(Bloomberg) — When the nineties finished, an overvalued stock industry took 3 extended many years to rid itself of its amassed excess in what is now acknowledged as the dot-com crash.

Most Browse from Bloomberg

That a very similar reckoning has necessary just 14 months to engage in out now is a indicator of how speedy going this industry is — and how risky it’s turn into for everyone believing they can decide a instant to get and market.

The perils were on entire screen Friday as a warm inflation reading jolted fiscal markets, shaking the S&P 500 out of a vary it had settled into this month. Traders who experienced seen the index rally 9{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} because it nearly tipped into a bear industry May well 20 were blindsided by the latest bout of promoting.

Persistent inflation is only the most up-to-date risk to a market place pounded by a flurry of macro blows. Attempting to figure out which matters most has develop into anything of a fool’s errand. That is fundamentally the see of Eric Schoenstein, co-manager of the $9.7 billion Jensen Excellent Advancement Fund (ticker JENSX), which according to Bloomberg information has crushed 96{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} of peers in the earlier year. With inflation, the Federal Reserve, a pandemic and war bearing down on trader psyches, the only safe and sound wager at this position is that fairness volatility will keep on.

“It just feels like there is nothing that you could point to and say, ‘that’s the explanation, and if we get this piece cleared up, anything will move and we can transfer on to the following iteration,’” Schoenstein stated by phone. “With all of that uncertainty, the sector is likely to pull back again, and investors, frankly, are in all probability in a method wherever they are performing a bit more indiscriminate providing.”

Study: It’s the Worst Fairness Rate Action in 4 Decades: Macro Man

The S&P 500 tumbled extra than 2.5{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} as of 11:05 a.m. in New York Friday, as unexpectedly incredibly hot customer-charges fueled bets the central lender will have to toughen its struggle against inflation. Down virtually 5{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} around five times, the index is on study course for its worst week because January.

That tendency to provide regardless of what you can has contributed to an epic drop in valuations. Soon after peaking previously mentioned 30 moments earnings a year in the past, the S&P 500’s several shrunk by around 40{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} through its trough in Could — almost matching the dimension of the contraction through the full 2000-2002 crash.

In other text, the correction to valuations is going on three occasions speedier than the bursting of the web bubble.

To Bloomberg Intelligence’s Gina Martin Adams, the accelerated drawdown demonstrates how significantly the write-up-pandemic fairness rally relied on the Fed. The moment the central bank turned hawkish, the unwinding was vicious.

“When straightforward revenue disappears, the bubble disappears,” Martin Adams claimed. “The foundation of the bubble in the 1990s was current market psychology about growth prospective customers and fairness ownership. It was tougher to deflate.”

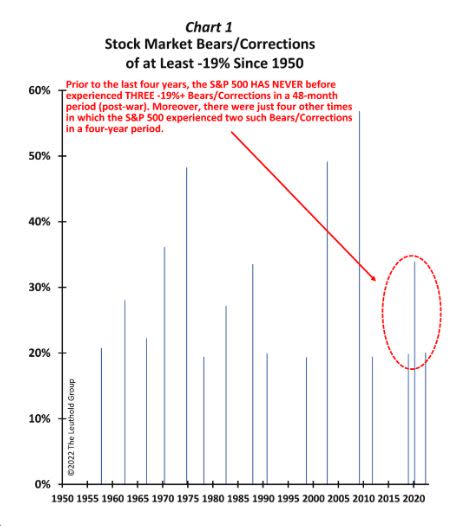

Thanks to reliable earnings, the meltdown in P/E has finished fewer destruction to the sector on the price amount. Even now, down 19{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} from its January peak to the May bottom, the S&P 500 just endured its 3rd retrenchment of at the very least that magnitude in four many years. Such oft-recurring turbulence experienced never ever transpired considering that at minimum 1950, according to Leuthold Team.

Underpinning the intense recurrence of fairness turmoil is an unusually unstable financial and plan backdrop. Following sinking into a recession for the duration of the pandemic, the US is now booming following unprecedented authorities and central lender stimulus. The Fed, which put in most of the previous decade combating deflation, is battling the speediest inflation in four a long time.

To the delight of the bulls, the initially two losses, 1 in late 2018 and the other in early 2020, have been all but erased in a make any difference of months. Though stocks have but to get better from their 2022 slide, anybody who experienced acquired shares 4 years in the past and stayed invested would have given that loved an annualized return of 12{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996}.

“The fact the S&P 500 has in some way shipped sound outcomes through 4 many years of remarkable volatility and uncertainty is fascinating,” Jim Paulsen, main investment strategist at Leuthold, wrote in a recent be aware. “Often, the stock sector ‘returns’ when most are waiting for the dust to settle. Volatility and uncertainty can be indications of trouble forward, but they also routinely signal wonderful chances.”

But just one large variation now is the Fed’s stance. Unlike in 2018 and 2020, when the central bank speedily came to the rescue, this kind of basic safety net no more time exists with plan makers laser-targeted on taming inflation.

Conflicting narratives abound. While recession talk is setting up, financial knowledge and company earnings carry on to stage to a balanced organization cycle.

Schoenstein at Jensen says he refrains from predicting the place equities are heading. Instead than timing the market, he claims, buyers ought to emphasis on buying stocks that will be in a position to endure any extended economic difficulties.

His business has taken advantage of this year’s selloff to insert to holdings of stable growers, this kind of as insurance policy broker Marsh & McLennan Co. and Moody’s Corp., a credit rating-score enterprise.

“When you do that independently, company by organization, in a higher conviction method, you really don’t devote as a great deal time making an attempt to figure out ‘is the current market at the base, is the current market at the top, or is the market place heading to flip all around?’” Schoenstein stated. “That will give you additional means to kind of slumber at evening.”

Most Study from Bloomberg Businessweek

©2022 Bloomberg L.P.