Aim Financial Partners Inc. (NASDAQ:FOCS) just introduced its newest quarterly benefits and points are wanting bullish. The company conquer each earnings and profits forecasts, with profits of US$537m, some 4.1{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} previously mentioned estimates, and statutory earnings for every share (EPS) coming in at US$.44, 175{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} in advance of anticipations. The analysts ordinarily update their forecasts at each earnings report, and we can decide from their estimates no matter whether their view of the corporation has modified or if there are any new worries to be informed of. So we gathered the latest put up-earnings forecasts to see what estimates advise is in retailer for following 12 months.

Look at our latest assessment for Aim Financial Associates

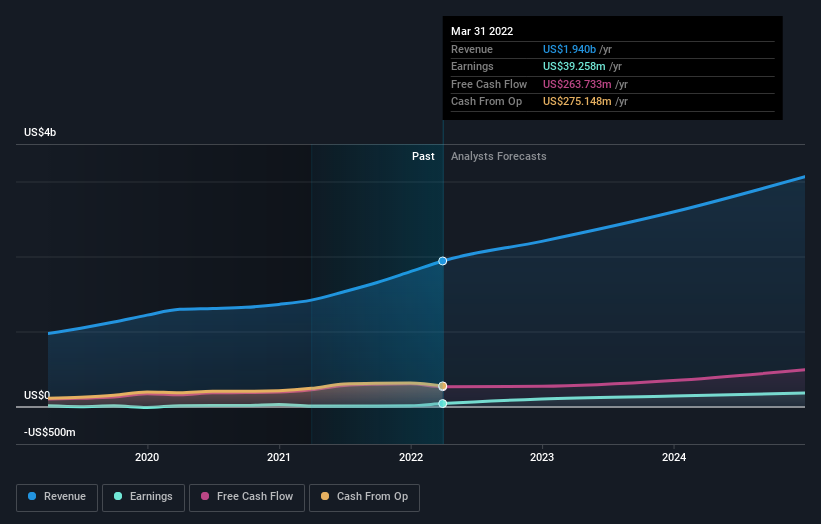

Following the most recent benefits, Aim Fiscal Partners’ 9 analysts are now forecasting revenues of US$2.20b in 2022. This would be a solid 13{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} improvement in income in comparison to the last 12 months. Statutory earnings per share are predicted to shoot up 184{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} to US$1.44. Nevertheless prior to the most current earnings, the analysts experienced been anticipated revenues of US$2.20b and earnings per share (EPS) of US$.81 in 2022. There was no serious improve to the income estimates, but the analysts do feel extra bullish on earnings, offered the sizeable expansion in earnings per share expectations subsequent these effects.

The consensus selling price goal fell 7.3{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} to US$66.00, suggesting the raise in earnings forecasts was not plenty of to offset other the analysts considerations. That is not the only conclusion we can attract from this facts even so, as some buyers also like to take into account the distribute in estimates when analyzing analyst cost targets. The most optimistic Focus Fiscal Partners analyst has a price tag concentrate on of US$76.00 per share, while the most pessimistic values it at US$60.00. With these kinds of a slim array of valuations, the analysts evidently share very similar views on what they feel the enterprise is really worth.

These estimates are fascinating, but it can be helpful to paint some extra broad strokes when seeing how forecasts examine, both of those to the Concentration Money Partners’ past functionality and to friends in the exact same market. We can infer from the hottest estimates that forecasts expect a continuation of Concentration Economic Partners’historical trends, as the 18{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} annualised revenue development to the close of 2022 is approximately in line with the 20{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} yearly income expansion around the previous a few many years. By distinction, our knowledge indicates that other businesses (with analyst coverage) in a identical business are forecast to see their revenues mature 5.4{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} for each calendar year. So although Concentration Money Associates is predicted to sustain its profits growth rate, it truly is certainly anticipated to mature quicker than the wider business.

The Bottom Line

The largest takeaway for us is the consensus earnings for each share improve, which suggests a very clear enhancement in sentiment all over Target Financial Partners’ earnings probable subsequent year. Happily, there ended up no important alterations to revenue forecasts, with the organization nonetheless expected to grow more rapidly than the wider marketplace. Moreover, the analysts also minimize their cost targets, suggesting that the most current information has led to greater pessimism about the intrinsic value of the organization.

With that in mind, we wouldn’t be as well speedy to arrive to a summary on Aim Monetary Associates. Prolonged-term earnings electricity is significantly much more significant than subsequent year’s revenue. We have estimates – from numerous Focus Economic Associates analysts – heading out to 2024, and you can see them no cost on our platform below.

As well as, you should also learn about the 3 warning indications we’ve noticed with Target Financial Associates (including 1 which can not be disregarded) .

Have comments on this write-up? Anxious about the content? Get in touch with us immediately. Alternatively, email editorial-team (at) simplywallst.com.

This article by Just Wall St is basic in character. We give commentary centered on historical facts and analyst forecasts only working with an impartial methodology and our content are not meant to be money information. It does not constitute a recommendation to purchase or provide any stock, and does not get account of your targets, or your money situation. We intention to deliver you extended-expression focused assessment pushed by fundamental knowledge. Note that our investigation could not component in the hottest price tag-sensitive corporation bulletins or qualitative product. Just Wall St has no posture in any stocks stated.