The threat of a Russian default on sovereign financial debt is noticed in close proximity to, but investors so far aren’t panicking more than any possible strike to world economic markets.

“While a default would be symbolic, it seems not likely that it will have significant ramifications, the two in Russia and somewhere else,” said William Jackson, chief emerging marketplaces economist at Cash Economics, in a Monday take note.

Discuss of a Russian default, nonetheless, stirs reminiscences of earlier turmoil. In August 1998, Russia devalued the ruble, defaulted on domestic credit card debt and declared a moratorium on payment to international lenders. The resulting crisis despatched tremors by fiscal markets, resulting in the collapse and subsequent rescue of hedge fund Extended Expression Cash Current market.

Intercontinental Monetary Fund Taking care of Director Kristalina Georgieva on Sunday stated Western sanctions in reaction to the country’s Feb. 24 invasion of Ukraine would hit Russia really hard, shrinking Russians’ genuine incomes and paying for energy. She warned that a Russian default can no for a longer time be thought of as an “improbable event.”

Georgieva, in an interview with CBS News’ Confront the Nation, mentioned that although Russia has the money to services its credit card debt, sweeping sanctions versus the nation’s economical establishments and central lender suggests it can no extended obtain it. Ratings corporations have sharply downgraded Russian financial debt, with Fitch past week warning of an imminent default as a final result of sanctions.

But Georgieva mentioned that although international exposure to Russia’s banking sector at $120 billion wasn’t negligible, it was “definitely not systemically relevant.”

Moscow is scheduled to make all around $117 million in mixed fascination payments on two greenback-denominated bonds on Wednesday, in accordance to news experiences. Russia’s finance ministry on Monday stated that it was well prepared to make the payments, but might do so in rubles if unable to accessibility the currency of challenge, in accordance to Reuters. Studies noted that neither bond allows for payments in a different currency.

Failure to make payment in bucks could see Russia in complex default following a 30-working day grace time period, analysts reported.

The biggest probable cost to Russia from a default is becoming locked out of international funds markets, or at the very least facing greater borrowing prices for extended time period, Jackson said, but noted that “sanctions have accomplished that anyway.”

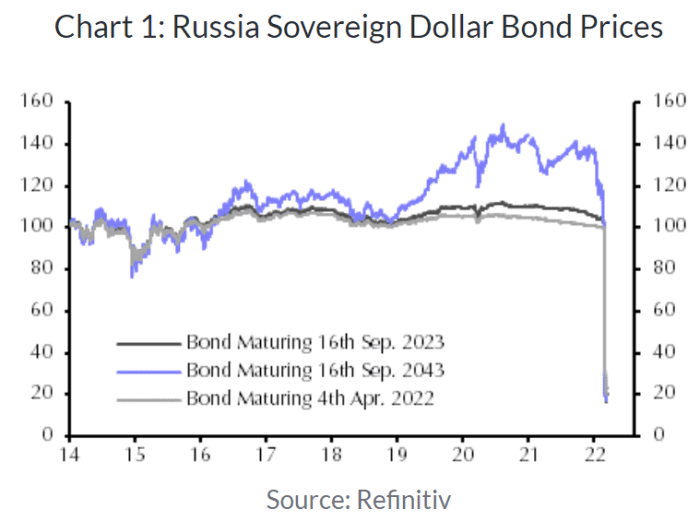

For international investors, “a default is mostly priced in,” the economist wrote, noting that Russia’s sovereign dollar bonds are already trading at close to 20 cents on the dollar (see chart beneath).

Money Economics

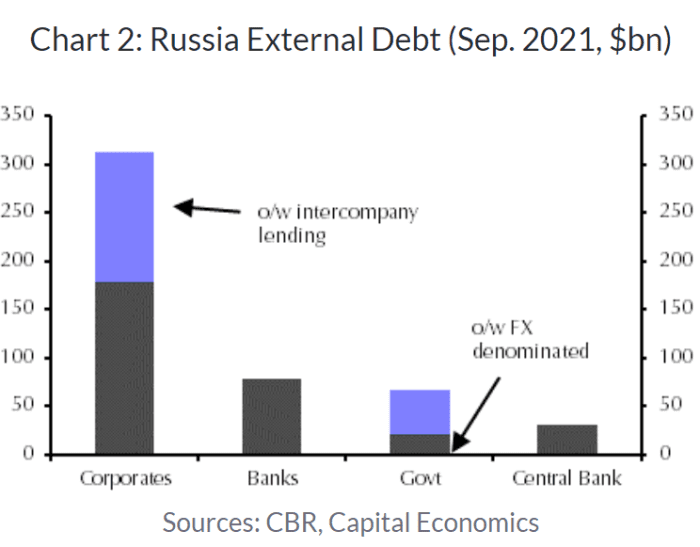

News reviews also suggest that collectors have currently marked down their holdings, he explained. And to Georgieva’s assertion that Russian financial debt is not systemically relevant, Jackson pointed out that the in general sizing of Russian international currency sovereign credit card debt held by nonresidents is “relatively modest,” at about $20 billion.

“Even if the authorities halts payments to overseas traders on all their holdings of sovereign personal debt (neighborhood and foreign), the full of about $70 [billion] is no larger sized than the credit card debt Argentina defaulted on in 2020 without the need of resulting in tremors in worldwide marketplaces (whilst in Argentina’s scenario, bond prices did not slide fairly as significantly),” Jackson claimed.

Fairness markets have been volatile in the wake of the invasion, but the threat of a default hasn’t been flagged as a main resource of be concerned for buyers. U.S. stocks have been mainly decreased Monday, extending the past week’s drop. The Dow Jones Industrial Ordinary

DJIA,

rose 1 position, or a lot less than .1{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996}, even though the massive-cap benchmark S&P 500

SPX,

was down .7{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996}.

So nothing to see here? Not very.

Jackson flagged two risks.

1st, there’s the possibility that beneath the aggregate numbers, a systemically vital institution is heavily exposed to Russian sovereign financial debt and is perhaps able of sending tremors by way of the monetary technique.

Second, a sovereign default could be a prelude to defaults by Russia’s corporates, he warned, whose exterior money owed are a lot greater than those people of the authorities (see chart below).

Capital Economics

“So much, Russian corporates feel to have ongoing servicing their debts considering the fact that sanctions were being tightened. But with trade disrupted, sanctions probably becoming widened and the economy set for a deep economic downturn, the likelihood of corporate defaults is rising,” Jackson stated.