(Bloomberg) — US equity-index futures fell as problem the Federal Reserve will continue to keep borrowing expenditures increased for for a longer time outweighed optimism around China’s financial recovery.

Most Read through from Bloomberg

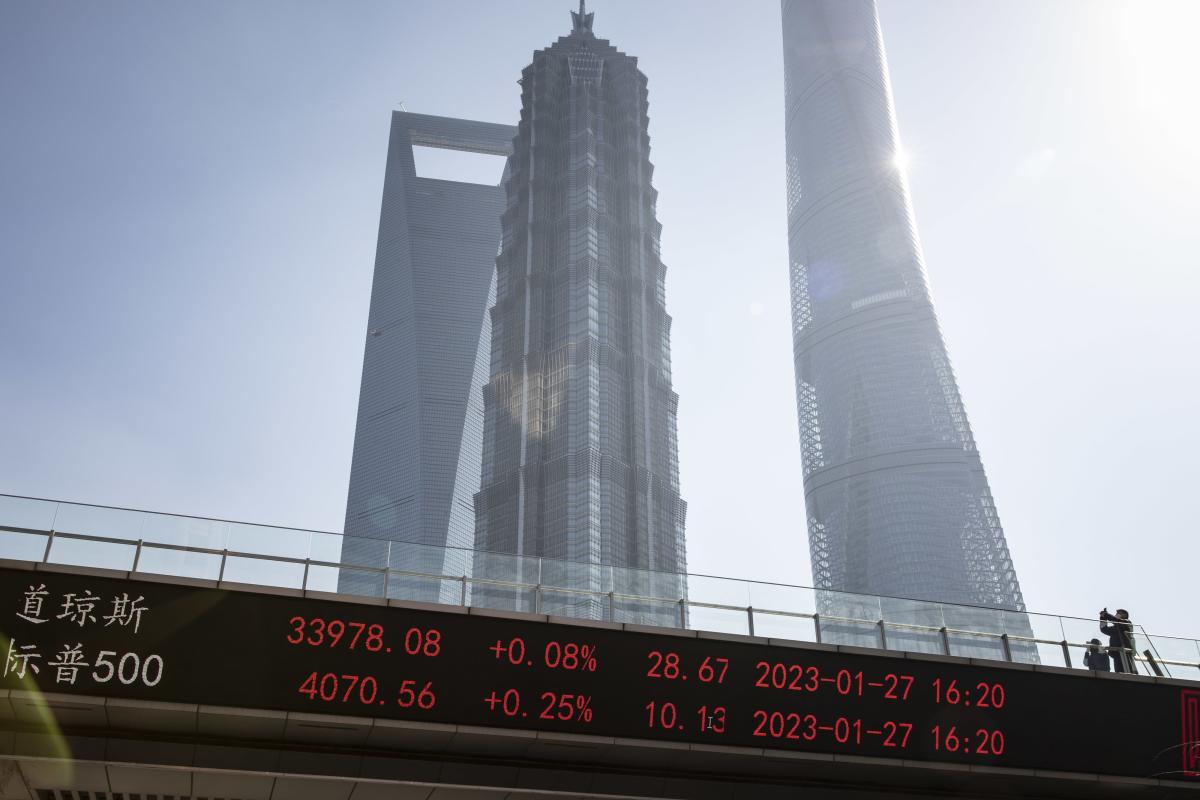

Contracts on the S&P 500 Index slipped .3{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} as buying and selling was muted amid a US vacation. The Stoxx Europe 600 Index was marginally bigger right after fluctuating in a restricted range throughout the day. The Shanghai Composite Index climbed the most considering that November. Treasury futures have been reduced as buyers assessed hawkish feedback by Federal Reserve officials. The dollar took a breather from a three-7 days rally.

A chorus of investors together with Goldman Sachs Team Inc. is betting on Chinese equities to resume a rally as the world’s 2nd-biggest economic system deepens stimulus and relaxes pandemic restrictions. Whilst this has sparked inflows into world wide assets tied to the Chinese economic climate, the broader sentiment in markets remains impaired, with the Fed resolute on its combat in opposition to inflation. Escalating geopolitical tensions are also blocking traders from turning a lot more bullish.

“2023 will be a great deal bumpier than the present effectiveness would propose,” Luca Fina, head of equities at Generali Insurance Asset Management, wrote in a be aware. “It would make perception to minimize the cyclicality of portfolios — including some low-priced calendar year-to-day losers that should carry out superior in a higher-volatility and uncertainty situation (and) by lowering those who are presently additional highly-priced and pricing a Goldilocks situation.”

Europe’s Stoxx 600 was minor improved, with purchaser and know-how shares acting as a drag, even as commodity names rallied. In China, shares acquired right after a Goldman report that penciled in a rebound on the back again of an earnings restoration. Phone calls for even more stimulus by way of lessen premiums also crafted up, prompting the nation’s financial institutions to keep their lending premiums unchanged.

Contracts on the S&P 500 and Nasdaq 100 indexes slipped, with Treasury futures dropping throughout the curve. Stocks finished last 7 days on a muted take note after Richmond Fed President Thomas Barkin and Fed Governor Michelle Bowman both equally expressed their assist for ongoing rate hikes. That adopted hawkish remarks by St. Louis Fed President James Bullard and Cleveland President Loretta.

Specified the holiday break absence of US traders, it was unclear how the markets considered the flurry of geopolitical developments more than the past couple days. Initially, the weekend underscored developing tensions between the world’s two superpowers: US Secretary of Point out Antony Blinken and China’s Point out Councilor Wang Yi traded barbs on everything from Taiwan to North Korea and Russia in their 1st conference given that a spy balloon controversy. Then, North Korea fired a barrage of suspected ballistic missiles and issued a warning to the US over joint navy exercise routines.

On Monday, US President Joe Biden made a surprise check out to Kyiv and met with his Ukrainian counterpart Volodymyr Zelenskiy, declaring “unwavering support” in a present of solidarity as Russia’s invasion nears the one particular-calendar year mark.

Oil futures innovative on Monday. Need from China will climb by 800,000 barrels a day in 2023, in accordance to the median estimate of 11 China-concentrated consultants surveyed by Bloomberg News. That would acquire usage to an all-time superior of about 16 million barrels a day, the study confirmed.

“The only spot where by the central lender will continue being smooth more than enough is China, to get better from a collection of absurd Covid actions that pushed the overall economy into an pointless frustrated zone,” Ipek Ozkardeskaya, a senior analyst at Swissquote Bank, wrote in a notice.

Buyers also awaited clues on US shopper demand as Walmart Inc. and Dwelling Depot Inc. have been established to kick off a slew of retail earnings reviews this 7 days.

Key functions this 7 days:

-

Earnings for the week are scheduled to include: Alibaba, Anglo American, AXA, BAE Devices, Baidu, BASF, BHP, Danone, Deutsche Telekom, Holcim, Dwelling Depot, Hong Kong Exchanges & Clearing, HSBC, Iberdrola, Lloyds Banking Group, Moderna, Munich Re, Newmont, Nvidia, Rio Tinto, Walmart, Warner Bros Discovery

-

US economic marketplaces shut for Presidents’ Day holiday getaway, Monday

-

PMIs for Japan, Eurozone, British isles, US, Tuesday

-

US present property revenue, Tuesday

-

US MBA mortgage loan apps, Wednesday

-

The Federal Reserve minutes from Jan. 31-Feb. 1 plan meeting, Wednesday

-

Eurozone CPI, Thursday

-

US GDP, preliminary jobless claims, Thursday

-

Atlanta Fed President Raphael Bostic speaks, Thursday

-

G-20 finance ministers and central lender governors fulfill in India, Thursday-Friday

-

Japan CPI, Friday

-

BOJ governor-nominee Kazuo Ueda seems before Japan’s lower house, Friday

Some of the key moves in marketplaces:

Stocks

-

S&P 500 futures fell .3{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} as of 4:19 p.m. New York time

-

Futures on the Dow Jones Industrial Typical fell .3{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996}

-

The MSCI Environment index rose .2{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996}

-

S&P 500 futures fell .3{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996}

-

Nasdaq 100 futures fell .2{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996}

-

The MSCI Asia Pacific Index rose .7{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996}

-

The MSCI Emerging Marketplaces Index rose .6{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996}

-

The Stoxx Europe 600 was tiny altered

Currencies

-

The Bloomberg Dollar Location Index was little improved

-

The euro fell .1{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} to $1.0684

-

The British pound was very little altered at $1.2041

-

The Japanese yen was very little improved at 134.27 per greenback

-

The offshore yuan rose .2{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} to 6.8594 for each greenback

-

The Mexican peso was little adjusted at 18.3867

Cryptocurrencies

-

Bitcoin rose 1{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} to $24,789.91

-

Ether rose 1.1{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} to $1,704.24

Bonds

-

The produce on 10-calendar year Treasuries was small improved at 3.81{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996}

-

Germany’s 10-12 months yield innovative two foundation details to 2.46{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996}

-

Britain’s 10-yr yield declined 4 basis factors to 3.47{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996}

Commodities

This story was produced with the support of Bloomberg Automation.

–With guidance from Cecile Gutscher, Tassia Sipahutar, Akshay Chinchalkar and Sebastian Boyd.

Most Read through from Bloomberg Businessweek

©2023 Bloomberg L.P.