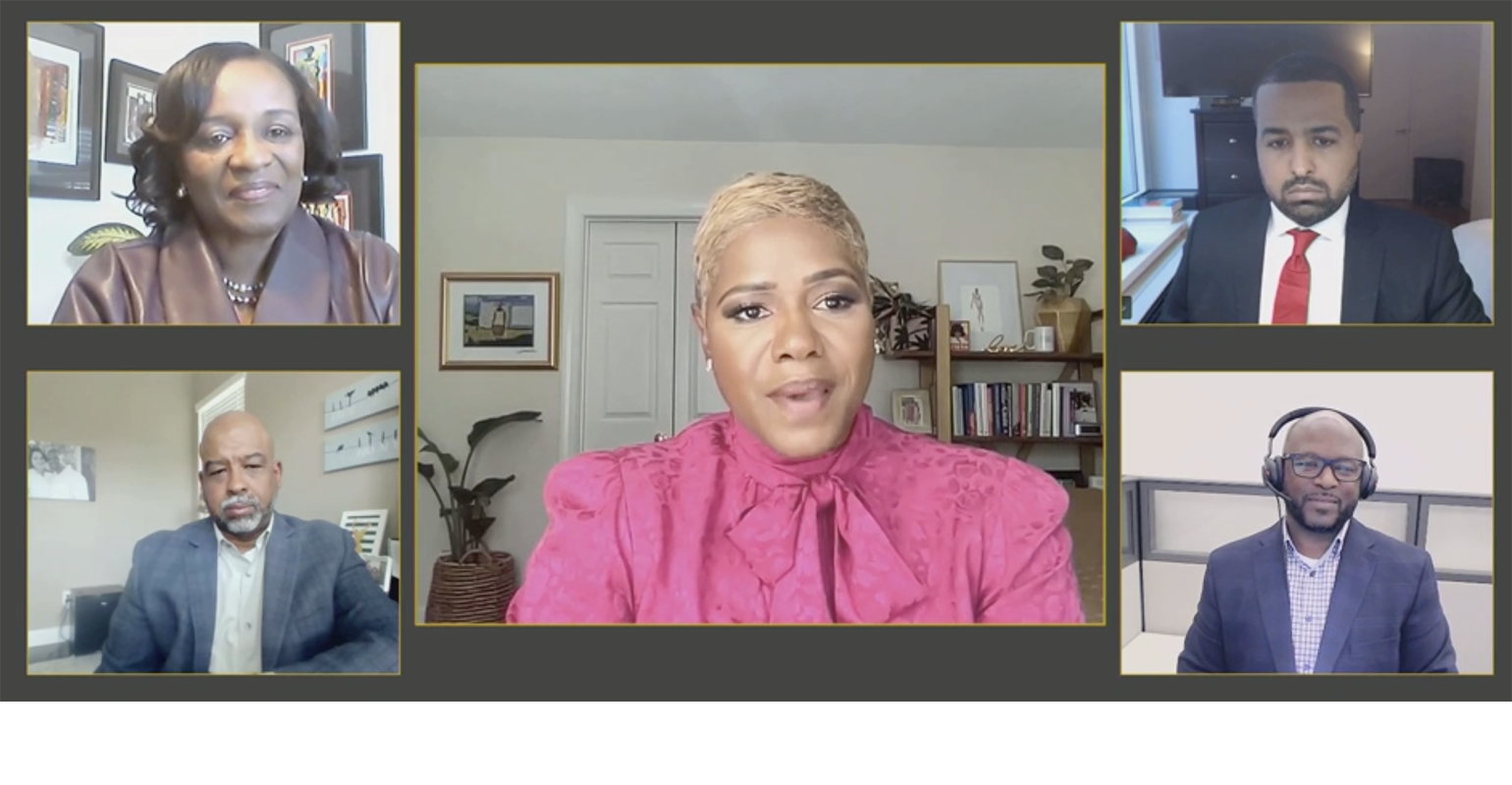

With in excess of 1,800 attendees, panelists representing the prosperity administration marketplace resolved systemic racism and its consequences for Black investors at the inaugural Black Prosperity Summit, a 3-working day digital occasion. Participants bundled speakers from Morgan Stanley, Raymond James, Charles Schwab, JPMorgan Chase and Bank of The us, all of which tackled cultural and systemic variables they saw as road blocks to the generation of prosperity by Black Americans, significantly intergenerational prosperity.

Between periods on Black wealth generation, party planners layered fireside chats on entrepreneurship, workshops on social media and education around behavioral finance together with digital networking chances. The function, which concludes on Friday, is billed as “an reply to earning prosperity accessible to Black individuals, therefore generating prosperity available to all folks.”

Cooperation, education and learning, place of work empowerment and open conversation had been all cited as keys to significant generation of Black prosperity, in accordance to panelists. A yr back, JPMorgan Chase fully commited $30 billion to a “racial fairness system,” stated Christopher Thompson, government director and head of diversity, fairness and inclusion at the firm. Black communities, whether or not they are one’s very own or other people, require systems that are actionable, measurable and sustainable, he explained.

The plan, portion of an initiative to fight “a tragic element of America’s background,” according to JPMorgan Chase CEO Jamie Dimon, delivers funding for Black- and Latinx-owned small business, dwelling ownership in “underserved communities,” increases obtain to banking and brings focus to inclusivity in the firm’s have workforce.

The wealth management division at the agency has a intention of hiring 300 Black and Latinx advisors by 2025, stated Thompson.

“This is about us reworking as a enterprise,” he explained. “The prosperity organization understands that we’re not likely to be ready to completely transform our organization except we lean in and recruit and employ the service of and prepare and acquire new. We are not able to just continue to keep trading advisors back again and forth.”

But “diversity and inclusion” initiatives are not ample to fix the depth of systemic inequalities that have negatively impacted Black Us citizens, said Willie Wheat, senior banker at Charles Schwab Leading Lender. All employees at a company are dependable for carrying out “discretionary efforts” to help Black communities. Bankers have a “direct seat” in correcting or perpetuating systemic issues.

Financial experts should really help their customer construct monetary plans and budgets, he stated, both of those of which are scalable, rapid strategies for laying a basis of generational prosperity. Monetary industry experts should really also be encouraging their clients to function at firms that make it possible for for development. “In the absence of a direct inheritance, which a large amount of us are not privileged to get, a good deal of our prosperity arrives from wages,” he explained.

Lender of America not too long ago raised its minimum wage for all U.S.-based mostly personnel, reported Ebony Thomas, a racial equality and economic chance initiative method government at the organization. “When we talk about, ‘How do we support help communities with prosperity generation?’ component of that is starting up with, ‘Do we pay our persons a wage in which they can live in their communities and help their communities?’”

The fiscal solutions firm has also designed investments in Traditionally Black University and Univerisities, she said.

“They’ve been autos to Black middle-class and Black development of prosperity,” she reported. “We want them to be about for one more 150 years. Expense in these institutions is critically essential to making certain that these institutions present the right methods, the appropriate techniques and the ideal help for learners.”

As people learners graduate and enter the workforce, new opportunities open up up to support Black prosperity creation. Morgan Stanley would like to “level the enjoying field” as Black Individuals enter the workforce, supplying these dealing with systemic racism options that have traditionally been denied them, explained Andy Saperstein, co-president of Morgan Stanley and head of the firm’s prosperity management division.

The organization has been vocal about its drive into the place of work, as it grows its prosperity management small business. As it seeks to get rid of gaps amongst brokerage accounts and fairness awards, it is also aiming to improve its company together with Black Us residents “as their desires develop into a lot more sophisticated,” mentioned Saperstein.

An additional part tackled by panelists was the need to have for family-amount conversations about goal location and wealth setting up. Just as official training creates the option for wealth-creating professions, advisors need to be encouraging their purchasers to have dinner and breakfast discussions about prosperity and economical education and learning, said Pedro Suriel, vice president of variety and inclusion at Raymond James.

“We have to be in it collectively with our clients,” he explained. “As an firm, as advisors, we are a lot more than offering money suggestions. From time to time we come to be counselors. Occasionally we turn out to be the trusted advisors of the individuals as they’re pondering about exactly where they are in the different phases of lifestyle and what they need to complete those people targets and targets.”

“It goes back again to educating our advisors and our customers about the resources that are out there,” he concluded. “Most importantly, supplying them entry to the instruments and resources that they need to make educated choices to stay the everyday living approach that they pick to.”