*FG raises N4.7 trillion as corporates elevate N802 bn YtD

*Analysts advise possibilities on personal sector debt cash

*Danger of sovereign default, financial nightmares rising, use of debt as funding instrument careless — Experts

By Peter Egwuatu

Indications have emerged that the Federal Government’s bond challenges are squeezing the private sector out of the bonds marketplace as it has lifted more than N4.7 trillion, much earlier mentioned what private sector organisations have been equipped to raise from the Nigerian funds market, Year-to-Day, YtD August 2021.

The private sector lifted N802 billion in corporate bonds from the money industry for the very same period of time.

For that reason, analysts and capital current market operators have criticised government’s abnormal borrowing from both inner and global markets without thinking about the revenue to provider the debt even as it has attained the alarming place of crowding out the effective authentic sector.

Browse ALSO: Makurdi inhabitants, business entrepreneurs groan over 4 months electricity outage

Analysts posited that the crowding out result on the personal sector poses grave hazard to the potential of the true sector to generate wealth and make effective work. They thus advocated small interest fee surroundings for the non-public sector to be encouraged to increase financial debt capital (company bonds).

Sukuk, Eco-friendly, Euro bonds

Meanwhile, the Federal Governing administration had issued Sukuk bond, Green bond and Eurobond. Federal Federal government bonds are the most liquid and capitalized bonds on the Nigerian Trade Restricted, NGX.

The Federal Government issues bonds in the primary market via the Personal debt Management Office environment, DMO at its month to month auctions and these bonds are subsequently detailed on the exchange for buying and selling.

These bonds are backed by the whole religion and credit rating of the Federal Authorities of Nigeria and are semi-yearly, coupon-paying bonds. Revenue attained on FGN Bonds is tax-totally free.

Money Vanguard findings from data received from NGX showed that the Federal Govt had raised more than N4.7 billion which had been detailed on the trade, Year to Date, YtD, August 2021though about N802 billion of corporate bonds in various groups had been lifted and shown accordingly.

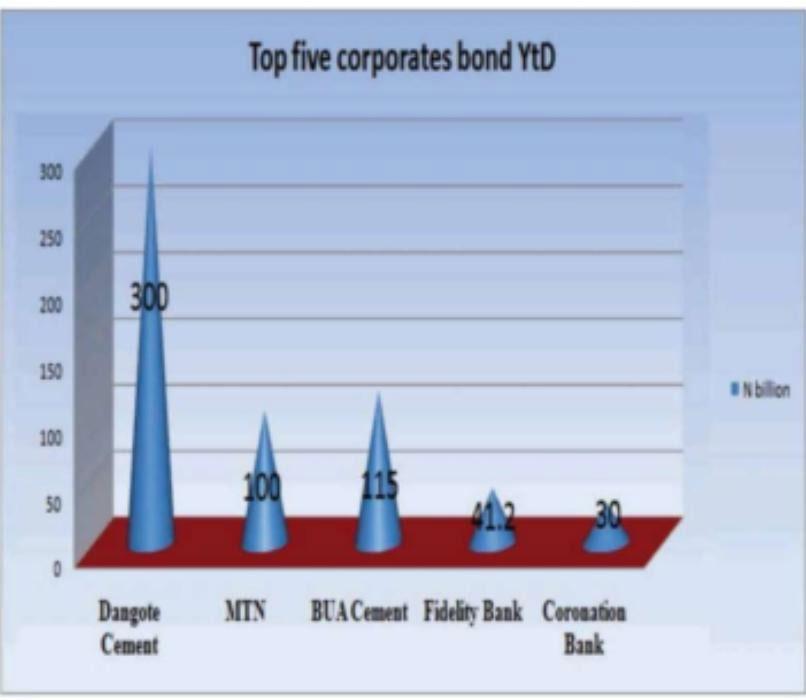

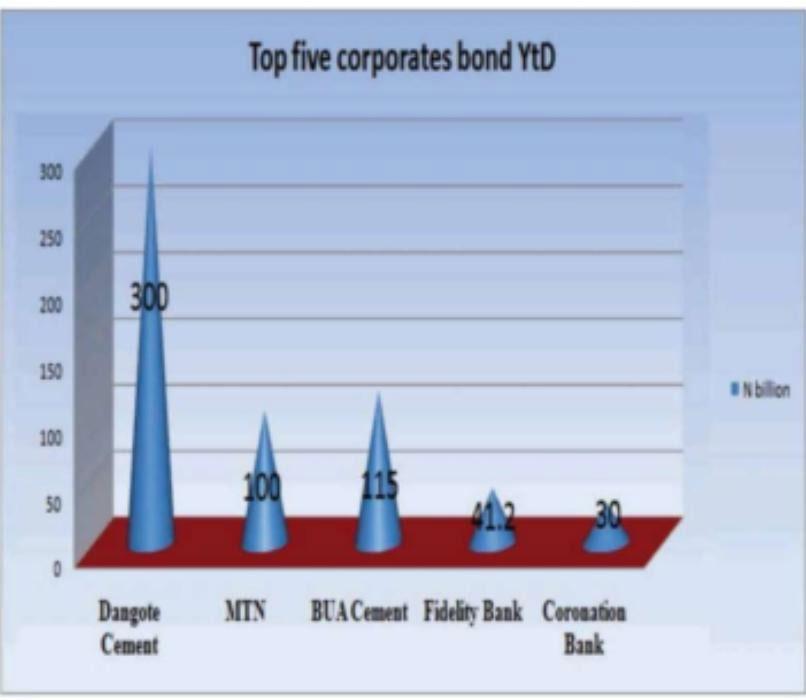

The many firms that have taken advantage of the low overall performance in the fixed income sector to raise bonds at prices underneath 10 per cent to the tune of N802 billion features 3 issuers particularly, Dangote Cement Plc, N300 billion MTN Nigeria Plc, N100 billion and BUA Cement Plc, N115 billion. They lifted more than 60 per ent of the overall bond raised in the current market.

Other issuers incorporate Fidelity Lender Plc which raised N41.213 billion Flour Mills of Nigeria Plc elevated N29.8 billion Nova Service provider Bank lifted N10 billion Emzor Pharmaceuticals raised N13.7 billion whilst Mecure Industries accessed the sector for N3 billion.

Other individuals are CardinalStone Financing SPV Plc which lifted N5 billion C& I Leasing Plc (N10 billion) CERPAC (N15 billion), and Coronation Service provider Lender, N30 billion.

Analysts, industry operators react

Reacting, analysts and Vice Chairman, Highcap Securities Confined, David Adonri claimed: “Both externally and internally, authorities has taken and is still getting additional debt. This is growing the hazard of sovereign default and economic nightmares.

“The hard currency earning capability of Nigeria may perhaps also not be enough, now and in near foreseeable future, to empower government services mounting international credit card debt.”

Lamenting the crowding out impact of government borrowing, Adonri reported: “Internally, the borrowing has now attained the alarming level of crowding out the productive true sector.

This poses grave danger to the capacity of the actual sector to generate prosperity and create effective employment. In just about every capitalist overall economy like ours, federal government has most important obligation via insurance policies and actions to protect against any crowding out effect and to ensure larger funds formation by the non-public, productive genuine sector.

“Excessive borrowing by this authorities at the cost of the private sector which is the engine place of the financial state, delivers to concern the soundness of their economic system.”

On credit card debt servicing, he stated: “The careless use of personal debt as a financing device is fraught with calamitous risks. Even far more disheartening is when the money owed are principally made use of to finance intake or to unwisely finance couple secondary infrastructure (streets and rail).

“These will neither increase the effective momentum of Nigeria’s light-weight industries nor make the economic climate self-reliant. The disorderly progress of the financial state this administration is pursuing can only mislead the country into an abyss if general public borrowing is not curtailed to reduce value of resources so that generation will be competitive.”

“Nigerian authorities is reckless in its monetary administration. Their expenditure is considerably outside of revenues and safe personal debt degree.

“If they do not retrace their steps by instituting prudent fiscal management and also boost advancement of primary infrastructure ie, engineering infrastructure (specialized instruction, metallurgical marketplace, electric electrical power industry, chemical field and modern day strength field), as a result of private sector initiative, the only outcome will be continuation of economic wailings” he observed.

Analyst and Head of Investigate and Financial commitment at Fidelity Securities Minimal, FSL, Victor Chiazor, claimed: “The Federal Governing administration will go on to lead in conditions of boosting debt money provided the fascination price environment in the country.

“Private sector borrowing does not prosper underneath significant fascination charge surroundings as this sort of borrowings most occasions develop into harmful for their small business. The desire price setting desires to be lower for the personal sector to be inspired to raise credit card debt cash.

“This expansionary evaluate will also make improvements to economic actions as the economic system will reward from higher level of business enterprise things to do as towards when firms are unable to elevate essential funds to mature their corporations for the reason that of the worry of getting not able to meet up with financial debt obligations.”

In his very own comment, analysts and Running Director, APT Securities & Fund Minimal, Mallam Garba Kurfi stated:

“The marketplace is large ample to accommodate both. Do not neglect PFAs take care of around N13 trillion which are all set to invest. I even now believe the point out governments are cost-free to check out the current market or Planet Lender for funds, specifically for improvement.

“Kaduna State has performed exact same and appear at the progress likely on. Lagos Point out has frequented the market for a state bond.

The economic system is sensation the strain as the Gross Domestic Product, GDP half-yr rise to five per cent. Without having borrowing the overall economy will not recuperate speedy.“

Reacting as perfectly, analysts and Chief Functioning Officer, InvestData Consulting Restricted, Ambrose Omorodion claimed: “From my have see, the market is to provider the federal government and non-public sector, govt crowding out private sector because of to their big and continued borrowing domestically and internationally is not superior but borrowing at a reduced fee is opportunity for the non-public sector to technique the current market for money but lots of are not getting gain of this.

If the federal government lowers its borrowing prices to handle the large charge of servicing personal debt, cash will circulation to equity area in lookup of improved returns, especially as these companies’ earnings are becoming more robust to aid share selling price and payout at the conclude of the working day.”