges and have specialised personnel on hand to realize these products and solutions and their healthy within portfolios,” reported Shapiro.