The close to $1.4 trillion collapse of the crypto marketplace in 2022 did not make a dent to classic assets like stocks or to the genuine financial system.

But a single academic has warned that the failure of a big stablecoin could have an effects on the U.S. bond marketplace, marking a prospective new area that investors have to have to preserve an eye on as contagion continues to unfold throughout the industry.

Stablecoins are a style of electronic currency that is meant to be pegged one particular-to-one particular with a fiat currency these kinds of as the U.S. dollar or the euro. Examples include tether (USDT), USD coin (USDC) and Binance USD (BUSD), which are the 3 greatest stablecoins.

All those varieties of cash have turn out to be the spine of the crypto financial system, enabling persons to trade in and out of various cryptocurrencies devoid of needing to transform their income to fiat.

Issuers of individuals stablecoins say they are backed by real property these as fiat currency or bonds so that end users can redeem their token one-for-one with a authentic asset.

Tether claims that additional than 58{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} of its reserves are held in U.S. Treasury Bills, accounting for all around $39.7 billion. Circle, the organization powering USDC, has around $12.7 billion value of Treasurys in its reserve. Paxos, which problems BUSD, stated it has all-around $6 billion of U.S. Treasury expenditures. All all those figures are from the companies’ latest studies which were being issued in November.

But when there are no signals of important stablecoins collapsing, Eswar Prasad, an economics professor at Cornell University, reported it really is one thing regulators he is spoken to are anxious about because of the influence it could have on regular financial markets. That is because a possible operate on a stablecoin — in which large swathes of end users seem to redeem their digital forex for fiat — would signify the issuer has to promote off the assets in their reserve. That could suggest dumping significant amounts of U.S. Treasurys.

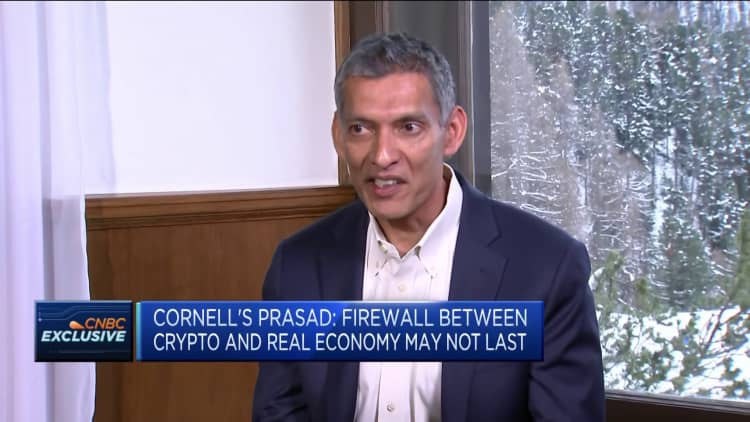

“And I consider [the] concern of regulators is if there were being to be a decline of self-assurance in stablecoins … then you could have a wave of redemptions, which will in convert indicate that the stablecoin issuers have to redeem their holdings of Treasury securities,” Prasad advised CNBC at the Crypto Finance Conference in St. Moritz, Switzerland, this week.

“And a large quantity of redemptions even in a relatively liquid sector can produce turmoil in the underlying securities sector. And provided how important the Treasury securities market is to the broader economical technique in the U.S. … I imagine regulators are rightly anxious.”

A expanding variety of voices have warned about the affect that a “run” on stablecoins could have on standard financial markets.

Just_super | Istock | Getty Photographs

Prasad advises regulators close to the planet on policy related to cryptocurrencies.

The academic warned that if this kind of a operate ended up to come about when bond market sentiment was “very fragile as it is in the U.S. right now,” there could be a “multiplier outcome” many thanks to big selling stress on Treasurys.

“If you have a large wave of redemptions that can genuinely damage liquidity in that sector,” Prasad mentioned.

The Federal Reserve hiked interest costs a number of instances in 2022 and is anticipated to go on to do so this calendar year as it appears to be like to tame rampant inflation. The U.S bond market had its worst 12 months on document in 2022.

Stablecoins account for about $145 billion of value out of the $881 billion that the complete cryptocurrency industry is worthy of, so they are major. And there have been failures by now.

Final 12 months, a coin called terraUSD collapsed. It was dubbed an algorithmic stablecoin, so termed since it taken care of its a person-to-a single peg with the U.S. dollar by way of an algorithm. It was not backed in complete by authentic assets these types of as bonds as USDC, BUSD and USDT are. The algorithm failed and terraUSD crashed, sending shock waves across the crypto market.

The U.S. Federal Reserve also warned in a report in May well 2022 that “stablecoins continue to be inclined to operates, and several bond and bank loan mutual funds go on to be susceptible to redemption dangers.”

Invoice Tai, a perfectly-acknowledged enterprise capitalist and crypto sector veteran, mentioned he doesn’t imagine there will be a collapse of any of the main stablecoins, but said that scrutiny on this style of cryptocurrency “has absent up for excellent rationale.”

“I imagine just like in our classic finance business, where people bought caught off guard by hidden contagion within the subprime market place during the fantastic economical crisis, there could be a pocket or two of leverage on some of the belongings that purport to support stablecoin,” Tai told CNBC in an job interview Thursday.

Tai likened a prospective stablecoin blowup to a surprise occasion like the subprime mortgage crisis, which began in 2007. Loan providers supplied mortgages to debtors with inadequate credit history, major to defaults and contributing to the monetary disaster. It came as to some degree of a shock.

“And if a single of these (stablecoins) goes down, there will be yet another downdraft,” Tai included.