1 chart is all it took to shift economical markets on Thursday.

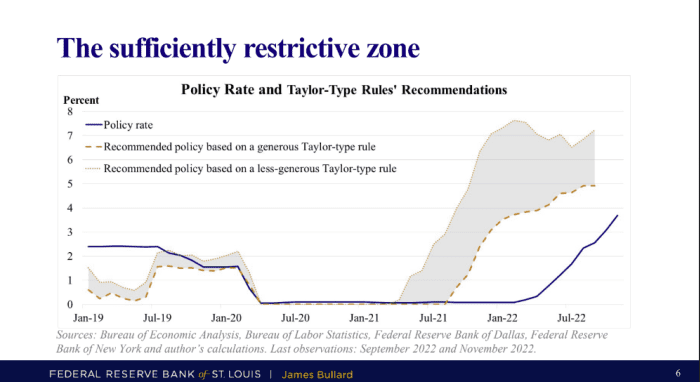

That chart was introduced by St. Louis Fed President James Bullard as portion of a presentation in Louisville, Ky., and it displays in which he sees “the sufficiently restrictive zone” for the central bank’s primary coverage level goal. Bullard set the zone someplace amongst 5{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} to 7{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996}, up from the present-day fed-money level selection of involving 3.75{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} to 4{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996}. That was plenty of to cause buyers to promote off stocks and bonds in tandem, thrust the dollar greater, and rewire anticipations all-around how significant desire costs could go.

Read: Fed’s Bullard says benchmark desire charge in 5{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996}-7{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} variety may possibly be necessary to convey inflation down

Resources: Bureau of Financial Evaluation, Bureau of Labor Data, Federal Reserve Lender of Dallas, Federal Reserve Lender of New York, Bullard’s calculations

Bullard’s zone was centered on estimated policy concentrations proposed by Taylor-form guidelines, 1 with generous assumptions and the other with considerably less-generous assumptions. The “Taylor rule” is a commonly approved equation, or what previous Fed Chairman Ben Bernanke described as “a rule of thumb,” designed by economist John Taylor of Stanford College for where by the central bank’s policy level should to be relative to the state of the economy.

Appropriate now, the economy’s current state incorporates an annual headline inflation charge from the customer-selling price index that’s at 7.7{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} as of Oct, slipping under 8{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} for the first time in eight months. Nevertheless policy makers favor other inflation indicators, the once-a-year headline CPI rate matters since it can effects house expectations.

Variations of the Taylor rule can produce distinct benefits relying on the numbers being utilized, and the upper range of Bullard’s zone is much bigger than what traders and buyers at this time imagine. As of Thursday, fed-funds futures traders, for example, were being nudging up their anticipations for a 5{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996}-plus fed-cash charge upcoming 12 months, but not nevertheless pricing in a considerable likelihood of a 6{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} policy fee.

A workforce at Goldman Sachs Team

GS,

revised its 2023 expectations a little upward in a new forecast this week, saying that the maximum degree at which the Fed will possible increase prices up coming year is among 5{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} and 5.25{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996}. On Thursday, even though, Bullard explained 5{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} to 5.25{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} as the minimal level for the fed-funds price.

After Bullard’s presentation on Thursday, U.S. shares

DJIA,

SPX,

ended the New York session with a second straight session of losses. The ICE U.S. Dollar Index

DXY,

state-of-the-art .3{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996}. And Treasury yields jumped — pushing the plan-sensitive 2-12 months level

TMUBMUSD02Y,

up to 4.45{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} and the benchmark 10-calendar year amount

TMUBMUSD10Y,

to 3.77{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996}.

The possibility of a 6{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} fed-funds fee has existed because April, but is 1 that hadn’t been approved broadly by monetary marketplaces. October’s softer-than-predicted readings on the CPI and producer selling prices gave traders motives to hope that the Fed might ease off aggressive charge hikes, though cash administrators and economists stated money marketplaces have been underestimating the risk that inflation would fail to tumble toward 2{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} rapid sufficient.

Bullard is a voting member of the level-setting Federal Open Marketplace Committee this calendar year, but falls off the voting roster in 2023.

Stock Industry Now: Reside protection of the sector motion