(Bloomberg) — Financial institution of Japan Governor Haruhiko Kuroda improved the program of world-wide markets when he unleashed a $3.4 trillion firehose of Japanese cash on the financial investment earth. Now Kazuo Ueda is possible to dismantle his legacy, environment the phase for a movement reversal that risks sending shockwaves by way of the international financial state.

Most Go through from Bloomberg

Just about a 7 days ahead of a momentous management modify at the BOJ, investors are gearing up for the seemingly inescapable finish to a 10 years of ultra-low fascination charges that punished domestic savers and despatched a wall of money overseas. The exodus accelerated following Kuroda moved to suppress bond yields in 2016, culminating in a mountain of offshore investments well worth extra than two-thirds Japan’s economy.

All this dangers unraveling less than the new governor Ueda, who may possibly have little alternative but to finish the world’s boldest effortless-funds experiment just as soaring curiosity fees somewhere else are by now jolting the worldwide banking sector and threatening economical balance. The stakes are tremendous: Japanese buyers are the major international holders of US government bonds and own every thing from Brazilian credit card debt to European power stations to bundles of risky loans stateside.

An boost in Japan’s borrowing expenses threatens to amplify the swings in world wide bond marketplaces, which are becoming rocked by the Federal Reserve’s year-very long campaign to fight inflation and the new hazard of a credit rating crunch. From this backdrop, tighter financial plan by the BOJ is likely to intensify scrutiny of its country’s creditors in the wake of the latest bank turmoil in the US and Europe.

A transform in policy in Japan is “an more force that is not currently being appreciated” and “all G-3 economies in a single way or the other will be reducing their stability sheets and tightening policy” when it transpires, mentioned Jean Boivin, head of the BlackRock Expense Institute and former Deputy Governor of the Bank of Canada. “When you handle a selling price and loosen the grip, it can be complicated and messy. We think it is a significant offer what takes place future.”

The circulation reversal is previously underway. Japanese investors sold a document total of abroad financial debt last yr as local yields rose on speculation that the BOJ would normalize policy.

Kuroda included gas to the hearth final December when he relaxed the central bank’s grip on yields by a fraction. In just hours, Japanese federal government bonds plunged and the yen skyrocketed, jolting anything from Treasuries to the Australian dollar.

“You’ve by now found the start of that income being repatriated again to Japan,” said Jeffrey Atherton, portfolio manager at Guy GLG, element of Person Group, the world’s most important publicly traded hedge fund. “It would be logical for them to carry the income dwelling and not to just take the foreign trade threat,” claimed Atherton, who operates the Japan CoreAlpha Fairness Fund which is beaten about 94{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} of its friends in the earlier year.

Coming Home

Bets for a shift in BOJ coverage have eased in the latest days as the upheaval in the banking sector raises the prospect that coverage makers may prioritize economic security. Investor scrutiny of Japanese lenders’ harmony sheets has grown, on worry they may possibly echo some of the stresses that have floored a number of regional US financial institutions.

But market participants assume chatter on BOJ tweaks to resume when tensions dissipate.

Why Japanese Financial institutions Are Well Put to Endure Banking Disaster

Ueda, the to start with at any time educational to captain the BOJ, is largely anticipated to speed up the pace of plan tightening sometime afterwards this yr. Portion of that might include things like further loosening the central bank’s management on yields and unwinding a titanic bond-getting application developed to suppress borrowing costs and enhance Japan’s moribund economic system.

The BOJ has bought 465 trillion yen ($3.55 trillion) of Japanese govt bonds considering that Kuroda carried out quantitative easing a 10 years in the past, in accordance to central lender data, depressing yields and fueling unparalleled distortions in the sovereign financial debt current market. As a final result, area funds sold 206 trillion yen of the securities in the course of the interval to request greater returns in other places.

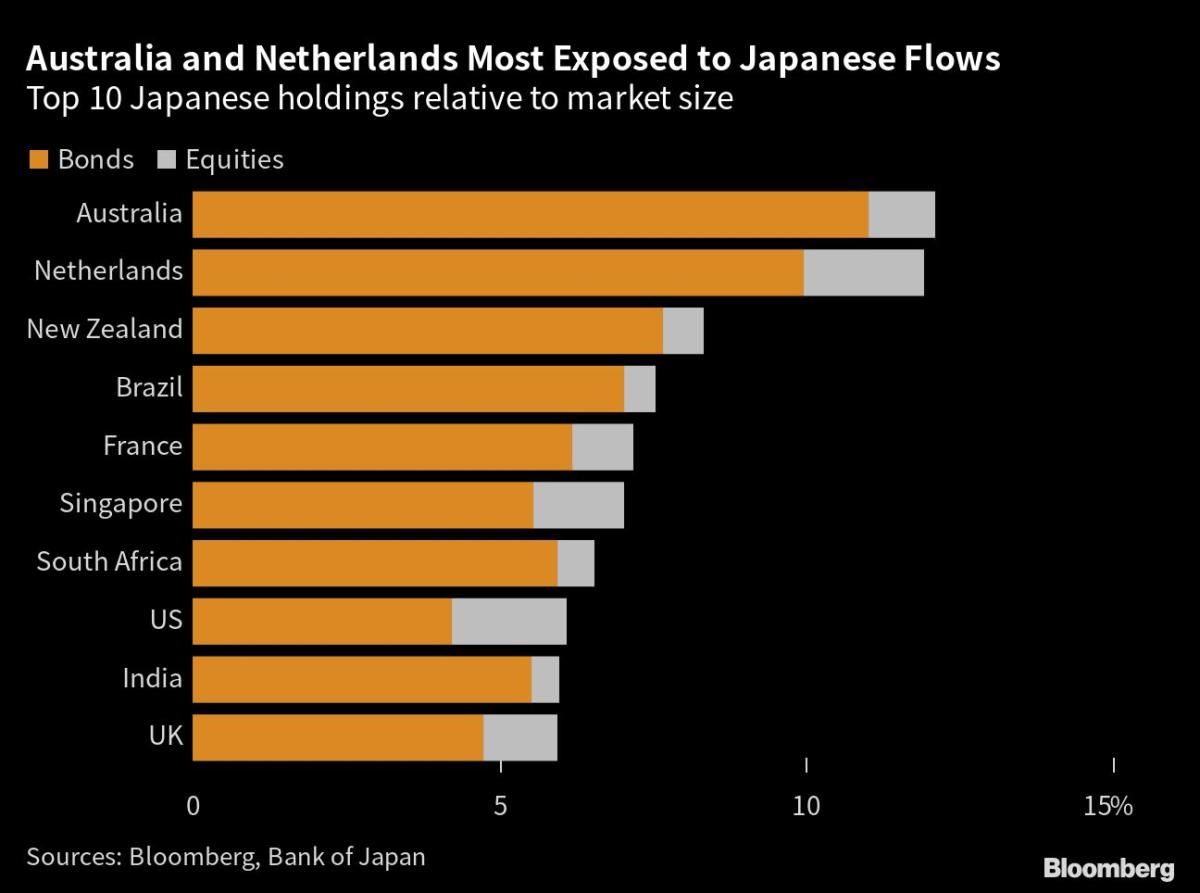

The shift was so seismic that Japanese buyers turned the largest holders of Treasuries exterior the US as perfectly as owners of about 10{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} of Australian debt and Dutch bonds. They also individual 8{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} of New Zealand’s securities and 7{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} of Brazil’s credit card debt, calculations by Bloomberg demonstrate.

The reach extends to stocks, with Japanese investors obtaining splashed out 54.1 trillion yen on worldwide shares since April 2013. Their holdings of equities are equivalent to involving 1{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} and 2{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} of the inventory marketplaces in the US, Netherlands, Singapore and the United kingdom.

Japan’s ultra-minimal charges had been a big reason the yen tumbled to a 32-calendar year reduced previous 12 months, and it has been a top possibility for revenue-searching for carry traders to fund buys of currencies ranging from Brazil’s serious to the Indonesian rupiah.

“Almost undoubtedly it contributed to a substantial drop of the yen, a huge dysfunctioning of the Japanese bond marketplace,” previous British isles govt minister and Goldman Sachs Team Inc. chief economist Jim O’Neill explained of Kuroda’s insurance policies. “Much of what transpired in Kuroda’s time will partially or fully reverse” ought to his successor go after coverage normalization, even though the banking crisis might bring about authorities to move forward a lot more cautiously, he added.

The forex has pulled again from final year’s lows, served by a look at that normalization is inevitable.

Include to that equation previous year’s historic world wide bond losses, and Japanese traders have even additional explanation to flock property, according to Akira Takei, a 36-calendar year industry veteran and dollars supervisor at Asset Management 1 Co.

“Japanese credit card debt investors have had negative encounters outdoors the state in the previous year due to the fact a significant soar in yields pressured them to slice losses, so lots of of them even really do not want to see overseas bonds,” stated Tokyo-based Takei, whose organization oversees $460 billion. “They are now considering that not all funds have to be invested overseas but can be invested locally.”

The incoming president of Dai-ichi Lifestyle Holdings Inc., one of Japan’s major institutional investors, verified it was shifting far more income to domestic bonds from foreign securities, right after aggressive US fee hikes built it highly-priced to hedge towards forex risks.

To be guaranteed, couple are geared up to go all out in betting Ueda will rock the boat when he gets into place of work.

A current Bloomberg survey confirmed 41{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} of BOJ watchers see a tightening action taking place in June, up from 26{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} in February, even though former Japan Vice Finance Minister Eisuke Sakakibara explained the BOJ may possibly raise costs by Oct.

A summary of views from the BOJ’s March 9-10 conference showed the central financial institution remains cautious about executing a policy pivot in advance of achieving its inflation concentrate on. And that was even soon after Japan’s inflation accelerated over and above 4{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} to set a contemporary four-ten years large.

The up coming central bank meeting, Ueda’s first, is scheduled to acquire put April 27-28.

Richard Clarida, who served as Vice Chairman at the Federal Reserve from 2018 to 2022, arguably has much more perception than most soon after possessing identified “straight shooter” Kuroda for a long time and weighed Japan’s affect on US and world wide financial plan.

“Markets expect very early under Ueda that yield-curve management is dismantled,” explained Clarida, who is now world-wide financial advisor at Pacific Investment decision Management Co. From here Ueda “may want to go in the way to shrink the equilibrium sheet or reinvest the redemptions, but that is not a single for working day 1,” he stated, introducing Japan’s tightening would be a “historic moment” for markets although it could not be a “driver of global bonds.”

Gradual Shift

Some other market watchers have extra modest anticipations of what will materialize as soon as the BOJ rolls again its stimulus method.

Ayako Sera, a current market strategist at Sumitomo Mitsui Belief Lender Ltd., sees the US-Japan fee gap persisting to a degree as the Fed is unlikely to provide significant level cuts if inflation stays higher and the BOJ is not anticipated to elevate premiums significantly in the in close proximity to expression.

“It’s essential to evaluate any tweaks and outlooks of the BOJ’s entire monetary plan offer when wondering about their implication on the cross-border fund flows,” she mentioned.

Ryosuke Oshima, deputy normal supervisor of item promotion team at Mitsubishi UFJ Kokusai Asset Administration Co. in Tokyo, is eyeing yield concentrations as a potential result in for a change in flows.

“There may possibly be some hunger for bond funds when the charges go greater, like 1{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} for the 10-year yield,” he said. “But on the lookout at the knowledge, it is not likely they reverse all their expenditure back house instantly.”

For some others like 36-calendar year markets veteran Rajeev De Mello, it is probable only a issue of time prior to Ueda has to act and the outcomes may have international repercussions.

“I thoroughly agree with the consensus that the BOJ will tighten — they’ll want to end this plan as shortly as attainable,” stated De Mello, a income manager at GAMA Asset Management in Geneva. “It arrives down to central bank trustworthiness, it comes down to inflation circumstances being increasingly fulfilled now — normalization will come to Japan.”

–With aid from Winnie Hsu, Ayai Tomisawa, Hideyuki Sano, Yumi Teso, Emily Cadman and Jane Pong.

Most Examine from Bloomberg Businessweek

©2023 Bloomberg L.P.