The unexpected collapse of FTX, the world’s 3rd-premier cryptocurrency trade, underlines how important it is for any investor to study about the risks they consider when they park their money with a evenly regulated organization.

FTX and its affiliate businesses submitted for personal bankruptcy Nov. 11. The company’s founder, Sam Bankman-Fried, resigned his situation as CEO and was replaced by John J. Ray III, a law firm who has worked on the bankruptcies of Enron, Nortel Networks and numerous other firms.

Bankman-Fried is being on with FTX “to aid with an orderly changeover,” in accordance to a push release.

FTX, dependent in the Bahamas, held about $16 billion in consumer assets but experienced lent about $10 billion of those people money to Alameda Investigate, a trading business also operate by Bankman-Fried and headquartered in Hong Kong, according to a Wall Road Journal report. Alameda, in switch, experienced lent out billions of bucks, with some financial loans secured by FTT, a cryptocurrency designed by FTX, in accordance to a Nov. 2 report from CoinDesk.

The benefit of FTT crashed as FTX confronted $5 billion in consumer withdrawal requests last weekend, which remaining FTX struggling with an $8 billion shortfall, in accordance to Bankman-Fried. Binance, the world’s premier crypto trade, had claimed it was selling its $500 million in FTT dependent on stories of FTX’s loans to Alameda.

In this week’s Dispersed Ledger column, Frances Yue rounds up the collapse of FTX, rescue makes an attempt and market response.

Weston Blasi summarizes Bankman-Fried’s amazing claim that he was unaware of FTX’s leverage hazard, which include an obvious absence of basic economical controls.

Much more coverage and differing thoughts as this story develops:

The increase and fall of Sam Bankman-Fried

Lukas I. Alpert chronicles FTX and Alameda Study founder Sam Bankman-Fried’s fast rise and the prompt collapse of his organizations.

Much more: Crypto billionaire Sam Bankman-Fried’s web worth could shrink by above $13 billion

What does the crypto crash signify for financial markets?

Riskier fiscal dominoes drop as extra liquidity dries up.

Getty Pictures/iStockphoto

MarketWatch’s Require to Know column is an early-morning roundup of important areas of worry for investors each individual investing day.

On Nov. 10, as FTX was immediately coming apart, Thomas H. Kee Jr., CEO of Stock Traders Every day and portfolio manger at Equity Logic, described how a decline in excessive liquidity experienced reversed the run-up for cryptocurrencies and riskier stocks. He defined how this could enjoy out in the broader inventory industry.

He also shared buying chances introduced about by this year’s declines.

Bitcoin’s volatility could not be as fantastic as you assume

Getty Photos

Bitcoin

BTCUSD,

alone does not depict the variety of possibility that FTX and Alameda Exploration took by accepting a digital coin as collateral for billions of pounds value of loans. But it absolutely sure is volatile.

On Nov. 10, improved-than-envisioned inflation numbers served drive bitcoin’s value up 11{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} to $17,524. But then bitcoin was down 6{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} early Friday to $16,527. At that issue, bitcoin was down 64{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} from the conclude of 2021. Continue to, it was up 150{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} from 5 many years before.

So how volatile is bitcoin? Mark Hulbert’s summary may perhaps shock you.

What’s genuinely going on with inflation?

Investors ended up ecstatic immediately after inflation figures for Oct came in decrease than envisioned, sending broad inventory indexes soaring Nov. 10.

As typical, the satan is in the facts. Here’s a set of further seems at the inflation facts:

How to handle firm inventory if you get rid of your career

Meta Platforms is in the approach of laying off 1000’s of employees.

Getty Images

This is an unsure time, even for the biggest tech companies that experienced been escalating employees levels steadily for a long time.

This week Meta Platforms

META,

the mother or father enterprise of Facebook, commenced laying off about 11,000 personnel. Amazon.com

AMZN,

is examining fees of unprofitable models. The greatest company expenditure is generally workers.

Generally when an personnel are demonstrated the doorway, they are nonetheless keeping selections in their previous employer’s stock. Here’s how to cope with that circumstance if it occurs to you.

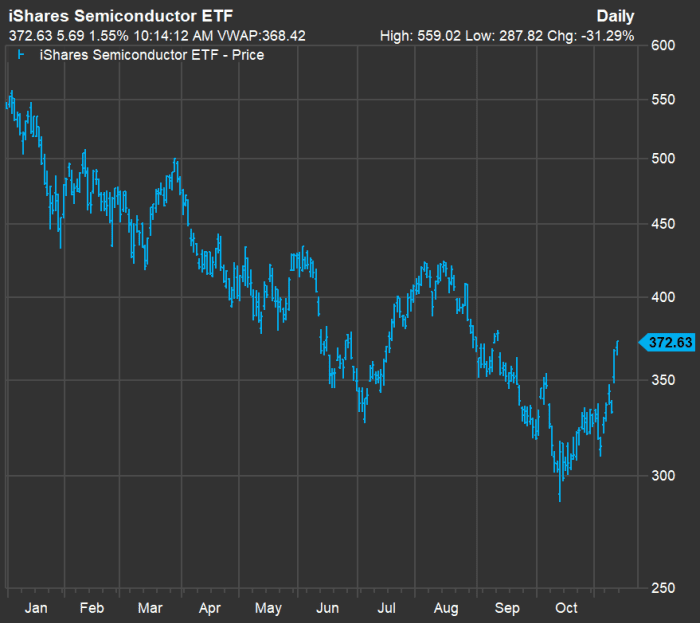

Semiconductor shares may perhaps have begun rebounding

Semiconductor stocks have been roaring again from their mid-Oct lows.

FactSet

The iShares Semiconductor ETF

SOXX,

tracks the PHLX Semiconductor Index

SOX,

by holding shares of 30 significant suppliers of computer chips or related hardware. The ETF was down 45{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} for 2022 as a result of Oct. 14 but rose 23{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} from there, such as a 10{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} enhance on Nov. 10.

The submit-CPI euphoria might transform out to be just another bear marketplace rally, but SOXX now trades for 16.7 periods weighted-consensus forward-earnings estimates among the analysts polled by FactSet. That is reduce than the forward P/E of 17.3 for the S&P 500

SPX,

— this may nevertheless be a great position for prolonged-time period traders to scoop up semiconductor shares at attractive selling prices.

Michael Brush favors this high quality tactic to deciding on semiconductor shares.

Associated: Semiconductor stocks have bounced from 2022 lows — and analysts anticipate upside of at least 28{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} in the upcoming 12 months

Advice on untangling your finances in advance of retirement

You might have worked challenging and saved and invested for retirement, but have you unwittingly established up a intricate mess that may be complicated to regulate? Alessandra Malito has suggestions on how to arrange your finances for retirement.

Examine on:

Want more from MarketWatch? Sign up for this and other newsletters, and get the most current information, private finance and investing guidance.