Beijing Stock Trade Image:Chi Jingyi/GT

Beijing is eyeing a greater role as the country’s financial management middle, as the Chinese capital, which hosts its very own stock trade and fiscal court, seeks to broaden its features over and above getting the national political heart, regulatory authorities and economic marketplace insiders stated on Wednesday at the conclusion of a keenly watched monetary forum.

In a speech to the Economic Street Forum 2022, an eponymous collecting of the Beijing Economical Avenue, Li Wenhong, director of the Beijing Regional Economical Supervision and Administration, disclosed programs to increase the capital’s role as the nationwide monetary management heart.

That suggests Beijing will ramp up its companies to aid the implementation of main money approaches and guidelines, and participate in a better part in fiscal determination-making, standard location, financial laws, payments and settlements, statistical publications, and worldwide cooperation and monetary protection, among its other functionalities, Li claimed.

In addition, the money envisions heavier clout as a money sector, she ongoing, citing the just one-calendar year-aged Beijing Inventory Exchange (BSE), which has turn out to be an vital component of initiatives to establish Beijing as the national fiscal management center.

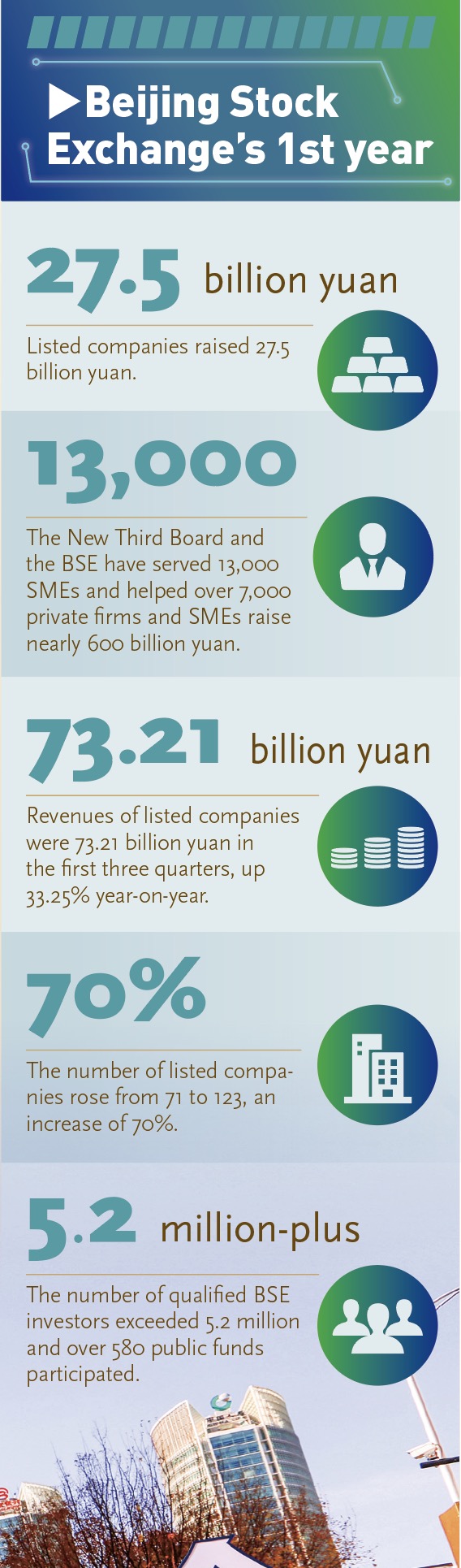

Organizations detailed on BSE elevated 27.5 billion yuan ($3.84 billion) in whole since the bourse started trading in November 2021, or 210 million yuan each and every, properly conference the capital requires of compact and medium-sized corporations, Shang Qingjun, an formal of the China Securities Regulatory Fee, disclosed at the forum on Wednesday.

“We’ll assistance the BSE in expanding its transaction scale, enriching buying and selling portfolios, and strengthening current market liquidity and vitality,” Li reported.

Graphic: GT

On top rated of that, the cash will continue to aid financial opening-up, for there to be a reasonable, open, transparent, secure and predictable organization environment for each domestic and overseas fiscal establishments.

Qian Yujun, president of UBS China and chairman of UBS Securities, stated Wednesday at the forum that as a massive selection of overseas and domestic financial establishments are situated in Beijing, it has very long turn out to be China’s countrywide money management heart, enterprise numerous missions including asset administration, market functions, money, payments and settlements, and so forth.

The a few-working day discussion board, which ended on Wednesday, was also in celebration of the 30th anniversary of the Beijing Financial Road.

“The 30 many years of Beijing Economical Street’s improvement has been a method of embracing opening-up and innovation repeatedly,” Qian explained to the forum, introducing that it is also important for China to nurture the regulations and concepts of a experienced marketplace, push positive competition, and use opening-up policies to advertise reforms. “We are completely self-confident of the Chinese market’s improvement,” he reported.

Given that its establishment in 1992, the Beijing Economic Avenue has steadily embraced fiscal management departments less than the Condition Council, massive fiscal establishments, important economic infrastructure facilities and market associations.

The avenue, covering an region of just 2.69 square kilometers, is the critical to accommodating the nationwide monetary administration centre, in accordance to Li.

Beijing’s whole fiscal assets have soared to 190 trillion yuan from 85 trillion yuan about the previous decade, and the economical industry has turn out to be the best pillar sector of the capital’s economic system, formal info showed.

“Setting up a nationwide economical administration centre is a essential method lifted in China, combining state-of-the-art intercontinental knowledge and China’s possess condition. It is of good importance to enhancing China’s financial administration abilities, bettering its economical governance program as nicely as coordinating growth and protection,” Zhang Weiwu, deputy head of the Industrial and Business Financial institution of China (ICBC), said at the closing ceremony of the Beijing discussion board on Wednesday.

According to Zhang, on the a person hand, the national economical management heart is an extension of Beijing as China’s political heart, which performed a essential part in maximizing China’s core competence and stabilizing security. On the other hand, the heart also undertook an important mission in constructing a modernized money technique and employing China’s mission of money opening-up, Zhang famous.

A report on the growth of the Beijing Financial Street, which was launched for the duration of the discussion board, lifted 7 recommendations for greater developing the Beijing Monetary Street as China’s countrywide economic administration center.

The solutions consist of perfecting financial infrastructural construction, directing finance to provide the genuine economic climate and bettering the small business natural environment.

Zhang also stated that the ICBC would support the building of the national economic administration centre from several views, these kinds of as top the digital up grade of monetary merchandise and expert services, as effectively as strengthening normalized inter-banking cooperative mechanisms together the Belt and Road Initiative routes.

Beijing has the probable to build into one more world money hub in China, although it really should have a unique point of concentrate than Shanghai, remarked Dong Shaopeng, a senior exploration fellow at the Chongyang Institute for Monetary Scientific studies at Renmin University of China.

“Beijing is like China’s financial mind with the cluster of regulatory departments, R&D facilities and consider tanks, while Shanghai is characterized by frontier fiscal current market actions,” Dong informed the World Situations on Wednesday, incorporating that Beijing has benefits in coverage sensitivity and strategic responsiveness.