A blend of hawkish remarks by a pair of Federal Reserve officials, good lender earnings experiences, and a rebounding buyer-sentiment studying on Friday are among the the aspects contributing to a different abrupt readjustment in the economic market’s considering about the route of desire charges.

The unexpected readjustment dented the popular look at that the Federal Reserve may well be approaching the conclude of its yearlong amount-hike cycle. All three important U.S. inventory indexes

DJIA,

SPX,

COMP,

completed reduce, although Treasury yields jumped — led by a 39.5-foundation-issue increase in the 1-month T-invoice fee

TMUBMUSD01M,

according to Tradeweb. The ICE U.S. Dollar Index

DXY,

jumped .5{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996}. And fed funds futures traders boosted the chances of Fed fee hikes in May perhaps and June, while paring their expectations for charge cuts later on this calendar year.

“Everything the marketplace believed as of the close yesterday was contradicted these days,” mentioned Steve Englander, the New York-based mostly head of worldwide G10 Fx study and North The us macro approach for Standard Chartered Financial institution. As he put it, “everything went incorrect in the ‘Fed-is-likely-to-quit-soon’ trade,” while any foreseeable future spillover from the banking-connected strain has the prospective to curtail coverage makers’ fee-hike cycle.

Friday’s information provided a report from the College of Michigan, which confirmed buyer sentiment creeping up and People in america much more nervous about higher inflation. And although retail profits tumbled by more than expected in March, some folks noticed the probable for even further weak point, which didn’t arrive to fruition, Englander said. On major of this, JPMorgan Chase

JPM,

and Citigroup Inc.

C,

claimed very first-quarter benefits that delighted investors.

See: JPMorgan Chase inventory moves good for the yr immediately after it blasts previous earnings and earnings estimates

Meanwhile, two Fed policy makers stepped into the fold with hawkish responses. Fed Gov. Christopher Waller claimed he sees the require for the central lender to continue to keep boosting rates, whilst Atlanta Fed President Raphael Bostic told Reuters that latest inflation knowledge “are regular with us relocating one particular extra time.”

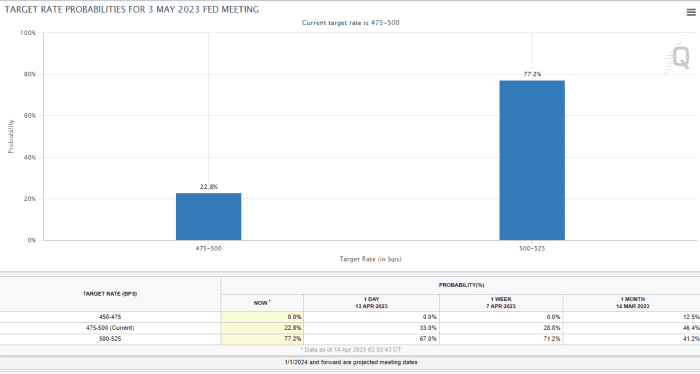

As a end result, fed funds futures traders set a far more than 70{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} prospect on an additional quarter-of-a-percentage-position charge hike in May, which would elevate the Fed’s main curiosity-rate concentrate on to amongst 5{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} and 5.25{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996}, and they boosted the probability of a comparable-size go in June, in accordance to the CME FedWatch Instrument.

Resource: CME FedWatch Device, as of Friday.

“The million-dollar question is, ‘how significantly much more does the Fed have to do?’” said Rob Daly, director of set earnings at Glenmede Financial investment Administration in Philadelphia. “I’m in the camp that believes it could be just one or two more hikes, but the upcoming problem is, ‘how prolonged do they maintain costs elevated?’”

“Risk assets have remained unbelievably resilient, we’ve witnessed a pretty strong labor industry, and inflation is nonetheless higher,” Daly stated by means of cellular phone. “I do not see any purpose the Fed would be reducing costs whenever before long. The knowledge has been resilient and not always weak enough for the Fed to alter system.”