The Russian invasion of Ukraine increased uncertainty all around the environment. Even though most U.S. companies have minimal direct exposure to Ukrainian and Russian trading associates, increased world wide uncertainty may still have an indirect result on funding circumstances through tightening monetary situations. In this publish, we take a look at how ailments in the U.S. corporate bond market place have developed since the start out of the yr by way of the lens of the U.S. Company Bond Sector Distress Index (CMDI). As described in a previous Liberty Road Economics post, the index quantifies joint dislocations in the main and secondary corporate bond marketplaces and can therefore serve as an early warning signal to detect economical market dysfunction. The index has risen sharply from traditionally reduced concentrations just before the invasion of Ukraine, peaking on March 19, but seems to have stabilized all over the median historic amount.

CMDI Is a Unified Measure of Market Performing

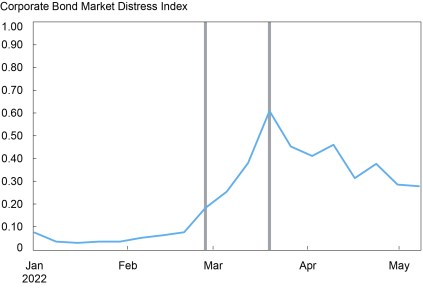

The CMDI brings together information and facts on various elements of working of both equally the most important and secondary markets for U.S. corporate bonds into a single metric, as described in element in our staff members report. Ranging from to 1, a better level of CMDI corresponds with traditionally severe amounts of dislocation. The chart beneath plots the evolution of the CMDI given that the start of the 12 months, with occasion traces at February 24 (the start of the invasion of Ukraine) and March 16 (date of the March Federal Open Current market Committee [FOMC] assembly at which the goal array of the federal funds level was lifted for the to start with time considering that 2019). The CMDI begun 2022 at historically reduced levels—below the fifth percentile—suggesting that disorders in both main and secondary markets for company bonds had been at traditionally accommodative stages. The chart reveals that the rise in world wide uncertainty precipitated by the invasion of Ukraine corresponded to a speedy increase in the CMDI, which peaked at the sixty-first percentile in the 7 days ending on March 19 but has subsequently retraced to the 20-3rd percentile in the 7 days ending on May perhaps 28.

The CMDI elevated swiftly next invasion of Ukraine but has considering the fact that stabilized

Notes: CMDI is Corporate Bond Industry Distress Index. The party line on February 24 corresponds to the commence of the Russian invasion of Ukraine and the one for March 16 corresponds to the date of the March Federal Open Industry Committee meeting.

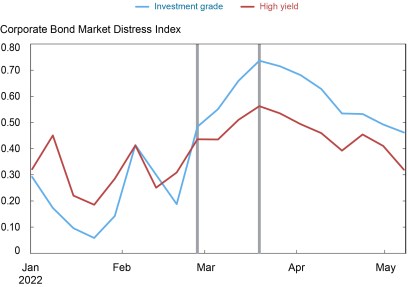

In addition to analyzing how circumstances have transformed in the company bond market in general, we can also evaluate the differential changes in ailments for expenditure-quality bonds—that is, individuals rated Baa-/BBB- or above—and large-yield bonds. The future chart reveals that market place performing deteriorated substantially much more for investment-grade bonds, peaking at the seventy-fourth percentile in the week ending on March 19. When the will increase in world wide uncertainty coincided with financial plan tightening, the larger sized deterioration in industry working for expense-quality bonds is suggestive that uncertainty might have performed a larger position than monetary coverage in the evolution of operating for the general market place. Market conditions for higher-rated corporate bonds are much less sensitive to adjustments in monetary policy than all those for higher-yield bonds for illustration, mainly because the typical maturity for substantial-generate bonds is shorter—increasing the probability that superior-yield issuances will be refinanced at greater desire rates.

Industry operating deteriorated more rapidly for expenditure-grade bonds

Notes: CMDI is Corporate Bond Industry Distress Index. The event line on February 24 corresponds to the get started of the Russian invasion of Ukraine and the one particular for March 16 corresponds to the day of the March Federal Open Sector Committee conference.

What Is Driving the Modern Movements in the CMDI?

To further more understand what has been driving the current variations in the CMDI, we turn to the contributions from the six underlying sub-indices—secondary market quantity, secondary market liquidity, secondary marketplace period-matched spreads, secondary marketplace default-adjusted spreads, most important market place issuance, and the unfold concerning most important and secondary marketplace pricing—to the stage of the CMDI-squared. The way the CMDI is built, the square of the index can be prepared as the sum of contributions from the particular person sub-indices. The future chart shows that, even though a slowdown in issuance was the most visible contributor to the degree of the CMDI at the beginning of 2022, the deterioration subsequent the February 24 invasion of Ukraine can be in the beginning attributed to buying and selling conditions in the secondary sector, with a decline in average trade dimension and the acquire-offer ratio and an raise in turnover. The peak in the week ending on March 19 coincided with a deterioration in the default-altered spread sub-index, suggesting bigger risk compensation for bearing default possibility, and a deterioration in the spread involving principal and secondary current market pricing, suggesting a decreased willingness by market place participants to intermediate in the key current market for U.S. corporate credit card debt.

Both key and secondary sector circumstances drive alterations in the CMDI

Notes: This chart illustrates contributions from the six underlying sub-indices of the Corporate Bond Industry Distress Index (CMDI)—secondary current market volume, secondary market place liquidity, secondary marketplace duration-matched spreads, secondary market default-modified spreads, primary market place issuance, and the spread in between principal and secondary current market pricing (PM-SM spread)—to the amount of the CMDI-squared.

Total, this chart highlights the wealth of details encoded in the CMDI. By combining facts from equally the most important and the secondary market, the CMDI is greater capable to seize the general sector functioning. Deteriorations in the CMDI are not pushed by secondary sector credit rating spreads or secondary current market liquidity alone but fairly reflect the stability of problems in both the most important and the secondary sector.

Financial Plan Tightening and Company Bond Industry Conditions

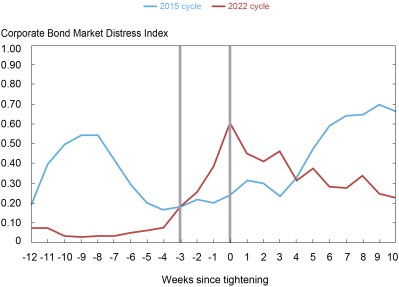

Even though we have concentrated so considerably on the prospective impression of the rise of world uncertainty, the stance of monetary policy and current market participants’ perceptions of the stance of financial policy have also shifted in the course of this interval. The FOMC voted to raise the target array for the federal cash amount at the March 15-16 FOMC meeting and fiscal sector members foresee ongoing charge will increase about coming FOMC conferences (see listed here). A normal concern to ask in this context is how much of the improvements in the CMDI can be attributed to financial plan somewhat than global uncertainty. The charts earlier mentioned present that the working of financial investment-grade industry deteriorated additional speedily than that of the significant-generate industry, and that the original deteriorations in the over-all index had been mainly driven by measures of secondary marketplace quantity somewhat than spreads, equally of which advise that at minimum the preliminary deterioration of sector performing amongst February 19 and March 19 is unlikely to have been driven by financial coverage. An alternative approach to analyzing this problem is to examine the latest evolution in the CMDI to the evolution in the CMDI more than a similar time period preceding the December 15-16, 2015, FOMC meeting—the begin of the preceding tightening cycle. The up coming chart displays that the CMDI was essentially declining ahead of the December 2015 FOMC assembly, supplying further suggestive evidence that the anticipation of tighter financial plan does not always translate into an quick deterioration of company bond sector performing.

The CMDI has not had an outsized response to financial plan tightening

Notes: This chart illustrates the new evolution in the Corporate Bond Market place Distress Index (CMDI) to the evolution in the CMDI over a equivalent period of time preceding the December 2015 Federal Open up Marketplace Committee assembly.

All Quiet on the Company Bond Market Front?

While the CMDI has retraced to some degree from its March 19 significant, it stays noticeably above its typical 2021 degrees. In other text, when the corporate bond industry proceeds to purpose at historically common amounts, current market operating has deteriorated relative to the modern earlier. It is so significant to go on to monitor problems in this market as equally the geopolitical predicament and the financial coverage tightening cycle evolve. As demonstrated in the personnel report, the CMDI generally supplies a a lot more timely sign of rapidly deteriorating situations than any of its particular person fundamental metrics or, indeed, other usually utilized metrics of financial distress, this sort of as the VIX.

Nina Boyarchenko is the head of Macrofinance Reports in the Federal Reserve Lender of New York’s Exploration and Statistics Team.

Richard K. Crump is a fiscal investigation advisor in the Bank’s Study and Figures Team.

Anna Kovner is the director of Economic Steadiness Policy Analysis in the Bank’s Investigation and Statistics Team.

Or Shachar is a economic economist in the Bank’s Research and Statistics Group.

How to cite this publish:

Nina Boyarchenko, Richard Crump, Anna Kovner, and Or Shachar, “How Is the Company Bond Sector Responding to Financial Industry Volatility?,” Federal Reserve Lender of New York Liberty Street Economics, June 1, 2022. https://libertystreeteconomics.newyorkfed.org/2022/06/how-is-the-corporate-bond-marketplace-responding-to-economical-sector-volatility/

Disclaimer

The views expressed in this put up are individuals of the author(s) and do not always mirror the posture of the Federal Reserve Financial institution of New York or the Federal Reserve System. Any glitches or omissions are the obligation of the creator(s).