About the past calendar year, advisors may have “recession-proofed” their clients’ portfolios.

For fantastic explanation: Based on whom you ask, the marketplaces could previously have priced in a recession. About two-thirds of economists consider a person is coming in 2023, in accordance to a World Economic Discussion board survey. And regardless of a rosy new work opportunities report, the Federal Reserve initiatives unemployment will inch up this yr, to 4.2{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996}. Whilst which is small by historic criteria, it however suggests more than 8 million looming task losses.

If the forecast bears out, some of those position losses will include things like advisors’ consumers, who from their operate with a professional should at least have an emergency plan and a portfolio attuned to their chance tolerance. But the place does that go away advisors them selves?

Previous AS PROLOGUE

If historical past is any tutorial, there is fantastic news.

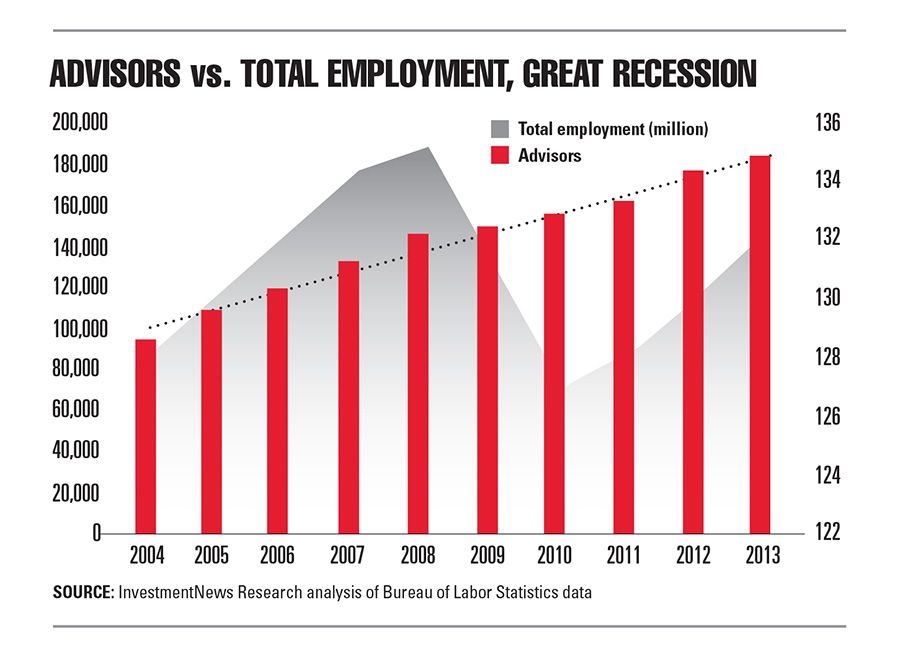

Fiscal advisors ended up amid the most economic downturn-evidence occupations all through the Wonderful Economic downturn, in accordance to an InvestmentNews Investigation investigation of Bureau of Labor Figures facts. The assessment focused on significant-earning professions where by employing was not countercyclical (i.e., showing non permanent development developing only for the duration of the recession). From 2007 to 2010, the peak decades of in general career reduction, the advisory career attained about 23,000 people today, earning it the fifth most secure career in the examination.

Though lots of of the most secure positions through the previous extended recession were concentrated in popular fields like health and fitness treatment and engineering, economical assistance was a refuge within its sector. Advisor employment rose 17.3{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} all through the peak occupation reduction years even amid a 9.3{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} drop in full finance and insurance sector employment. Occupations like mortgage officers, accountants and credit history analysts have been among the the toughest hit all round.

Section of the increase in advisor employment in this interval could reflect the prevalence of career-changers in the industry. The knowledge are constrained on this, but work losses in other financial occupations could have led people gurus to pivot into the rising subject of information. Yet that nevertheless doesn’t demonstrate why the industry for suggestions supported these kinds of an inflow of specialists during a down period.

Academics Yuanshan Cheng, Charlene M. Kalenkoski and Philip Gibson later examined the Fantastic Recession’s impression on the choosing and firing of advisors in the Journal of Fiscal Counseling and Planning, hypothesizing consumers would be pushed to and from advisors principally by reduction of prosperity or profits.

Rather, they observed that whilst an enhance in earnings experienced a major effects on no matter if people employed advisors, losses did not significantly raise the chance of an existing consumer firing their advisor. Demographics like instruction, which they used as a proxy for an knowing of the sector, ended up much more vital.

“Our results demonstrate that clients do not fireplace their economical advisor due to the fact they working experience a decrease in net truly worth in the course of recessionary intervals,” they wrote, but “demographics and psychological attributes of consumers have a greater affect on the advisor-client relationship.”

In other words and phrases, advisors can see upside from the portions of the financial system continue to doing properly through a recession, without having as considerably downside from present-day shoppers faring worse. Far more latest study lends the plan credence: In a buyer survey executed past 12 months by InvestmentNews, only 17{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} of respondents doing the job with an advisor explained they would be pretty most likely to fireplace them over a decrease in their portfolio.

Of system, each individual downturn is unique. Scenario in point: This analysis overlooked the center of 2020, which even with conference the technical definition of a recession features tiny in conditions of precedent. Even a recession that looked much more like 2009 would be formed by new variables.

Query OF AUTOMATION

For advisors, maybe the major variable is the 15 a long time of market technology that has arrived since.

However there is small explanation to imagine the field has the know-how on hand to noticeably minimize the need to have for human advisors limited expression. Surveys of technology final decision-makers at firms have proven shelling out growing year just after yr, but largely on consumer acquisition instruments like CRMs, digital onboarding plans and marketing software program.

For all the know-how bringing in new consumers, it’s not clear the economics of serving them have improved substantially. From 2018 to 2021 (the newest 12 months obtainable), the InvestmentNews Advisor Benchmarking Study tracked a 51{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} enhance in normal firm spending on engineering. Over the exact same time period, the typical amount of clientele served by advisors fell to 73 from 74. Client associations grew extra rewarding, and tech likely performed a purpose, but it did not change the human ability demanded to serve clients.

That is not to say evolving developments like the increase of Diy investing or emerging engineering like synthetic intelligence won’t pose for a longer time-phrase threats to the job. But they are possible a for a longer period way off than the future recession.

So advisors can almost certainly go on to assuage their clients’ economic downturn fears without perspiring their own careers much too substantially. Continue to, a small recession-proofing hardly ever hurts.

[More: Most recession-proof jobs]

[More: Least recession-proof jobs]