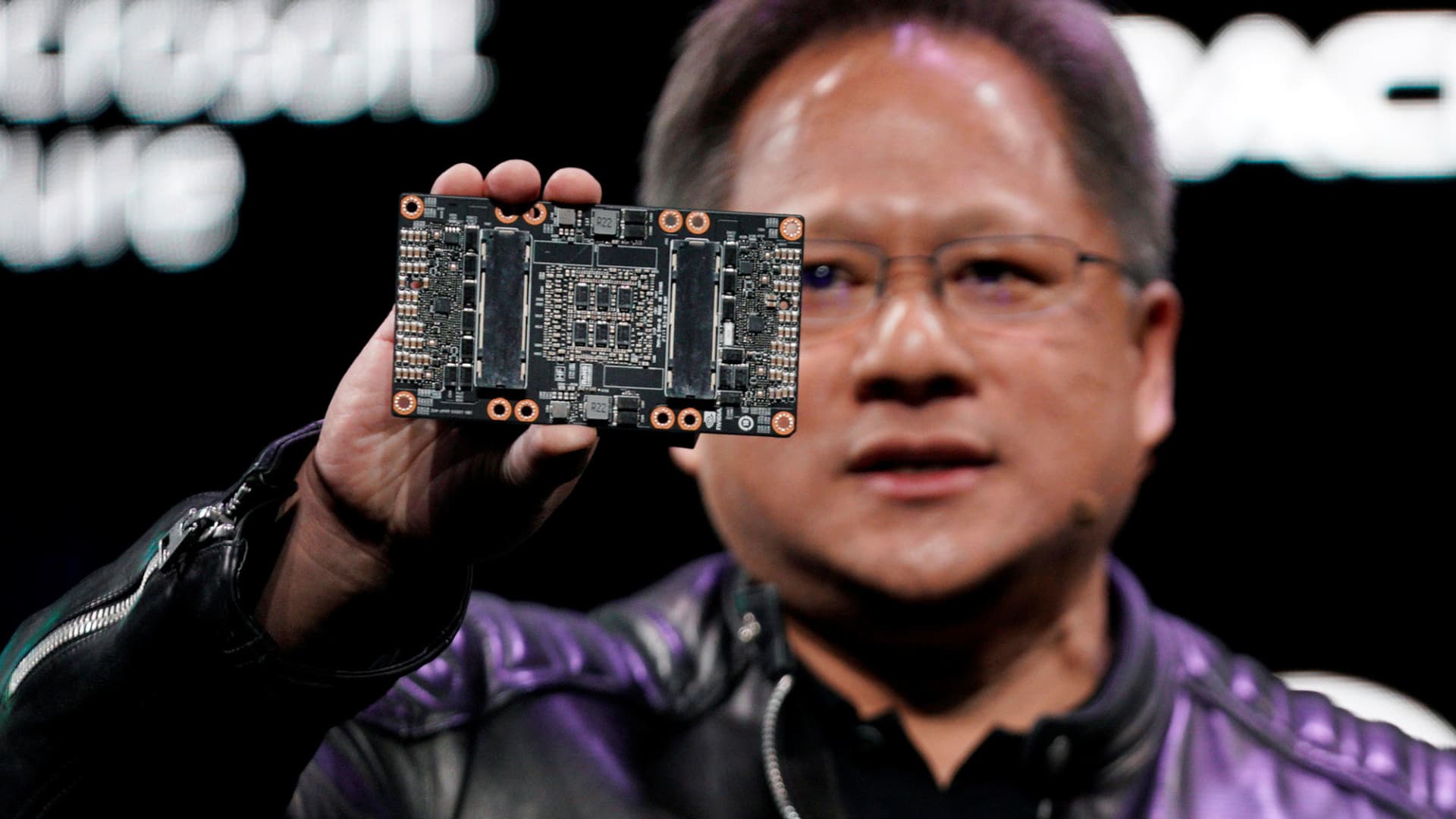

Jensen Huang, CEO of Nvidia, exhibits the NVIDIA Volta GPU computing system at his keynote handle at CES in Las Vegas, January 7, 2018.

Rick Wilking | Reuters

Even nevertheless the holiday break 7 days finished on a optimistic observe for shares, a lot more volatility is very likely in the cards.

All eyes are on November’s future payrolls report, thanks out Dec. 2. Even further, the Federal Reserve’s Dec. 13-14 assembly looms in advance, and traders await the central bank’s following ways on its monetary policy marketing campaign. There is nevertheless a great deal of time for shares to churn in advance of the year ends.

This usually means traders want to shift their concentration towards lengthier-time period prospects as a substitute of fixating on near-term gyrations in the marketplace. See down below for five shares picked by Wall Street’s top rated execs, in accordance to TipRanks, a system that ranks analysts primarily based on their former performance.

Nvidia

Nvidia (NVDA) has been hurting from weakening demand for its chips from the gaming and information center end marketplaces thanks to the macroeconomic headwinds and source-chain troubles.

On the other hand, after the company posted its quarterly benefits, Susquehanna analyst Christopher Rolland discovered that Nvidia is “having back again on keep track of.” This prompted him to reiterate a buy rating on the stock and elevate the cost target to $185 from $180. (See Nvidia Dividend Day & Historical past on TipRanks)

Though elevated channel inventories are still a dilemma, Nvidia foresees them falling back to regular levels from the up coming quarter onward. Other than that, Rolland was pretty contented with the quarterly general performance and developments. Nvidia’s gross margin direction amid reduce profits run level amazed the analyst, who explained that this “may possibly be indicative of drastically increased ASPs (ordinary marketing rate) for the two new gaming and facts centre goods.”

The analyst stated that of the 4 major conclusion markets (car, datacenter, professional visualization, and gaming), at least 3 are expected to improve at a few periods the level of the total semiconductor current market.

Rolland is rated 26th amid additional than 8,000 analysts tracked on TipRanks. His monitor document about the earlier yr displays a achievement price of 69{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} and ordinary returns of 21.8{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} for every score.

Marvell Technology

Yet another of Rolland’s stock picks is semiconductor organization Marvell Know-how (MRVL), which is slated to post its third-quarter fiscal 2023 results on Dec. 1. In advance of the print, the analyst identified quite a few dampening components that are expected to be a in close proximity to-expression sore issue. Preserving that in brain, Rolland trimmed the price tag target to $75 from $90.

The firm’s nearline HDD business enterprise is expected to have remained weak in the quarter, owing to a large inventory make. General, the analyst expects Marvell to have experienced a somewhat disappointing quarter, regardless of some tailwinds from the North American rollouts of 5G infrastructure. (See Marvell Stock Chart on TipRanks)

Seeking beyond the quarter, Rolland sees many upsides to Marvell. “We believe the get started of India’s 5G deployments could be a beneficial for the narrative (with revenue to appear later on in 2023). Marvell’s 5G products and solutions keep on to ramp at equally Samsung and Nokia (two large shoppers), as the networking organizations at equally firms conquer anticipations,” the analyst mentioned.

Rolland reiterated his invest in rating on the corporation.

Costco

Costco (Cost) operates an international chain of warehouse golf equipment that supply branded and non-public items from several product categories. Recently, in gentle of food stuff inflation, slowdown, and other economic forces, Bank of The usa analyst Robert Ohmes analyzed the company’s potential clients and emerged bullish.

“We be expecting significant foodstuff inflation to travel continued share gains for the warehouse club channel (which includes Costco) presented the sturdy worth proposition and selling price positioning on overlapping SKUs vs. mass and regular grocery,” said Ohmes. (See Costco Internet site Targeted traffic on TipRanks)

The analyst pointed out that Costco churns out far more than 20 new clubs a 12 months. Even more, he expects strong traits in shopper targeted visitors and membership renewal premiums to go on. Even in the international marketplaces, ongoing expansion in same-retailer revenue is a beneficial for the enterprise

Ohmes is ranked at No. 854 among the far more than 8,000 analysts on TipRanks. The analyst has delivered financially rewarding ratings 56{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} of the time, and each individual just one has produced ordinary returns of 8.3{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996}.

Monday.com

Previously this thirty day period, project management software provider Monday.com (MNDY) delivered banner quarterly effects, which buoyed the self-confidence of buyers and analysts alike. Amongst the Monday.com bulls was Tigress Money Partners analyst Ivan Feinseth, who reiterated a buy rating on the inventory.

Feinseth noted that the firm’s effectiveness stands to acquire from consistently sturdy customer adoption rates. Moreover, Monday.com’s competitive benefit lies in its minimal-code/no-code Do the job OS. He also maintains that simple integration and person-friendliness of the system will continue on to entice major consumers and strengthen revenue growth. (See Monday.com Fiscal Statements on TipRanks)

“Ongoing innovation and progress will go on to travel MNDY’s now solid model equity alongside one another with its superior-margin SaaS (Software package as a Services) membership-dependent income design will travel an ongoing acceleration in Company General performance developments which will drive an increasing Return on Capital, even further gains in Financial Earnings, and prolonged-phrase shareholder price development,” mentioned Feinseth.

He is rated 232nd between additional than 8,000 analysts on TipRanks. Feinseth has issued financially rewarding rankings 60{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} of the time, and every has delivered 11.3{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} returns on average.

Disney

Entertainment company Disney (DIS) is an additional stock on Feinseth’s obtain record. The analyst lately reiterated a get ranking and $177 cost concentrate on on the stock, mainly inspired by the return of previous CEO Bob Iger, who is envisioned to generate “a return to creativeness dominance.”

What’s more, the sound content material roster is expected to drive the firm’s development. Feinseth is also upbeat about Disney’s ongoing investments in its concept park updates, new know-how and ongoing information growth, which he thinks will go on to push the company’s overall performance. (See Walt Disney Hedge Fund Trading Exercise on TipRanks)

“DIS will carry on to generate escalating concept park attendance with ongoing park updates and introductions of new sights the ongoing leverage of its sophisticated reservation system is driving ability optimization and larger profits produce, and its Genie and Genie+ virtual park assistant significantly enhance guest ordeals,” explained Feinseth.

The analyst highlights Disney’s sturdy equilibrium sheet, income move generating abilities and simple cash-allocating methods. These are assisting the firm commit in information advancement, new concept park points of interest and other development-driving endeavours.