The prepared acquisition of German chip provider Siltronic by its larger Taiwan rival GlobalWafers has collapsed soon after Berlin did not approve the deal, highlighting how countrywide safety problems about source chains are shaping bargains in the marketplace.

“The takeover offer by GlobalWafers and the agreements which arrived into existence as a result of the offer will not be completed and will lapse,” the Taiwanese business said on Tuesday following Germany did not make a choice on the offer by the January 31 deadline.

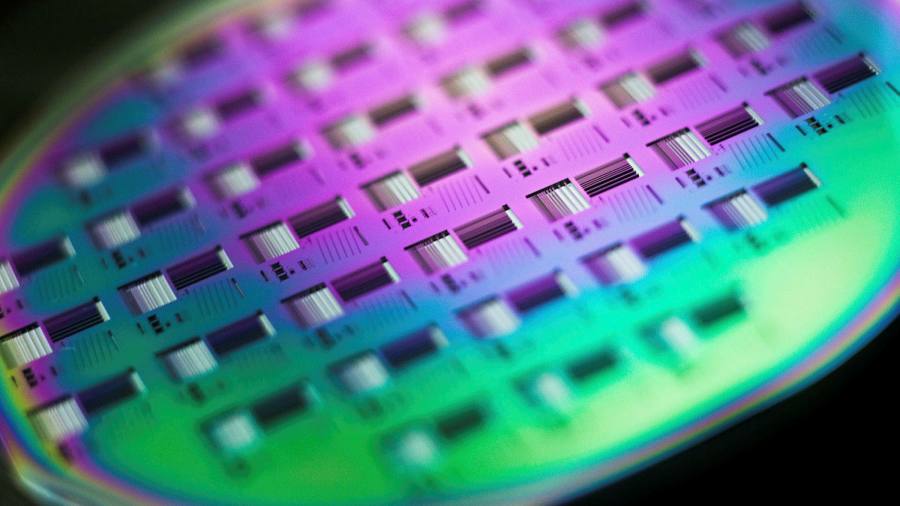

Berlin’s failure to crystal clear the proposed €4.35bn transaction prevented consolidation in a significant section of the extended and intricate source chain for semiconductors. The chips are essential elements to a vary of solutions which includes cars and trucks and smartphones and have been in extreme lack for extra than a year.

With each other GlobalWafers, the world’s 3rd-biggest manufacturer of silicon wafers, and Siltronic, which ranks fourth, would have grow to be the sector’s next-major participant and a significant rival for Japan’s Shin-Etsu, the major manufacturer. In individual, GlobalWafers had aimed at strengthening its presence in Europe, where by Siltronic is the top supplier.

Germany’s economics ministry mentioned it could not entire all necessary actions in its review by January 31. German media quoted a ministry spokesperson declaring that the conditional approval from Chinese antitrust regulators, granted on January 21, experienced occur way too late for Berlin to assessment.

Chinese regulators experienced offered a environmentally friendly light for the acquisition on the situation that GlobalWafers spun off Topsil, a Denmark-based mostly unit, and ongoing to market wafers to Chinese clientele without discrimination. The calls for could have intricate functions for the mixed enterprise if a 3rd country, these as the US, imposed sanctions necessitating providers to lower provides to China in the future.

But government officials and industry observers also observed broader factors behind Berlin’s failure to crystal clear the offer. In new yrs, the German authorities has toughened guidelines for overseas takeovers of domestic providers, introducing protection evaluations for offers in a selection of industries including semiconductors, and letting the condition to get a stake in companies if required to defend them.

“The most probable genuine purpose this fell by means of is that Germany is concerned about their technological innovation sovereignty,” mentioned a senior Taiwanese govt official. “We comprehend these factors, they are not the only kinds who are progressively searching at this sort of variables now. But it can make the world ecosystem for our providers more complicated, just as they look to diversify their footprint.”

Taiwan dominates semiconductor manufacturing, generally through TSMC, the world’s most significant deal chipmaker, which accounts for additional than 50 percent of the international market for manufactured-to-buy chips. But the region is keen to greatly enhance its position in other segments of the industry.

GlobalWafers mentioned it was “very unhappy about this outcome”. The corporation additional that it would analyse the German government’s determination and think about its effect on its future financial investment tactic.

Doris Hsu, main govt, has reported in the earlier that GlobalWafers would pursue investments outdoors Europe if the Siltronic offer could not be completed.

#techAsia newsletter

Your important guide to the billions becoming made and lost in the world of Asia Tech. A curated menu of distinctive news, crisp evaluation, intelligent knowledge and the newest tech excitement from the FT and Nikkei