Let us get prepared to rumble.

The Federal Reserve and investors appear to be locked in what 1 veteran market watcher has described as an epic video game of “chicken.” What Fed Chair Jerome Powell says Wednesday could ascertain the winner.

Here’s the conflict. Fed policy makers have steadily insisted that the fed-funds rate, now at 4.25{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} to 4.5{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996}, should increase higher than 5{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} and, importantly, stay there as the central financial institution attempts to convey inflation back to its 2{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} focus on. Fed-funds futures, nonetheless, exhibit money-sector traders are not entirely confident the amount will major 5{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996}. Most likely a lot more galling to Fed officials, traders anticipate the central bank to provide cuts by year-conclusion.

Stock-marketplace traders have also purchased into the latter plan “pivot” scenario, fueling a January surge for crushed down technology and growth stocks, which are significantly fascination rate-delicate. Treasury bonds have rallied, pulling down yields throughout the curve. And the U.S. greenback has weakened.

Cruisin’ for a bruisin’?

To some industry watchers, investors now look way too large for their breeches. They be expecting Powell to endeavor to consider them down a peg or two.

How so? Look for Powell to be “unambiguously hawkish,” when he holds a information conference adhering to the summary of the Fed’s two-working day plan conference on Wednesday, said Jose Torres, senior economist at Interactive Brokers, in a mobile phone job interview.

“Hawkish” is marketplace lingo utilised to explain a central banker sounding difficult on inflation and considerably less anxious about financial expansion.

In Powell’s scenario, that would possible signify emphasizing that the labor marketplace remains considerably out of balance, contacting for a significant reduction in task openings that will need financial coverage to remain restrictive for a lengthy period, Torres mentioned.

If Powell appears adequately hawkish, “financial situations will tighten up promptly,” Torres reported, in a cellular phone job interview. Treasury yields “would increase, tech would drop and the greenback would increase immediately after a concept like that.” If not, then be expecting the tech and Treasury rally to go on and the greenback to get softer.

Hanging loose

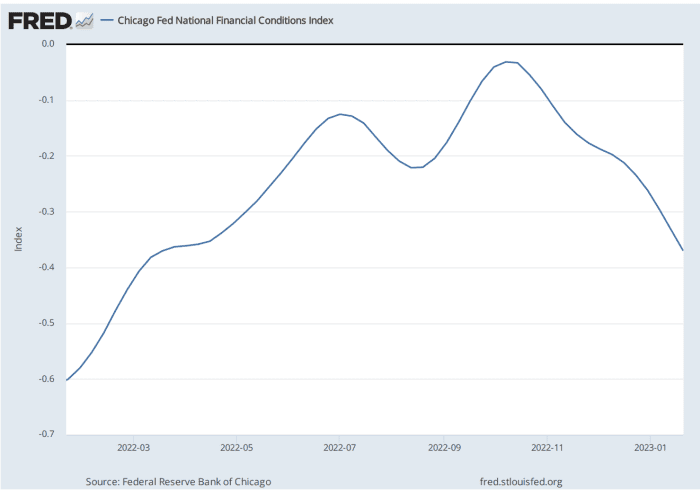

Without a doubt, it is a loosening of financial problems that’s observed striving Powell’s endurance. Looser situations are represented by a tightening of credit rating spreads, decreased borrowing fees, and increased inventory price ranges that add to speculative activity and improved danger getting, which aids fuel inflation. It also will help weaken the greenback, contributes to inflation through greater import prices, Torres stated, noting that indexes measuring money problems have fallen for 14 straight months.

The Chicago Fed’s Countrywide Fiscal Disorders Index provides a weekly update on U.S. financial situations. Good values have been historically connected with tighter-than-typical money disorders, when adverse values have been traditionally associated with looser-than-common economical problems.

Federal Reserve Bank of Chicago, fred.stlouisfed.org

Powell and the Fed have undoubtedly expressed concerns about the possible for loose economic situations to undercut their inflation-battling efforts.

The minutes of the Fed’s December assembly. launched in early January, contained this notice-grabbing line: “Participants observed that, for the reason that monetary plan labored importantly by means of money markets, an unwarranted easing in fiscal disorders, especially if pushed by a misperception by the general public of the Committee’s response perform, would complicate the Committee’s energy to restore selling price stability.”

That was taken by some investors as a sign that the Fed wasn’t keen to see a sustained stock marketplace rally and may even be inclined to punish economic markets if ailments loosened too significantly.

Go through: The Fed delivered a information to the stock market place: Significant rallies will prolong agony

If that interpretation is correct, it underlines the notion that the Fed “put” — the central bank’s seemingly longstanding willingness to answer to a plunging sector with a loosening of plan — is mainly kaput.

The tech-significant Nasdaq Composite logged its fourth straight weekly rise last 7 days, up 4.3{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} to close Friday at its maximum due to the fact Sept. 14. The S&P 500

SPX,

superior 2.5{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} to log its greatest settlement given that Dec. 2, and the Dow Jones Industrial Average

DJIA,

rose 1.8{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996}.

Meanwhile, the Fed is just about universally anticipated to supply a 25 foundation point amount maximize on Wednesday. That is a downshift from the series of outsize 75 and 50 foundation place hikes it sent over the program of 2022.

See: Fed set to supply quarter-stage price increase along with ‘one very last hawkish sting in the tail’

Information demonstrating U.S. inflation proceeds to gradual right after peaking at a about 4-decade significant past summertime along with anticipations for a much weaker, and possibly recessionary, economy in 2023 have stoked bets the Fed will not be as intense as marketed. But a pickup in gasoline and food stuff costs could make for a bounce in January inflation readings, he explained, which would give Powell yet another cudgel to beat again market place expectations for less complicated plan in future meetings.

Jackson Hole redux

Torres sees the set up heading into this week’s Fed meeting as comparable to the run-up to Powell’s speech at an annual central banking symposium in Jackson Hole, Wyoming, past August, in which he delivered a blunt message that the struggle versus inflation intended financial soreness in advance. That spelled doom for what proved to be one more of 2023’s many bear-market place rallies, commencing a slide that took stocks to their lows for the yr in October.

But some problem how frustrated coverage makers truly are with the current backdrop.

Certain, money problems have loosened in recent months, but they stay far tighter than they had been a yr in the past right before the Fed embarked on its intense tightening marketing campaign, said Kelsey Berro, portfolio supervisor at J.P. Morgan Asset Management, in a mobile phone interview.

“So from a holistic point of view, the Fed feels they are obtaining policy additional restrictive,” she reported, as evidenced, for case in point, by the significant rise in house loan costs above the previous year.

Nonetheless, it is very likely the Fed’s information this week will carry on to emphasize that the current slowing in inflation is not plenty of to declare victory and that even more hikes are in the pipeline, Berro explained.

Also before long for a shift

For buyers and traders, the target will be on whether Powell continues to emphasize that the most important hazard is the Fed carrying out too tiny on the inflation front or shifts to a message that acknowledges the probability the Fed could overdo it and sink the economy, Berro claimed.

She expects Powell to finally produce that message, but this week’s information conference is in all probability as well early. The Fed will not update the so-referred to as dot plot, a compilation of forecasts by unique policy makers, or its employees economic forecasts right until its March meeting.

That could verify to be a disappointment for investors hoping for a decisive showdown this 7 days.

“Unfortunately, this is the form of conference that could stop up becoming anticlimactic,” Berro said.