The initial 6 months of 2022 were dreadful for economical marketplaces.

In actuality, you could argue we just lived via one particular of the worst 6 thirty day period periods At any time for stocks and bonds.

This isn’t hyperbole. The details backs it up.

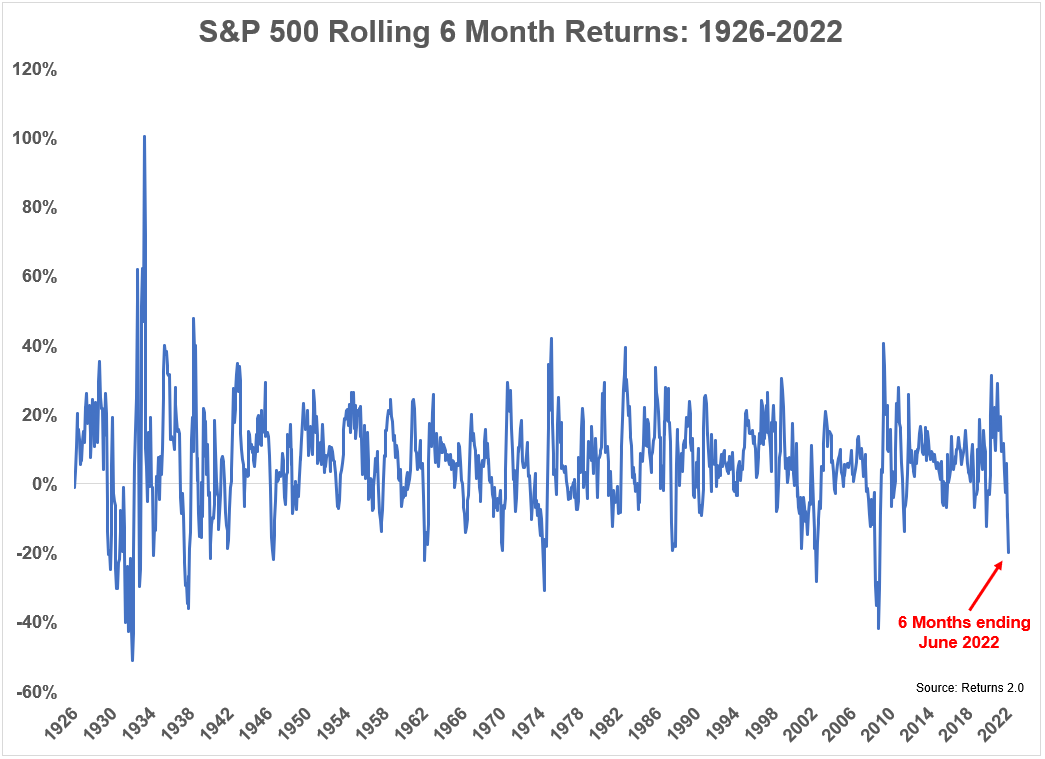

Here’s a glimpse at the rolling six thirty day period returns1 for the S&P 500 heading back again to 1926:

Not great.

The interval ending June 30, 2022 ranks in the worst 3{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} of all 6 month returns since 1926.

The only 6 thirty day period functionality numbers that had been worse than what we just lived as a result of transpired all through the Great Depression, 1937 crash, WWII, 1970s bear current market, bursting of the dot-com bubble and 2008 crash.

That’s a who’s who of horrible, no very good returns.

Incorporating insult to injuries, bonds experienced a single of their worst 6 thirty day period operates as properly. By means of June, 5 12 months treasuries were being down 6.4{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} on the calendar year. The -7.4{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} return on 5 calendar year government bonds by Might 31, 2022 was the second-worst 6 thirty day period return ever (only topped by the 8{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} decline in early 1980).

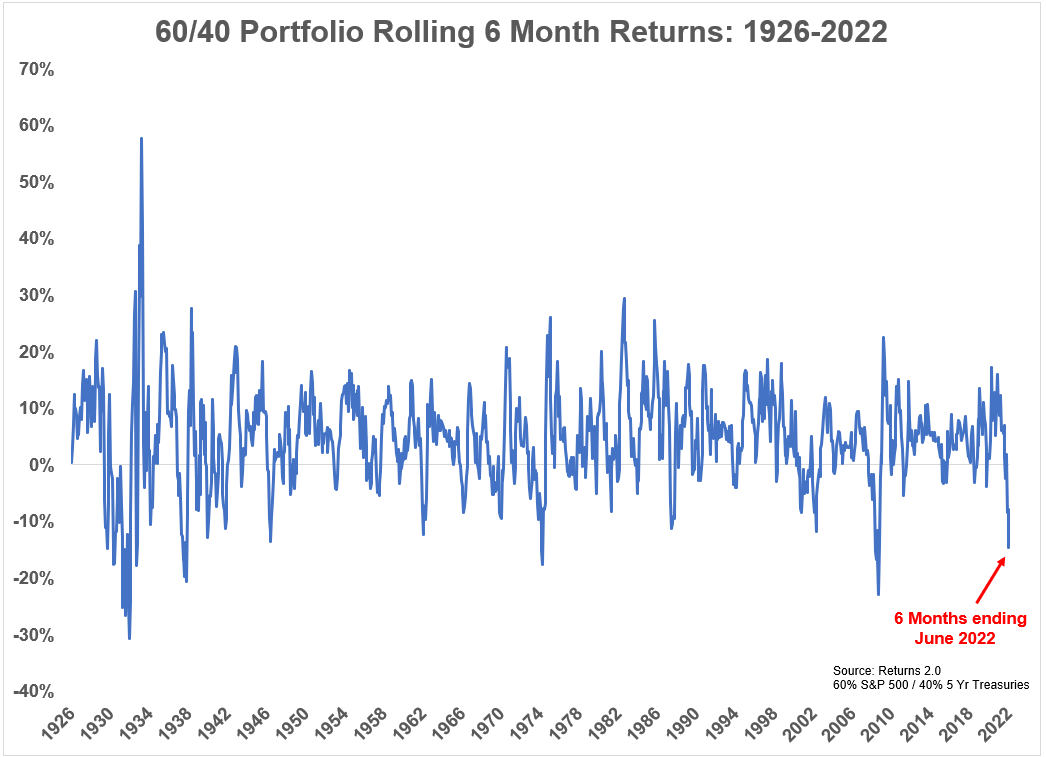

So it would make perception that a 60/40 portfolio of U.S. shares and U.S. bonds also had 1 of its worst 6 thirty day period stretches of all time:

The 6 month returns for a 60/40 portfolio were in the bottom 2{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} of rolling returns heading again to 1926.

This signifies 98{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} of the time, returns have been better than what we just lived through.

It was also just the 4th time in excess of the earlier 100 many years or so that stocks and bonds were down two quarters in a row at the similar time.

The last time U.S. shares and intermediate-phrase bonds were being both of those down two quarters in a row occurred in the initial two 3 month periods in 1974.

Inflation was doubled-digits back again then so the two of these time frames experienced an even worse experience on a actual return foundation.

This unusual double-dip for stocks and bonds also took location in 1969.2 The only time I could discover that saw stocks and bonds the two down for a few quarters in a row was in the past 9 months of 1931.3

It is never ever transpired four occasions in a row for both of those at the same time. With any luck , we really do not go setting any new data this calendar year.

I could present a pep converse here but it wouldn’t do significantly great. Basically surviving is a deserving goal when things go this poorly in the marketplaces.

There are plenty of businesses and buyers that have blown by themselves up these past couple of months that didn’t survive this bear marketplace.

It is no pleasurable to lose money but there are some silver linings listed here.

If you are earning contributions to a 401(k) or IRA on a periodic foundation you can now purchase the stock sector at prices that are 20-30{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} lower than they have been just 6 months back.

You can also receive all over 3{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} on intermediate-expression U.S. governing administration bonds rather of the .4{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} to .9{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} you could generate just 18 months back.

No one needs to hear this ideal now but predicted returns are now bigger than they were in advance of coming into the year. We just experienced to go by way of some losses to get to this place.

The other favourable is you really don’t have to listen to folks brag about how effortless it is to get rich any more. That has to count for a little something, suitable?

I detest to be that man, but 6 months is also a short interval of time in the grand scheme of matters. If 6 months is going to make or crack your investment prepare, it wasn’t a really excellent system to start out with.

If you’ve only been investing for a small time, this is a fantastic initiation into the way marketplaces perform sometimes. Down marketplaces are a excellent detail if you’re heading to be a internet saver for more than the next handful of a long time or so.

A lot of persons imagine bull markets are how you get loaded but genuine wealth is built in the course of bear marketplaces, specifically when you’re younger.

And if you have been invested for the past 5-10 yrs or a lot more the gains you’ve designed (assuming you stayed invested) have additional than produced up for the recent losses.

That doesn’t mean the current losses do not sting but you simply cannot hope markets to go up and to the right each year devoid of fail.

I really don’t know what the up coming 6 months or even 6 a long time will carry in the economical marketplaces.

There could be a lot more pain ahead or marketplaces that go nowhere or who is aware of what else.

There’s no these types of detail as ‘always’ or ‘never’ when it arrives to the marketplaces but I come to feel strongly that investing in the midst of dreadful inventory and bond returns will be a very good strategy in excess of the extended run.

Threat and reward are inextricably connected at the hip.

You simply cannot generate first rate extensive-phrase returns without dealing with periods of excruciating losses from time to time.

The past 6 months have been 1 of people periods.

I for 1 am excited to be placing new funds to do the job at much decrease selling prices.

Even further Studying:

Is the 60/40 Definitely Dead This Time?

1I made use of every month complete returns for all of the general performance details here.

2The 1969 episode wasn’t all that bad in terms of magnitude. Stocks ended up down a lot less than 7{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} though bonds fell a minimal additional than 3{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996}.

3The inventory sector was down virtually 50{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} around these 9 months. Bonds declined additional than 3{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} so this was more about shares than set earnings.