Torsten Asmus/iStock through Getty Photos

Introduction

On days like this I sense a bit like the Weatherman dispensing his forecast:

Outlook unsettled, changeable, stormy, higher force going in, occasional thunderstorms and that is just your home loan costs.

Joking aside, the entire world is in a very restless point out with civil unrest from the Ukraine to France. Our news stream is dominated by concerns of migration, inflation, interest fee hikes, war, uneasy east/west relations and so on. This all will come on the back of a pandemic which wreaked havoc on our wellbeing and left a path of economic destruction for us to offer with.

A lot more quick complications for the authorities are the the latest failures in the banking sector these as Silicon Valley Financial institution, Signature Bank, Credit rating Suisse and many others. This raises the problem of how substantially contagion is there and who else has liquidity complications. In an Evening Briefing from Bloomberg they described the price tag of insurance policy as follows:

“The Federal Deposit Insurance plan Corp., dealing with pretty much $23 billion in costs from current bank failures, is reported to be considering steering a bigger-than-regular part of that burden to the nation’s biggest financial institutions. The company has explained it programs to propose a so-called exclusive evaluation on the sector in May well to shore up a $128 billion deposit coverage fund that’s established to get hits soon after the new collapses of Silicon Valley Lender and Signature Bank.”

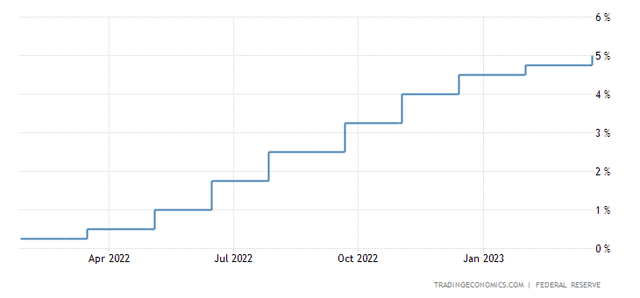

We can see that the banking sector has issues, but as yet we will not how significantly they increase or how deep they will be. Some peace of financial policy may possibly be needed by using a halt to curiosity fee hikes or even a reduction in buy to calm the marketplaces. The Federal Reserve elevated the money amount by .25{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} to 4.75{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996}-5{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} as indicated on the chart down below during their March 2023 meeting.

United States Fed Funds Amount (Trading Economics)

Most of us are facing expense raises ideal across the board so the Feds may be tempted to “pivot” at this juncture and revert to a plan of financial easing. I would be expecting the US Greenback to head south if a coverage of curiosity charge reduction were to be carried out. In turn I would count on Gold which is displaying considerable strength at the moment to rally to better floor and hit a new all-time high this 12 months.

However, the reader must be knowledgeable that I am a gold bug at coronary heart and it is my most well-liked hard asset in instances this sort of as these.

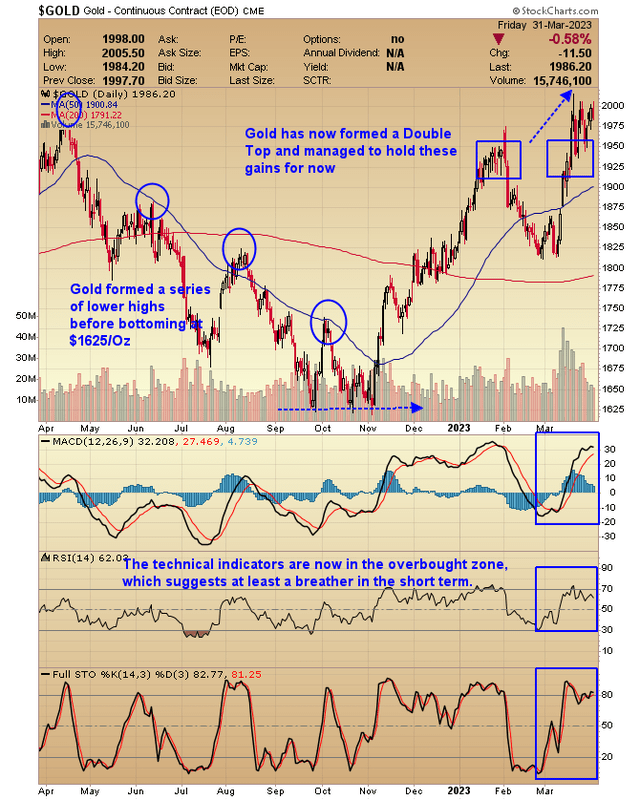

A single Yr Chart Of Gold

A fast appear at the gold chart demonstrates us that gold has not long ago formed a double top. At this juncture gold could have failed to make progress which would have been witnessed as a unfavorable indicator and gold could have been offered off throughout a bout of earnings using.

Nonetheless gold has managed to get over the double best and delivered it’s not an additional bogus dawn could do perfectly from here. On the downside the specialized indicators these kinds of as the MACD are in the Overbought Zone suggesting that gold may perfectly acquire a breather at this point.

One Yr Chart of Gold (stockcharts.com)

I have been lengthy physical gold and silver for several yrs and I am content to go on to maintain them as the outlook seems to be positive for them. However I am also extensive on gold and silver mining shares and am puzzled as to why they are not attracting the investment resources that I feel they have earned. In 2011 when gold traded previously mentioned $1900/Oz the Gold Bugs Index (HUI) stood at 630, below in 2023 with gold investing above $1900/Oz this Index stands at 256, which is less than half of what it was in 2011. This aberration implies that possibly gold is going to arrive clattering down or the mining shares are about to catapult to substantially higher ground.

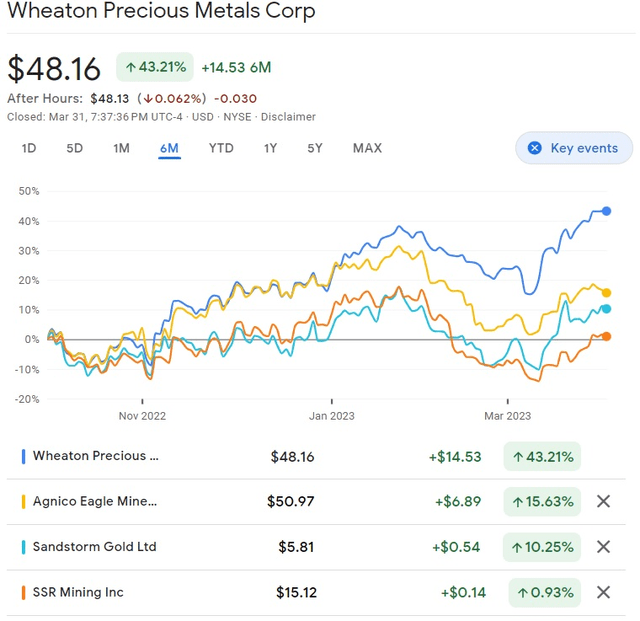

Now when I glance at my individual trading design, contrary to my school reports, I have a tendency to be ‘in’ far too early as my portfolio features but is not constrained to: Sandstorm Gold Ltd. (SAND), Wheaton Important Metals Corp. (WPM), Agnico Eagle Mines Ltd. (AEM) and SSR Mining Inc. (SSRM).

The overall performance of these four stocks about the previous 6 months is varied for a myriad of causes, even so in standard provided gold’s current toughness they ought to be investing at considerably greater degrees.

Gold Mining stocks 6 month period of time (Google Finance)

A amount of these mining stocks are now having to pay a dividend these kinds of as Agnico-Eagle Mines Confined which has an once-a-year dividend generate of 3.14{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} with a $.40 quarterly dividend. So the dividend is not much too shabby, and the probability of a money attain really should attraction to the financial investment group

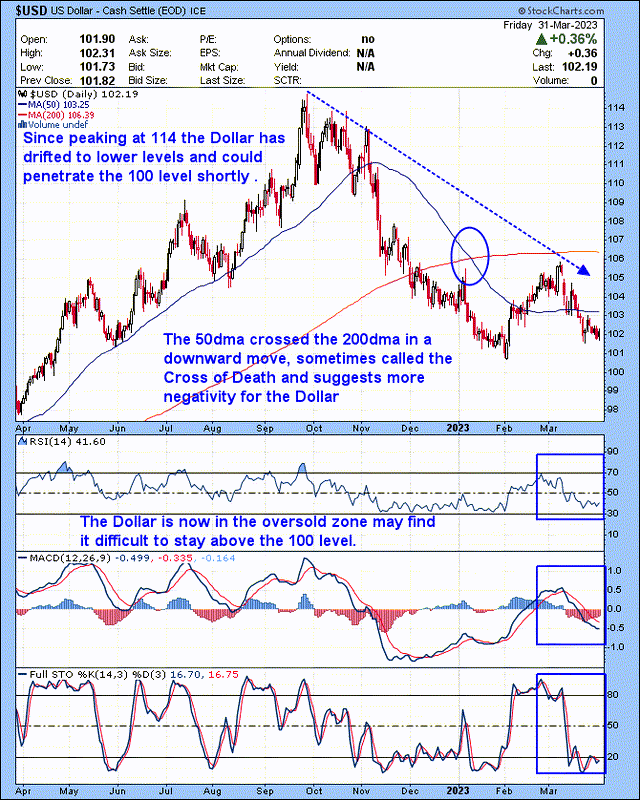

A single Calendar year Chart Of US Greenback

A brief look at the chart of the US greenback and we can see that it truly is dropped from 114 to 102 in 6 months. Really should interest prices be lessened the US dollar could easily trade below the 100 level.

One Year Chart Of The US Dollar (stockcharts)

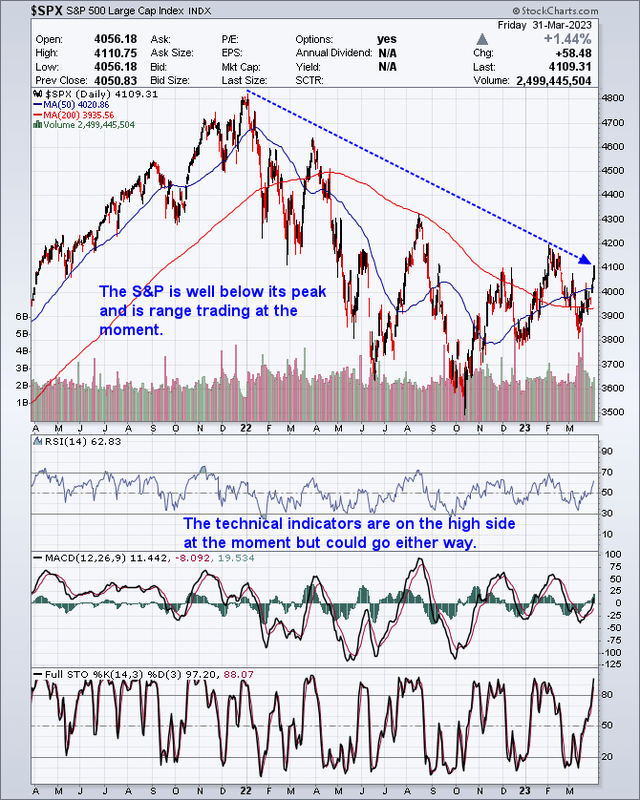

A person 12 months Chart Of S&P 500

Because the beginning of 2022, the S&P 500 has fallen from 4800 to all-around 4000 these days. This decrease has been punctuated by wild oscillations in both directions. This decline can be attributed in some portion to inflation, the increased value of finance and the probability of a intense recession. Specified that the outlook is not really vivid then some traders may perhaps be seeking at alternate current market sectors to make investments in and the important metallic sector could be 1 of them.

Just one 12 months Chart Of The S&P500 (stockcharts)

Summary

The S&P500 would surface to be rolling about so buyers will be seeking for an alternative for their expenditure resources.

Inflation is continues to be stubbornly substantial and could be with us for some time to occur.

Irrespective of high curiosity premiums the US Dollar carries on to drop and inflation continues to decimate its acquiring ability.

The value of borrowing funds is large and could get better in the brief time period igniting a provide-off in the economic markets.

Tricky assets these kinds of as gold and silver are considered by some as insurance coverage towards economic uncertainty and social unrest.

Gold mining shares have been disregarded in my perspective and they have earned to be incorporated, even as a modest proportion of any investors portfolio.

Your reviews are incredibly a lot appreciated so you should fireplace them in, and I will do my greatest to handle each and every and every one particular of them.

Go gently as these are complicated times.