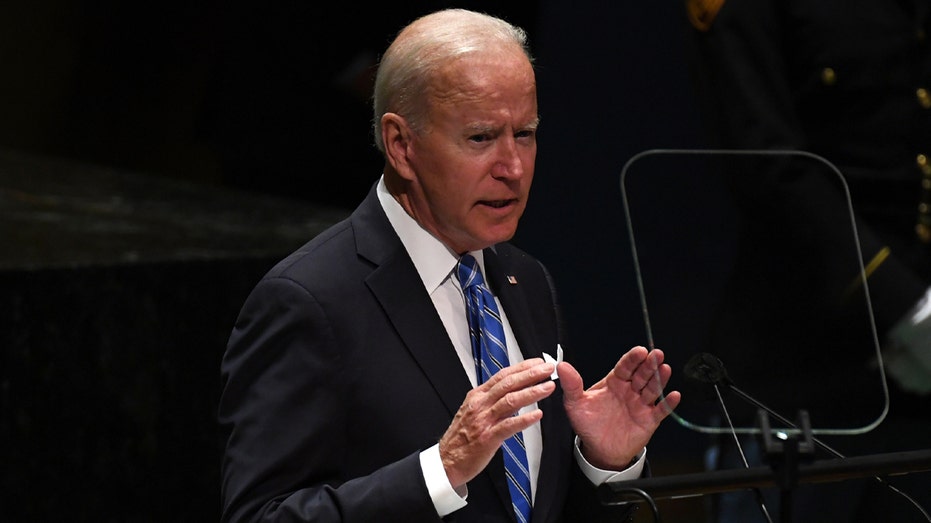

President Biden announces his budget for fiscal calendar year 2023.

President Biden manufactured a renewed force on Monday to impress congressional Democrats to overhaul the nation’s tax code and dramatically increase premiums on companies and ultra-rich Americans.

The president laid out the tax hikes as section of his $5.8 trillion spending budget blueprint for federal paying in fiscal 2023, which commences in Oct. Less than his proposal, taxes would increase by $2.5 trillion, marking the most significant boost in historical past in dollar terms. The deficit would be $1.15 trillion.

THESE STATES ROLLED Again THEIR GASOLINE TAXES. Other people COULD Comply with

The greater taxes would mainly be borne by Wall Street and the prime sliver of U.S. households, in the kind of a steeper corporate charge, a modified wealth tax and a worldwide bare minimum tax.

“We are cutting down the Trump deficits and returning our fiscal dwelling to purchase,” Biden reported at the White Household on Monday, referring to the widening paying out hole underneath former President Donald Trump. He stated the finances “tends to make prudent expense and financial advancement, a much more equitable financial system, though making positive organizations and the really wealthy pay out their fair share.”

U.S. President Joe Biden addresses the 76th Session of the U.N. Common Assembly on September 21, 2021, at U.N. headquarters in New York City. ((Picture by Timothy A. Clary-Pool/Getty Pictures) / Getty Photos)

The taxes outlined on Monday involve a least 20{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} tax on the incomes of U.S. homes well worth $100 million or extra – identical to other proposals that Democrats floated past calendar year to pay for Biden’s significant spending prepare. But individuals pitches fell to the wayside immediately after talks with West Virginia Sen. Joe Manchin collapsed.

The so-known as “Billionaire Bare minimum Money Tax” would raise $361 billion in earnings about 10 several years and implement to the top rated .01{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} of households, or about 20,000 Us residents. The White Household mentioned that around 50 {21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} the profits stems from the country’s 700 billionaires.

Less than the proposal, the wealthiest Us citizens would be expected to fork out a tax amount of at least 20{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} on their comprehensive money, or the mixture of wage cash flow and whatever they designed in unrealized gains. If a billionaire is not shelling out 20{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} on their money, they will owe a “prime-up payment” that tends to make up the change to fulfill the new bare minimum.

Economic downturn INDICATOR FLASHES Red AS Pieces OF Yield CURVE INVERT FOR To start with TIME Considering that 2006

Homes that are shelling out 20{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} will not be necessary to fork out an more tax.

Mainly because numerous of the ultra-loaded derive their extensive wealth from the soaring benefit of property like stock and property – which are not deemed to be taxable money unless of course that personal sells – they are able to lawfully keep their fortunes and lower their tax legal responsibility. Under existing law, a get is only taxed if and when the proprietor sells the asset.

Sen. Joe Manchin (D-WV) speaks to reporters in advance of a caucus meeting with fellow Senate Democrats on Capitol Hill January 18, 2022, in Washington, DC. (Drew Angerer/Getty Pictures / Getty Photos)

“As a consequence, this new minimal tax will reduce the skill for the unrealized earnings of ultra-substantial-internet-truly worth homes to go untaxed for decades or generations,” the White Property mentioned in the spending plan proposal.

Despite the fact that Biden did not endorse a billionaires’ tax in the course of the 2020 presidential marketing campaign, he threw his help at the rear of the strategy this past calendar year soon after Manchin killed a various paying out approach that incorporated tax hikes on perfectly-off corporations and Americans earning extra than $400,000.

It continues to be unclear whether or not congressional Democrats will approve of Biden’s approach to tax billionaires and ultra-millionaires.

Evening falls at the the Capitol in Washington, Thursday, Dec. 2, 2021, with the deadline to fund the govt approaching. ( (AP Photo/J. Scott Applewhite) / AP Newsroom)

Manchin known as a different billionaires’ tax proposal from Sen. Ron Wyden, D-Ore., “convoluted,” but has considering that advised that he could aid some variety of levy focusing on the richest Individuals.

Tax professionals are also skeptical about the feasibility of the proposal.

John Gimigliano, the head of federal legislative regulatory solutions at KPMG, instructed FOX Business enterprise the proposed billionaire tax is “very likely to be a sluggish burn off.”

“It’s heading to take substantial time for Congress to digest this proposal each intellectually and politically,” he reported. “It is really difficult to uncover occasions in the Inner Income Code in which Congress has picked to tax unrealized gains – it’s virtually taboo.”

Biden also proposed elevating the corporate tax charge to 28{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} from 21{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} as element of his price range ask for and pitched a global least tax which is developed to crack down on offshore tax havens. Arizona Sen. Kyrsten Sinema has formerly reported that she will not guidance a corporate tax improve.

GET FOX Company ON THE GO BY CLICKING Listed here

Under his envisioned finances, the nation’s deficit would shrink by additional than $1 trillion in excess of the next ten years. In fiscal 12 months 2021, the federal deficit attained almost $2.8 trillion, in accordance to the Congressional Funds Place of work, although the national credit card debt ballooned past $30 trillion.