Silicon Valley Lender shoppers ended up found outside a Menlo Park, California locale, Friday, after the Federal Deposit Insurance coverage Corporation seized its assets. (Cointelegraph)

Silicon Valley Financial institution (SVB) government, Jospeph Gentile, was a previous government of the Lehman Brothers’ World-wide Financial commitment Bank prior to the bank’s community collapse in 2008.

Prior to becoming a member of SVB as Chief Administrative Officer, Gentile worked as Main Fiscal Officer at Lehman Brothers’ World wide Financial investment Bank. Gentile still left Lehman in 2007, just just one 12 months right before it went bankrupt in 2008.

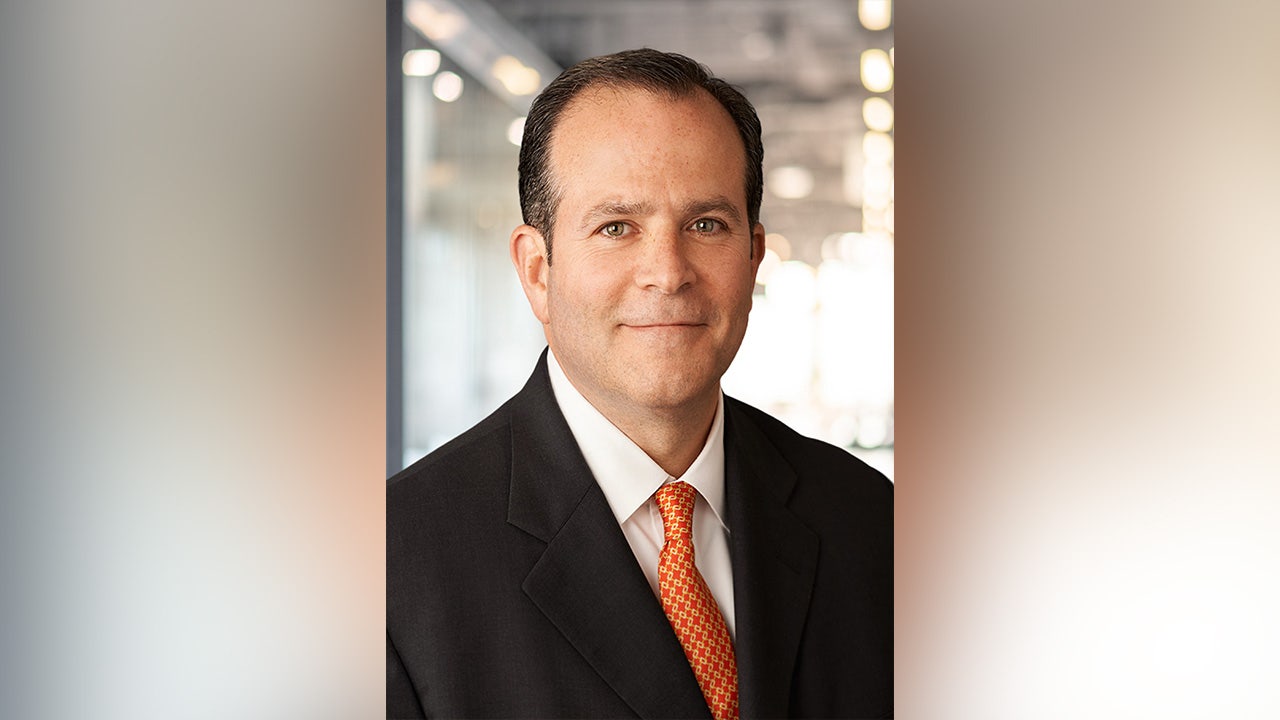

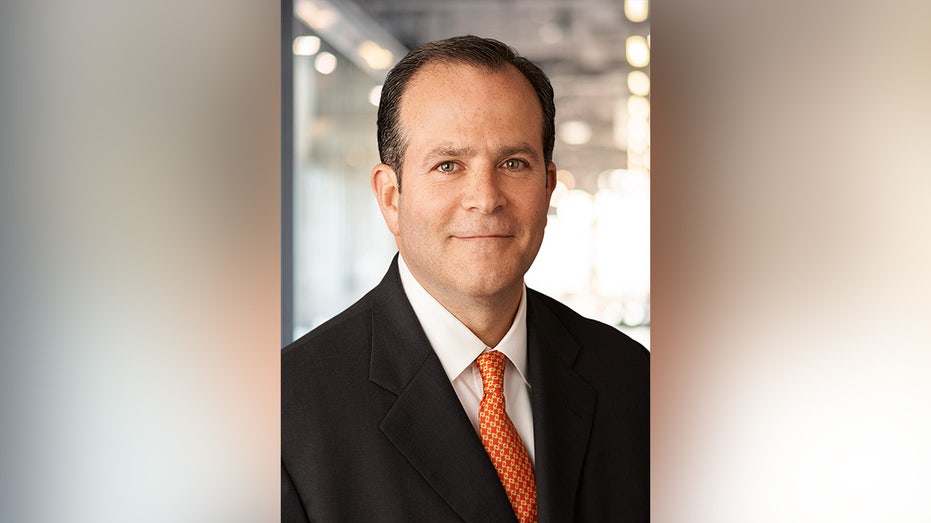

Silicon Valley Bank’s Main Administrative Officer Joseph Gentile joined the financial institution in 2007. Prior to performing at SVB, Gentile was the CFO for Lehman Brothers’ Worldwide Expenditure Bank. (Silicon Valley Financial institution / Fox Information)

“You can not make this up.” one Twitter wrote as the online erupted at the revelation.

“This is definitely unconventional” yet another user included.

“It is really all setting up to make sense now!” a different wrote.

ANDREW YANG WARNS OF ‘MASS LAYOFFS,’ Calls FOR Govt INTERVENTION After SILICON VALLEY Lender COLLAPSE

Prior to the Federal Deposit Insurance policies Corporation (FDIC) seizing handle of SVB, the bank disclosed mounting losses, and shares plummeted far more than 60{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} ahead of staying halted. The bank was in the middle of a liquidity disaster right after asserting plans for a $1.25 billion stock sale with minimal fascination.

Silicon Valley Lender was shut down on Friday morning by California regulators and was put in manage of the U.S. Federal Deposit Insurance policy Company. (Justin Sullivan/Getty Visuals / Getty Illustrations or photos)

SILICON VALLEY Financial institution COLLAPSE: MARK CUBAN Says FED Should ‘IMMEDIATELY’ Choose THIS Action

According to the FDIC, SVB was amongst the prime 20 American commercial banking companies, with $209 billion in whole property at the close of 2022.

This is the 2nd-largest bank to near in the U.S. considering the fact that 2008. Lehman Brothers’ International Expense Financial institution was also impacted in the 2008 financial meltdown.

A worker carries a box out of the U.S. financial commitment bank Lehman Brothers offices in the Canary Wharf district of London in this September 15, 2008 file photo. (Reuters/Andrew Winning/File Image / Reuters Photos)

At the time of its collapse, Lehman was the fourth-greatest investment decision financial institution in the United States with 25,000 workers around the globe. It experienced $639 billion in assets and $613 billion in liabilities.

Trader and “Shark Tank” star Kevin O’Leary reacted to the SVB collapse on “Your Planet with Neil Cavuto,” blaming the collapse on very poor administration.

GET FOX Organization ON THE GO BY CLICKING Right here

“Financial institutions blow on their own up all the time mainly because of weak administration or management problems. This happens.” O’Leary mentioned. “So you have to have diversification, not just of your holdings in terms of portfolio property. You require institutional diversification.”