The market’s expectation is that the Federal Reserve will preserve lifting its plan desire amount right until it brings it to 5{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} just before pausing for some time.

But it is attainable that the Fed could choose that 5{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} is not practically more than enough. That would be the circumstance if the U.S. financial system proceeds growing at a reliable clip and inflation doesn’t substantially amazing off.

Strategists at JPMorgan led by Nikolaos Panigirtzoglou decided to examine a scenario in which the Fed would get its benchmark level to 6.5{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} all through the second 50 percent of 2023. They mentioned that the JPMorgan economics group assigns a 28{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} probability to that situation, so it is inside of the realm of likelihood, even though the premiums current market only assigns a 10{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} likelihood to that outcome.

In discussions with customers, the strategists claimed, that situation is widely perceived as the Armageddon situation. “After all, the very last time the Fed resources rate was at 6.5{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} was in 2000 and that level of coverage costs was followed by very significant losses for threat markets at the time,” they claimed.

But the JPMorgan team would not expect genuine Armageddon to choose put in money marketplaces. “In our opinion, even though there is minor question that [Fed rates at 6.5{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996}] would be negative for most asset courses like equities, bonds and credit history, the eventual draw back is probable to be extra constrained that an Armageddon would advise,” they mentioned.

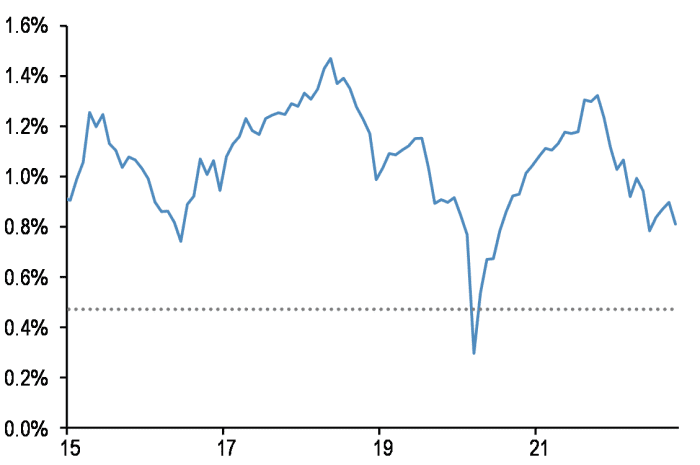

Net debit balances in NYSE margin accounts are at lower concentrations.

Finra/NYSE/JPMorgan

Need for bonds, the strategists famous, has by now collapsed, and it’s envisioned to keep on being weak as central financial institutions have interaction in quantitative tightening. “This unprecedentedly weak demand projected for 2023 raises the hurdle that need would submit a further big destructive shock in 2023 and raises the chance of an upward shock,” they claimed. Furthermore, source is forecast to fall by $1.7 trillion subsequent 12 months.

Granted, the Fed having charges to 6.5{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} would have major implications on the quick conclusion

TMUBMUSD02Y,

of the Treasury generate curve. But yields on the lengthier finish would rise “by a lot a lot less,” they stated, implying an even starker inversion than what we’re seeing now.

They made similar opinions on the U.S. stock market place, centered on Commodity Futures Trading Commission data on leveraged resources and asset manager positioning. “All these fairness demand from customers indicators stand at instead low ranges, making an uneven backdrop where by another major drop looks a good deal fewer probably for 2023,” the analysts claimed.

Already, they pointed out, the S&P 500

SPX,

has been in essence unchanged about the previous 7 months, even as the peak in Fed pricing has climbed to 5{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} from about 3{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} in May possibly.