I have been a reader of Jamie Catherwood’s Investor Amnesia due to the fact it released. It is often loaded with interesting reminders from the previous.

Investor Amnesia is a amazing reminder that we tend to ignore that which came before. Ray Dalio place it even far more starkly, noting that very little is definitely unparalleled, and we are likely to use that word to refer to those people items we have not expert in our lifetimes.

Towards that close, check out Catherwood’s newest undertaking: The Ages Of Finance: A Timeline Of Marketplaces. You can kind the extensive background of finance on a timeline, both by distinct subjects — Equities, Milestones & Improvements, Commodities, Personal debt, and Manias & Crashes — or by “All Marketplace Record.” It is nonetheless an additional reminder of how exceptional really novel occasions are, and how almost everything old becomes new once again.

I’ve bundled some samples beneath, but you need to go test out the Timeline in its entirety….

~~~

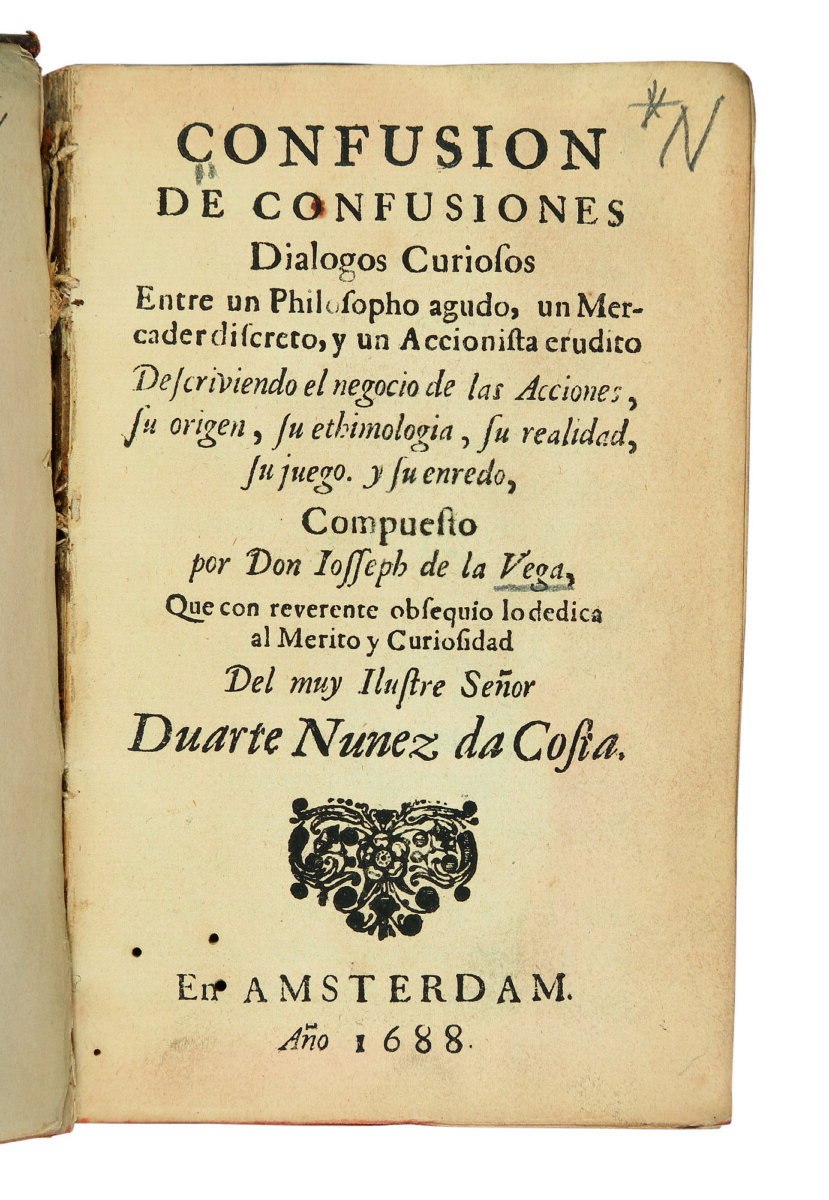

Joseph de la Vega wrote the very first ever behavioral finance e-book in 17th century Holland. His book, Confusion de Confusiones, is a conversation between an Investor, Thinker and Service provider in which the Investor explains how the inventory current market features. This excerpt features just just one of the outstanding descriptions of marketplaces:

“This enterprise of mine [investing] is a mysterious affair, and that, even as it was the most truthful and noble in all of Europe, so it was also the falsest and most notorious small business in the entire world. The fact of this paradox turns into comprehensible, when one appreciates that this organization has automatically been converted into a sport, and merchants [concerned in it] have come to be speculators…“

~~~

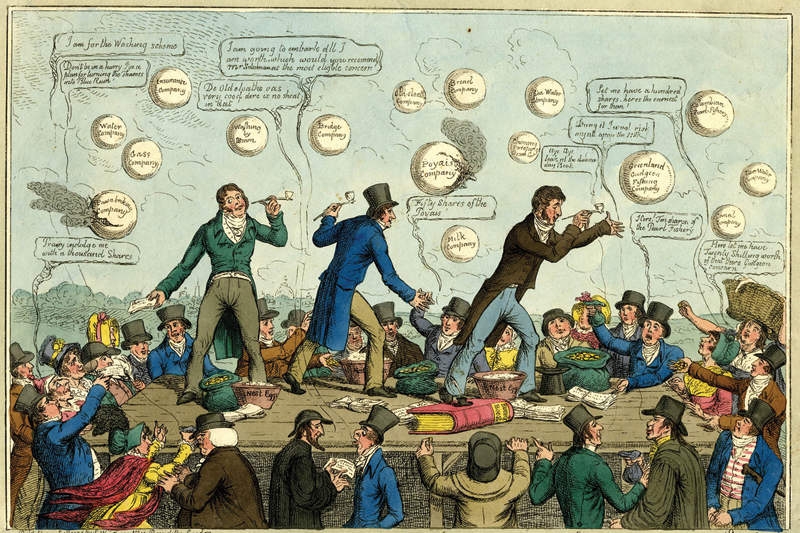

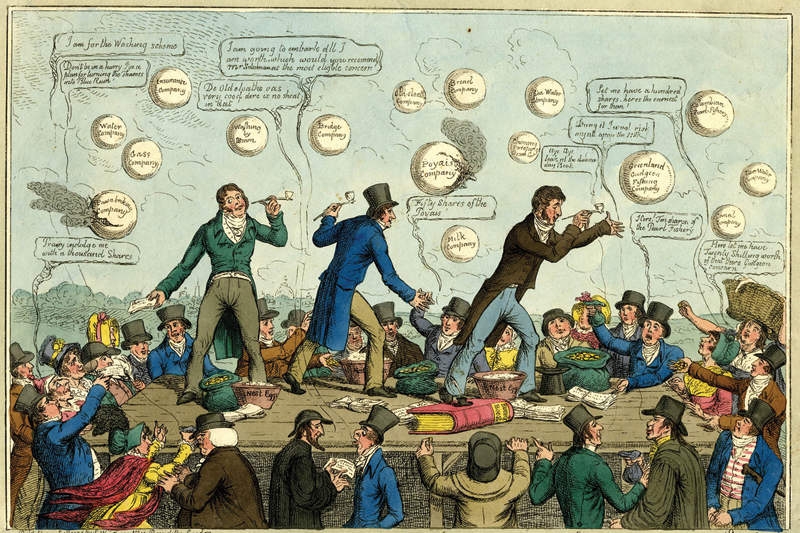

The Poyais Fraud

Gregor MacGregor was considered the ‘King of Con-Men’ by The Economist for pulling off the ‘greatest self esteem trick of all time’. MacGregor attained this title by finding an uninhabited piece of land on the coastline of Honduras, making a fictitious country named Poyais, and promoting over a billion bucks well worth of ‘Poyais bonds’ in London by deceptive traders with lies about how Poyais was a created society. MacGregor claimed that Poyais was home to beautiful architecture, an opera house, parliamentary making, cathedral, and extra. In reality, it was an uninhabited jungle. –Poyais Fraud

~~~

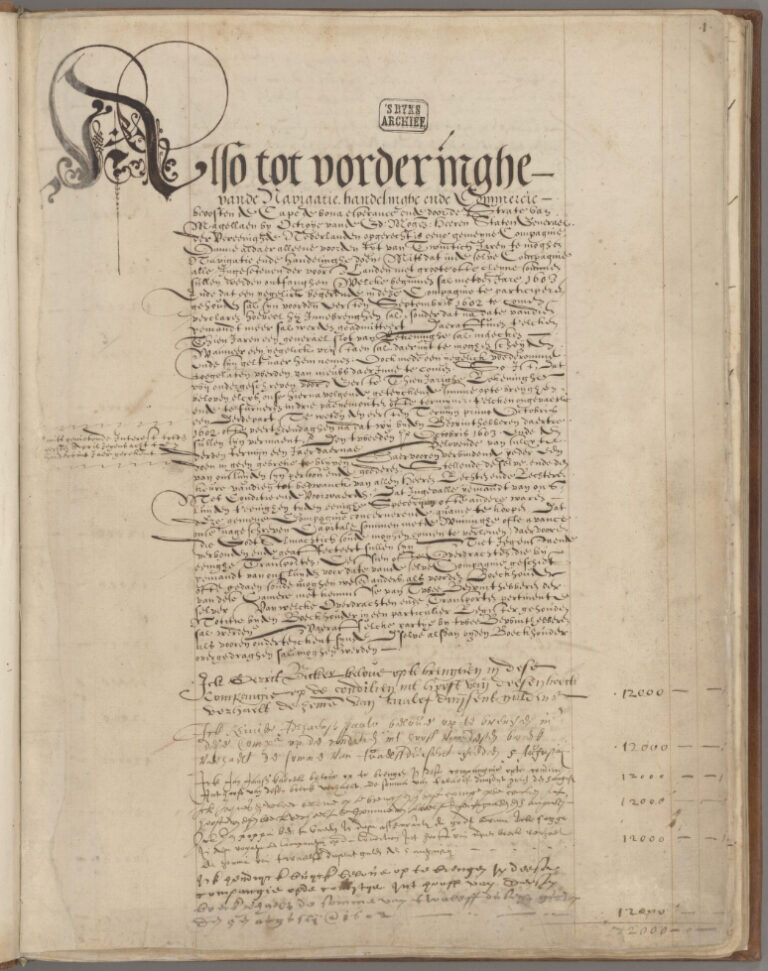

The Very first IPO

The Dutch East India Organization formally declared its IPO in the corporation’s founding constitution on March 20, 1602. The firm invited all Dutchmen to invest when shares grew to become available for acquire in August 1602. The general public’s ability to devote in this share supplying was what designed this 1st “IPO” so exclusive, as previously firms raised capital from tiny groups of wealthy investors. When the IPO membership time period ended on August 31, some 1,100 buyers experienced bought shares in the IPO. Go through Much more: The World’s 1st IPO

~~~

The Worry Of 1882