Fears about worldwide financial and fiscal

fragmentation have intensified in latest several years amid rising geopolitical tensions,

strained ties in between the United States and China, and Russia’s invasion of

Ukraine.

Financial fragmentation has vital implications for world-wide financial

steadiness by impacting cross-border expense, worldwide payment

methods, and asset selling prices. This in convert fuels instability by growing

banks’ funding expenditures, reducing their profitability, and lowering their

lending to the private sector.

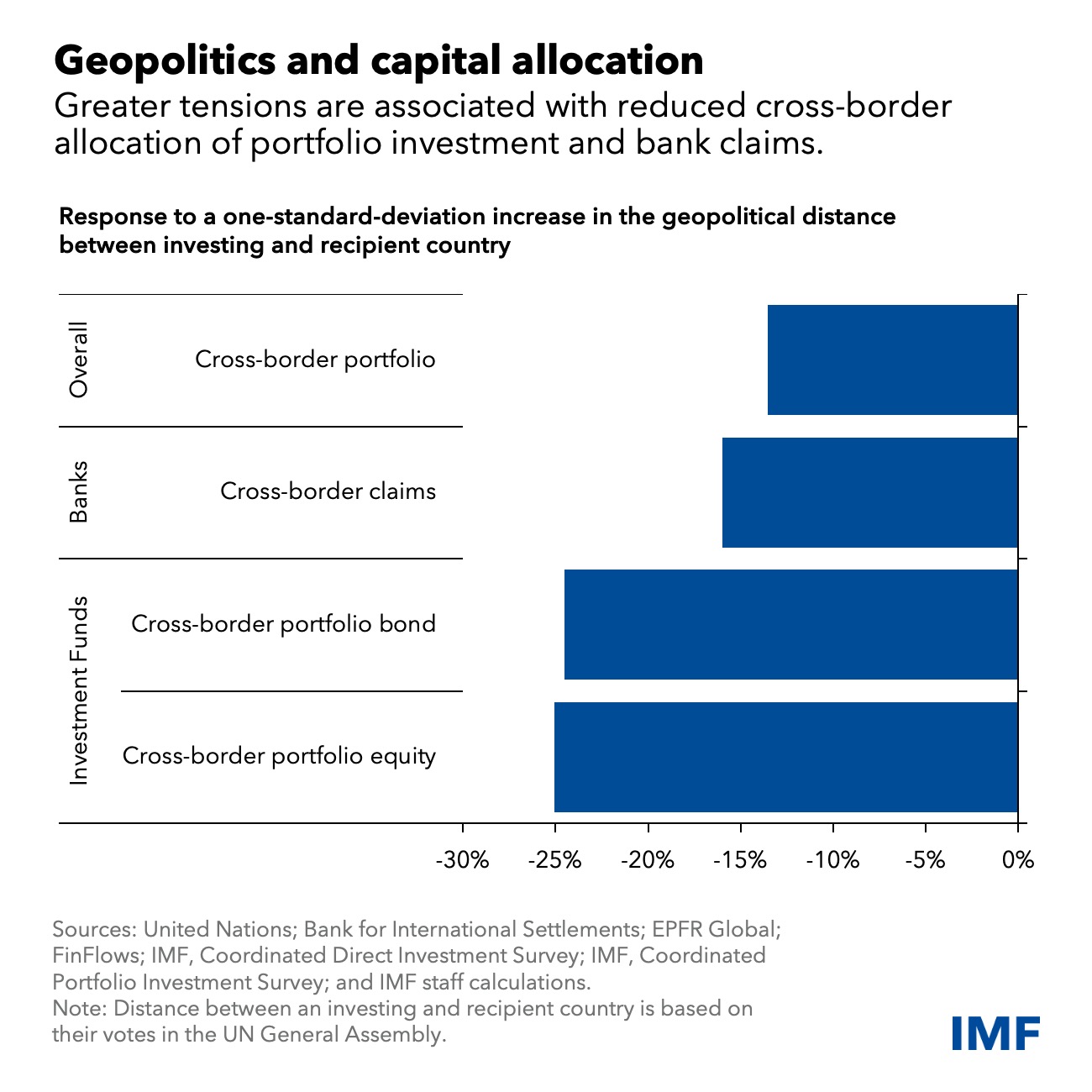

Outcomes on cross-border expenditure

Geopolitical tensions, measured by the divergence in countries’ voting

habits in the United Nations General Assembly, can participate in a huge function in

cross-border portfolio and financial institution allocation, as we compose in an analytical chapter of the latest

World wide Money Security Report

.

An boost in tensions among an investing and a recipient place, these kinds of

as between the United States and China considering that 2016, reduces total

bilateral cross-border allocation of portfolio expense and bank statements

by about 15 percent.

Investment decision money are especially delicate to geopolitical tensions and

tend to reduce cross-border allocations notably to nations with a

diverging overseas policy outlook.

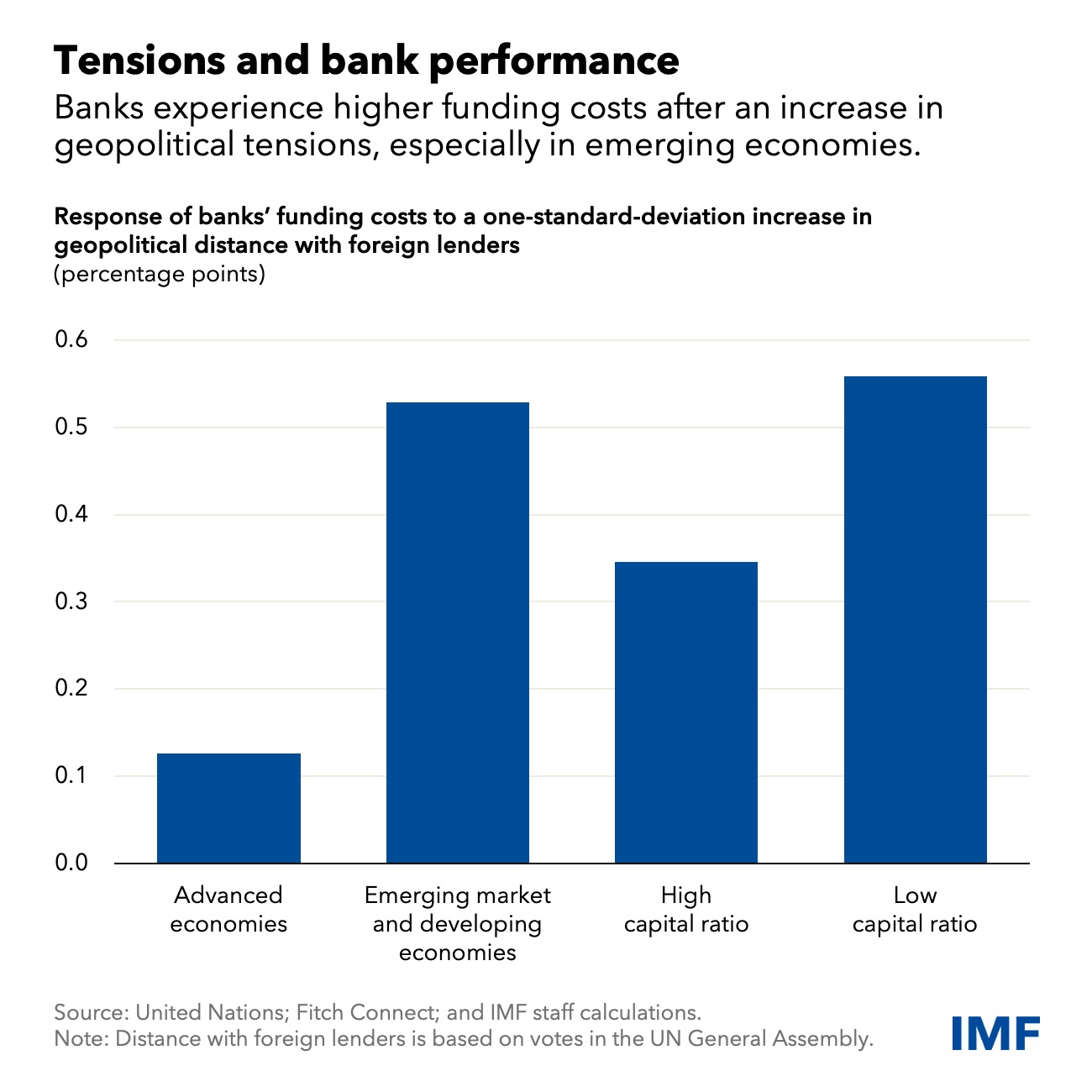

Economical security challenges

Geopolitical tensions threaten economical security by way of a fiscal channel. Imposition of economic limitations, enhanced

uncertainty, and cross-border credit history and investment decision outflows induced by

an escalation of tensions could enhance banks’ personal debt rollover dangers and

funding costs. It could also push-up interest prices on government bonds,

minimizing the values of banks’ belongings and including to their funding prices.

At the exact time, geopolitical tensions are transmitted to financial institutions as a result of

the true economy. The result of disruptions to offer chains and

commodity marketplaces on domestic expansion and inflation could exacerbate banks’

sector and credit losses, more cutting down their profitability and

capitalization. The anxiety is probably to diminish the threat-using capability

of banking companies, prompting them to minimize lending, further weighing on financial

progress.

The economic and real-economy channels are probably to feed off a person another,

with the total result remaining disproportionately more substantial for financial institutions in

rising marketplaces and producing economies, and for these with reduced

capitalization ratios.

In the for a longer time run, higher fiscal fragmentation stemming from

geopolitical tensions could also roil funds flows and critical financial and

economical market place indicators by restricting the alternatives for international

possibility diversification, these kinds of as by lowering the range of countries in which

domestic inhabitants can spend.

How to control challenges

Supervisors, regulators, and economic establishments must be conscious of the

hazards to financial steadiness stemming from a opportunity rise in geopolitical

tensions and commit to identify, quantify, deal with, and mitigate these

threats. A much better knowledge and monitoring of the interactions involving

geopolitical challenges and extra regular ones associated to credit rating, curiosity

level, market, liquidity, and functions could enable prevent a perhaps

destabilizing fallout from geopolitical functions.

To establish actionable rules for supervisors, policymakers should adopt

a systematic method that employs strain screening and state of affairs examination to

evaluate and quantify transmission channels of geopolitical shocks to

money institutions.

Other steps contain:

In response to mounting geopolitical pitfalls, economies reliant on external

financing must ensure an enough stage of worldwide reserves, as

effectively as money and liquidity buffers at financial establishments.

- Policymakers should fortify disaster preparedness and management

frameworks to offer with likely economical instability arising from

heightened geopolitical tensions. Cooperative arrangements involving

distinctive nationwide authorities really should continue to assistance make certain productive

management and containment of intercontinental money crises, like

through development of productive resolution mechanisms for fiscal

establishments that function in numerous jurisdictions. - The world wide money safety net—a established of establishments and mechanisms that

insure versus crises and funding to mitigate their impact—must be

bolstered via mutual guidance agreements involving nations around the world. These

would include things like regional basic safety nets, forex swaps, or fiscal

mechanisms—and precautionary credit strains from global economic

institutions. - In the face of geopolitical threats, attempts by international regulatory

and typical-environment bodies, these kinds of as the Economical Security Board and the

Basel Committee on Banking Supervision, should really proceed to advertise frequent

economic polices and specifications to stop an raise in economical

fragmentation.

In the end, policymakers should be conscious that imposing money

limits for countrywide stability causes could have unintended

implications for world wide macro-financial steadiness. Supplied the major

dangers to international macro-money security, multilateral initiatives ought to be

strengthened to reduce geopolitical tensions and financial and economic

fragmentation.

—This web site is based mostly on Chapter 3 of the April 2023 Worldwide Fiscal Security Report,“Geopolitics and Monetary Fragmentation: Implications for Macro-Economical Balance.”