Shareholders in Primis Monetary Corp. (NASDAQ:FRST) could be thrilled to master that the analysts have just shipped a important enhance to their around-time period forecasts. The earnings forecast for this yr has expert a facelift, with analysts now considerably much more optimistic on its revenue pipeline.

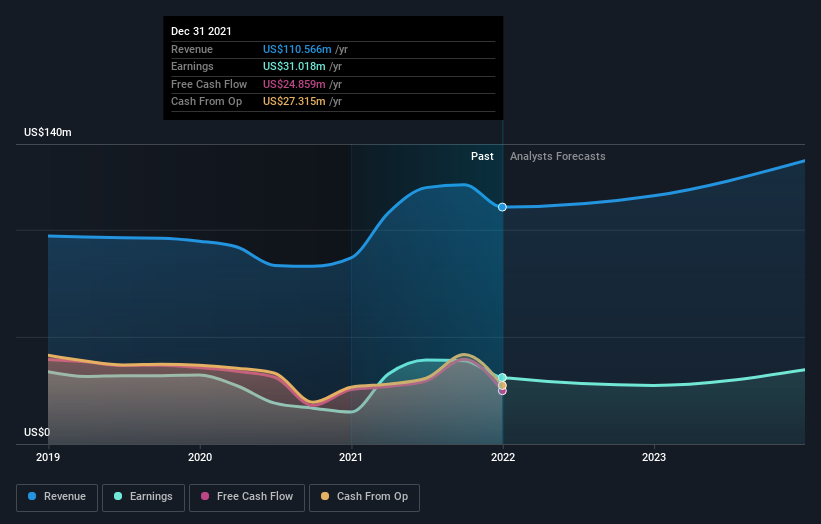

Immediately after this improve, Primis Financial’s a few analysts are now forecasting revenues of US$116m in 2022. This would be a credible 4.7{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} enhancement in product sales in comparison to the last 12 months. Statutory earnings for each share are expected to tumble 12{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} to US$1.11 in the exact time period. Earlier, the analysts had been modelling revenues of US$100m and earnings per share (EPS) of US$1.08 in 2022. The forecasts seem to be far more optimistic now, with a pleasant raise in profits and a slight bump in earnings per share estimates.

See our latest evaluation for Primis Economical

Of class, a further way to seem at these forecasts is to location them into context from the field alone. We would highlight that Primis Financial’s earnings development is expected to slow, with the forecast 4.7{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} annualised advancement rate till the finish of 2022 currently being well down below the historical 16{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} p.a. expansion about the past five decades. By way of comparison, the other businesses in this field with analyst protection are forecast to grow their income at 6.9{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} for each year. Factoring in the forecast slowdown in growth, it would seem apparent that Primis Money is also envisioned to develop slower than other field participants.

The Base Line

The most critical detail to choose absent from this enhance is that analysts upgraded their earnings per share estimates for this 12 months, expecting strengthening small business problems. Pleasantly, analysts also upgraded their earnings estimates, and their forecasts advise the company is envisioned to mature slower than the wider market place. Provided that analysts seem to be expecting considerable advancement in the income pipeline, now could be the suitable time to consider one more glance at Primis Economical.

Even so, the for a longer time phrase trajectory of the business enterprise is a great deal a lot more crucial for the price creation of shareholders. We have estimates – from a number of Primis Financial analysts – likely out to 2023, and you can see them totally free on our system below.

Of course, viewing enterprise administration spend substantial sums of dollars in a stock can be just as helpful as understanding no matter whether analysts are upgrading their estimates. So you may well also would like to look for this free list of stocks that insiders are acquiring.

Have suggestions on this post? Concerned about the content? Get in contact with us immediately. Alternatively, e-mail editorial-staff (at) simplywallst.com.

This posting by Simply just Wall St is basic in mother nature. We give commentary dependent on historical knowledge and analyst forecasts only making use of an unbiased methodology and our articles or blog posts are not supposed to be monetary suggestions. It does not constitute a advice to purchase or provide any inventory, and does not take account of your goals, or your financial circumstance. We aim to provide you lengthy-expression concentrated examination driven by essential information. Notice that our analysis may well not component in the latest rate-sensitive enterprise bulletins or qualitative content. Basically Wall St has no placement in any stocks mentioned.