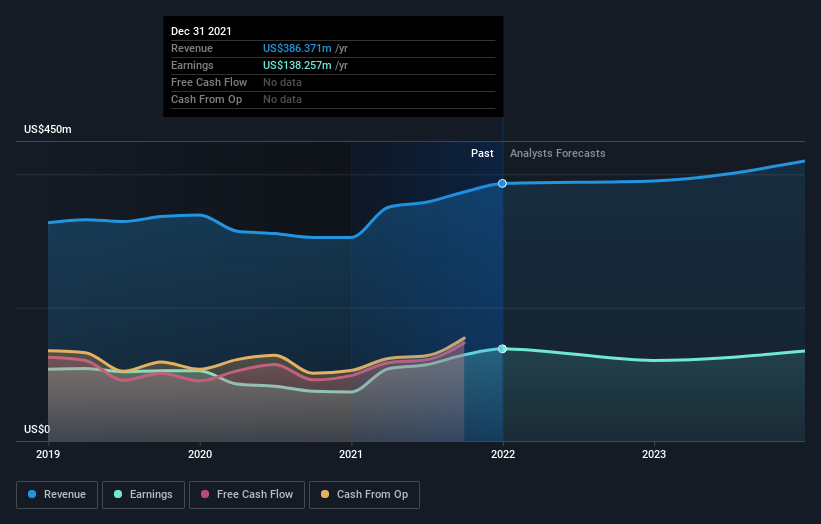

As you may well know, First Commonwealth Money Company (NYSE:FCF) a short while ago reported its total-yr quantities. Very first Commonwealth Economical claimed US$386m in income, about in line with analyst forecasts, while statutory earnings per share (EPS) of US$1.44 defeat anticipations, being 2.7{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} greater than what the analysts envisioned. The analysts commonly update their forecasts at each and every earnings report, and we can decide from their estimates whether their check out of the corporation has adjusted or if there are any new considerations to be conscious of. We have gathered the most recent statutory forecasts to see whether the analysts have changed their earnings types, subsequent these effects.

See our most current examination for Very first Commonwealth Economical

Getting into account the latest outcomes, Initial Commonwealth Financial’s six analysts at this time count on revenues in 2022 to be US$390.2m, approximately in line with the very last 12 months. Statutory earnings per share are envisioned to sink 13{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} to US$1.28 in the exact interval. In the direct-up to this report, the analysts had been modelling revenues of US$391.2m and earnings per share (EPS) of US$1.27 in 2022. The consensus analysts will not appear to have found everything in these effects that would have improved their watch on the organization, presented you can find been no important improve to their estimates.

With the analysts reconfirming their revenue and earnings forecasts, it can be surprising to see that the rate concentrate on rose 7.8{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} to US$18.50. It appears as though they beforehand had some doubts over regardless of whether the organization would reside up to their anticipations. That is not the only conclusion we can draw from this information nevertheless, as some investors also like to think about the spread in estimates when assessing analyst price targets. The most optimistic Very first Commonwealth Monetary analyst has a price goal of US$20.00 for every share, while the most pessimistic values it at US$15.00. The narrow unfold of estimates could suggest that the business’ long run is somewhat effortless to benefit, or thatthe analysts have a powerful see on its prospects.

Using a search at the bigger photograph now, one particular of the methods we can comprehend these forecasts is to see how they examine to each earlier overall performance and industry expansion estimates. We would emphasize that Initial Commonwealth Financial’s profits expansion is anticipated to slow, with the forecast 1.{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} annualised development level until the close of 2022 currently being properly below the historic 5.7{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} p.a. expansion about the last five many years. Evaluate this towards other businesses (with analyst forecasts) in the industry, which are in aggregate expected to see income expansion of 4.9{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} per year. Factoring in the forecast slowdown in growth, it appears apparent that 1st Commonwealth Fiscal is also envisioned to grow slower than other business members.

The Base Line

The most obvious summary is that there is been no important change in the business’ prospective customers in recent times, with the analysts keeping their earnings forecasts constant, in line with prior estimates. Fortuitously, the analysts also reconfirmed their profits estimates, suggesting gross sales are tracking in line with expectations – though our details does suggest that First Commonwealth Financial’s revenues are anticipated to accomplish worse than the wider market. We note an upgrade to the selling price focus on, suggesting that the analysts believes the intrinsic value of the small business is likely to make improvements to more than time.

With that claimed, the extensive-expression trajectory of the company’s earnings is a lot more essential than future year. We have forecasts for Initially Commonwealth Fiscal going out to 2023, and you can see them free of charge on our system here.

We do not want to rain on the parade far too considerably, but we did also discover 1 warning indicator for Initial Commonwealth Economical that you have to have to be conscious of.

Have opinions on this posting? Worried about the content material? Get in contact with us directly. Alternatively, e mail editorial-team (at) simplywallst.com.

This article by Merely Wall St is basic in mother nature. We give commentary centered on historical facts and analyst forecasts only applying an unbiased methodology and our content articles are not intended to be monetary tips. It does not represent a suggestion to get or promote any stock, and does not just take account of your aims, or your monetary predicament. We intention to provide you extensive-time period focused investigation driven by basic knowledge. Be aware that our assessment may well not variable in the newest rate-sensitive organization announcements or qualitative material. Only Wall St has no situation in any stocks described.