As a end result, American investors will be barred from purchasing or selling shares of the companies.

“Today’s motion highlights how personal companies in China’s protection and surveillance technological know-how sectors are actively cooperating with the government’s endeavours to repress associates of ethnic and religious minority teams,” explained Brian Nelson, undersecretary for terrorism and economic intelligence. “Treasury continues to be fully commited to guaranteeing that the U.S. fiscal method and American traders are not supporting these activities.”

Dozens of Chinese firms and organizations had been extra to that export blacklist by the US Commerce Office on Thursday, in a bid to restrict China’s use of US systems for military services applications and for alleged human rights violations.

Thursday’s twin announcements arrived a week just after Treasury slapped identical economic sanctions towards two Chinese politicians and a Chinese synthetic intelligence agency, SenseTime.

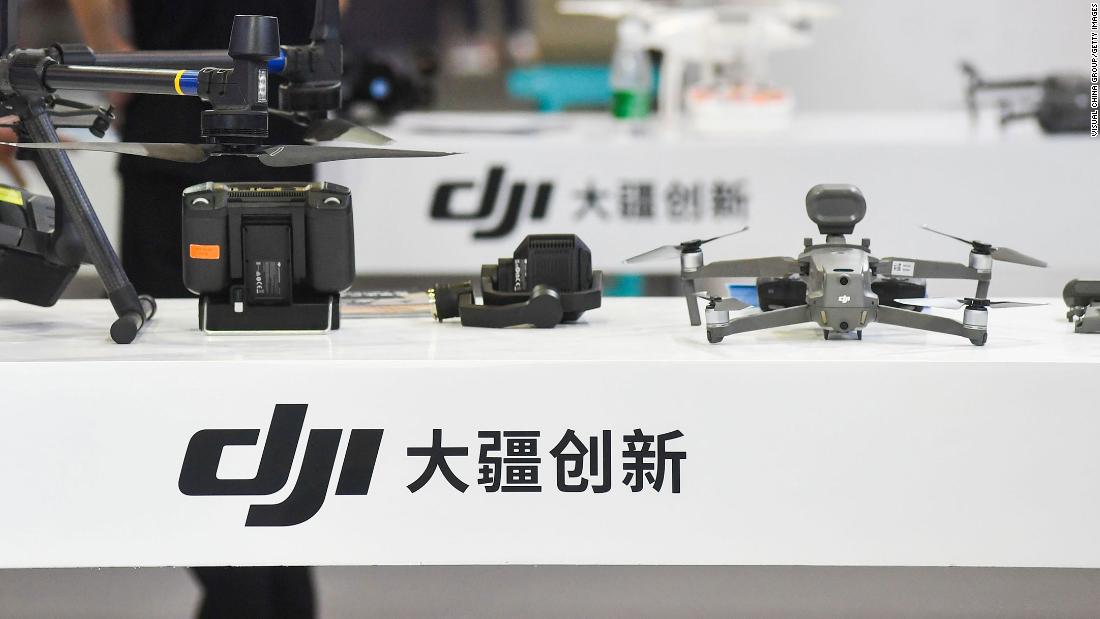

The drone maker declined to remark in advance of the US Treasury’s announcement on Wednesday. As an alternative, it referred CNN Organization to a preceding assertion designed in response to earlier limits final December, when it explained it experienced “carried out very little to justify getting put on the entity checklist.”

DJI additional at the time that it was also “analyzing possibilities to guarantee our shoppers, companions, and suppliers are handled reasonably,” with no elaborating even further. It declined to provide an update or remark on those people strategies this 7 days.

Washington’s latest clampdown could build financing complications for the upstart drone maker, which is privately held and headquartered in Shenzhen.

But according to a individual familiar with the issue, Sequoia’s investment in DJI is handled by Sequoia Cash China, which operates as a different lawful entity from the US company.

That signifies it would likely not be impacted by any restriction barring American investment decision in DJI, the person mentioned.

Turning up the heat

Washington has been piling force on Chinese organizations a short while ago.

Likewise, the Treasury Office stated that the choice to block SenseTime was thanks to the position its technologies allegedly played in enabling human legal rights abuses towards the Uyghurs and other Muslim minorities in Xinjiang.

The company stated the hold off was “to safeguard the passions of the possible buyers of the corporation,” and allow for them to “take into consideration the likely effects of” the US shift on any investments.

Independently, the FT reported previously this 7 days that US officers were deliberating irrespective of whether to stiffen regulations about marketing to 1 of China’s top rated chipmakers. No action was taken Thursday, on the other hand.

SMIC did not react to a request for comment.

Separately, last calendar year the US Division of Protection also extra the agency to a checklist of organizations the company statements are owned or managed by the Chinese army. That final decision signifies Us citizens are banned from investing in SMIC.

China’s Overseas Ministry criticized the United States on Wednesday soon after reports of Washington’s prepared crackdown.

At a briefing, spokesperson Zhao Lijian called on the Biden administration to quit “politicizing” technological and financial challenges by “generalizing the concept of national security.”

“Quit abusing point out ability to unreasonably oppress certain sectors and enterprises of China,” Zhao claimed, warning that sanctions on corporations such as DJI would threaten world industrial and offer chains, and undermine international trade guidelines.

“China will, as generally, firmly protect the respectable legal rights and interests of Chinese corporations,” he included.

— CNN’s Beijing bureau and Jill Disis contributed to this report.