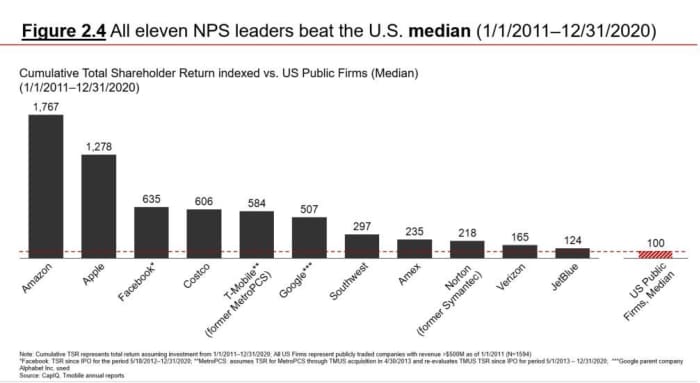

I am not a professional stock picker, but over the past decade my portfolio has beaten the stock market by a factor of three to one.

Unlike Peter Lynch, who advocated investing in the makers of products you love and who, in my estimation, stands out as one of the greatest of all stock pickers, I did not examine a single financial metric to build my portfolio. Instead, I simply ranked competitors in each industry based on customer love and then bet on the winner.

My portfolio has performed so well because the market undervalues the economic power of customer love. When customers feel loved, they come back for more and refer their friends. This is the economic flywheel that drives sustainable prosperity, and companies built on it generate surprising levels of profitable growth.

To measure customer love, I used the Net Promoter Score (NPS) that I created 20 years ago. It captures how likely a customer is to recommend a product or service to a friend or colleague. I relied on the market to incorporate all financial insights into the current stock price.

My buy-and-hold investing portfolio started with the 11 public NPS leaders profiled in my 2010 book, “The Ultimate Question 2.0“: Amazon

AMZN,

Meta Platforms (formerly Facebook)

FB,

Apple

AAPL,

Costco Wholesale

COST,

Google parent Alphabet

GOOG,

GOOGL,

Southwest Airlines

LUV,

American Express

AXP,

JetBlue Airways

JBLU,

Verizon Communications

VZ,

T-Mobile US

TMUS,

NortonLifeLock

NLOK,

and Metro PCS Communications (which merged with T-Mobile in 2013).

In hindsight some of those stocks look like no-brainers, but back when the book was written they were anything but. Amazon had a market cap below eBay’s. T-Mobile was considered by many to be the weakest player in mobile telephony.

In the years since, however, this group’s extraordinary customer focus has paid off. From Jan. 1, 2011 to Dec. 31, 2020 these stocks outperformed Vanguard’s Total Stock Market Index exchange-traded fund

VTI,

by a factor of 2.8 to 1. (This performance is market-cap weighted and rebalanced quarterly akin to VTI’s rebalancing).

Fred Reichheld

Since then, Bain & Co., where I have worked since 1977, has applied NPS to a long list of industries, and created NPS Prism, a data benchmarking service that ranks competitor NPS on an apples-to-apples basis. As we X-ray more industries, we continue to uncover new NPS leaders, among them Texas Roadhouse

TXRH,

Discover Financial

DFS,

Tesla

TSLA,

Chewy

CHWY,

and FirstService

FSV,

I serve on the board of directors at FirstService, a real-estate services company whose social media handle #FirstServeOthers provides a hint about its corporate philosophy. Over the 25 years since the IPO, its annual total shareholder return has been just under 22{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996}, a better record than all but seven of the 2,800 firms with revenues of at least $100 million at the time of their NASDAQ listing.

For a long time, like many great customer-focused organizations, it remained below investors’ radar screens. One reason: GAAP accounting is woefully lacking at measuring customer centricity. It doesn’t even require organizations to report the number of customers they serve, let alone how many are returning, increasing purchases, or referring friends and family.

This makes it hard to find comparable data. I first discovered online pet supply retailer Chewy when its self-reported NPS appeared in its IPO documents. Chewy does a tremendous job tapping into the special emotional tie between owner and pet, with things like the hand-painted pet portraits the company mails as surprise thank-yous to customers, who, delighted, then post them, along with glowing testimonials, across social media.

By our calculations Chewy’s NPS beats Amazon’s by 24 points in its category — an extraordinary performance. Chewy’s own numbers are slightly different from ours, however, and the inconsistency of self-reported numbers is one reason we developed a new metric called earned growth rate. It measures the revenue growth generated by returning customers and their referrals by combining net revenue retention (NRR), the back-for-more battle-tested statistic used in the software-as-a-service (SaaS) industry among others, with earned new customers (ENC), measuring how much new customer spending is earned through referrals rather than bought through promotional channels.

NPS exemplar First Republic Bank

FRC,

has in the past earned 82{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} of its deposit growth, with 50{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} coming from existing customers and another 32{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} from referrals. Warby Parker

WRBY,

the direct-to-consumer pioneer in prescription eyeglasses, earns almost 90{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} of its new customers through referrals.

You can use this calculator to estimate your company’s earned growth rate.

Abingdon Press

In addition to these metrics, it’s also possible to spot NPS leaders by their common features.

- They apply the Golden Rule – love thy neighbor as thyself. This often means eschewing bad profits. Discover Card, for example, never sells receivables to collection agencies.

- They empower their front-line employees to serve customers in creative ways. Companies like Chewy that give employees the freedom to serve customers with empathy and creativity engender trust in and loyalty to their companies.

- They integrate in-store and online customer feedback. Technology-rich companies like Warby Parker augment direct feedback with digital signals from customers and front-line employees to guide decision-making—crucial in helping companies respond to holiday shopping trends this season.

- They make customers their primary purpose. By going the extra mile to provide a customer with an experience that’s not just good, but remarkable, companies can play a part in enriching their lives beyond the product they offer.

I have spent most of my 44-year career focused on understanding the role that loyalty plays in building great organizations and helping leaders inspire their teams to embrace a mission of purposeful service enriching the lives of customers and colleagues. That is the right way—and the best way—to win in business and the stock market.

Fred Reichheld is the creator of the Net Promoter system of management and the author of “Winning on Purpose: The Unbeatable Strategy of Loving Customers” (together with Darci Darnell and Maureen Burns), among other books.