Focus on on Wednesday described a 52{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} fall in financial gain for the first quarter, lacking Wall Street’s forecasts and triggering a broad industry selloff.

Joe Raedle/Getty Images

Worse-than-expected earnings reports from the largest publicly traded U.S. firms are established to become but a different “shock” for buyers struggling to defeat stagflation fears.

Which is the view of Capital Economics’ Thomas Mathews, who states the S&P 500 index can conveniently hit a trough of 3,750, and in all probability decrease, on a lot more undesirable earnings news. On Thursday, the S&P 500

SPX,

finished down by .6{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} at 3,900.79, a working day immediately after submitting its most significant just one-day decrease considering that June 11, 2020. It skipped falling beneath the 3,837.25 level that would have marked the specialized definition of a bear sector, according to Dow Jones Sector Data.

Read: Inspite of bounce, S&P 500 hovers shut to bear market place. Here’s the quantity that counts

Wednesday’s brutal shares selloff appeared to mark a turnabout of imagining in the markets, as cracks appeared in the earnings final results of big-name retailer Focus on Corp.

TGT,

adhering to a earnings skip by Walmart Inc.

WMT,

the prior working day —- a indicator that better inflation is seeping into just about every single corner of the U.S. economy. For the past year, investors, traders and skilled forecasters have all stayed optimistic that inflation will at some point subside. Marketplaces have still to value in a worst-scenario scenario for the economic climate, in which inflation fails to appear down and/or the U.S. falls into economic downturn, analysts reported.

“The full overall economy is currently being afflicted as a result of this robust inflation we’re looking at and I don’t see any sort of resolution until finally equity selling prices commence reflecting reduce GDP and decreased earning advancement,’’ said Tom di Galoma, a Treasurys trader at Seaport Worldwide Holdings in Greenwich, Connecticut.

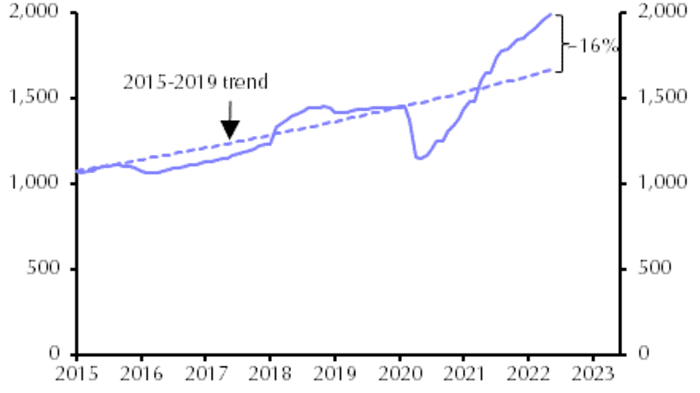

Nevertheless the S&P 500 is on the verge of moving into a bear sector, earnings expectations continue being good, Cash Economics’ Mathews wrote in a be aware on Thursday. Analysts have been expecting almost double-digit earnings development for firms in the index, on regular, over the up coming couple of yrs, he mentioned. And 12-month ahead earnings anticipations for S&P 500 organizations stay about 16{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} higher than their prepandemic craze, in accordance to the markets economist.

Supply: Refinitiv, Funds Economics

With the index obtaining fallen 4{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} in a solitary day on Wednesday, “earnings are surely a shock struggling with the S&P 500,” Mathews wrote in an electronic mail to MarketWatch. “And earnings expectations still appear genuinely upbeat, which suggests there’s potential for a good deal additional to appear on that entrance.”

More terrible earnings news could thrust the S&P 500 to as small as 3,750, but even that may be too optimistic, he explained. In the function of a recession, it “wouldn’t be out of the question” for the index to slide 20{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} from below, based on historical knowledge.

Refinitiv’s S&P 500 Earnings Scorecard, launched last Friday, reveals that there have been 55 damaging earnings-per-share preannouncements issued by S&P 500 organizations for the 2nd quarter. That compares with 28 which have been positive.

Beneath is a rundown of dangers experiencing marketplaces:

Inflation

Inflation sits at the major of the record of shocks percolating by way of the economic program correct now.

A single massive motive is that the U.S. —- which saw an 8.3{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} yearly headline level in April’s purchaser-selling price index report, continue to in the vicinity of a 40-year large — may not be previous the peak of value gains. Disruptions from China’s zero-tolerance coverage on COVID-19 and Russia’s war on Ukraine have nevertheless to fully display up in the details, and traders are expecting five much more months of 8{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996}-in addition readings.

Browse: Next huge shoe to drop in economic markets: Inflation that fails to answer to Fed price hikes

‘Growth Scare’

Wednesday’s brutal selloff in equities —- which despatched Dow the industrials down by 1,164.52 factors and remaining the Dow, like the S&P 500, nursing its worst every day fall in virtually two many years —- had a distinctly distinct flavor than past selloffs.

The newest leg down “had all the hallmarks of a growth scare,” Mathews wrote in his take note. Bonds rallied as investors unwound bets for amount hikes, harmless-haven currencies strengthened, and stocks bought off throughout the board.

By comparison, the variables powering most of this year’s drop in equity price ranges ended up mainly tied to increasing “safe” asset yields as buyers absorbed the Fed’s hawkish pivot, he explained.

As of this week, U.S. and euro-space inventory markets appeared to be pricing in around a 70{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} possibility of a close to-time period economic downturn, centered on an estimate from JPMorgan Chase & Co.’s Marko Kolanovic and many others. In their look at, that is “too a great deal economic downturn risk.”

Even now, one particular underappreciated threat is how swiftly monetary and financial situations could deteriorate in the present atmosphere. Seaport’s di Galoma expects the U.S. to tumble into economic downturn by early 2023, nevertheless the arrival time is “accelerating and heading to occur a whole lot more rapidly than persons assume.” “It’s suitable on our doorsteps and I imagine this recession will be rather deep,’’ di Galoma explained by using cellphone on Thursday.

Bigger curiosity costs

The Federal Reserve is nonetheless poised to retain tightening monetary conditions, with a reduction of its virtually $9 trillion harmony sheet beginning next thirty day period and policy makers set to provide two additional 50 basis place price hikes in June and July. Financial plan on your own is an additional “key shock,” albeit a single that is been likely on for a whilst, and weighs on earnings multiples, claimed Mathews of Cash Economics.

Investors have even experimented with to forget about the influence of mounting premiums, these kinds of as on Might 4 when Fed Chairman Jerome Powell told reporters that a 75 basis place charge hike wasn’t actively currently being regarded. Inventory market investors cheered the remark, but missing enthusiasm the pretty subsequent day —- with a additional than 1,000-point fall in the Dow Jones Industrial Average

DJIA,

on May perhaps 5.

Russia, Ukraine and China

Russia’s war on Ukraine, which proceeds to rage immediately after virtually 3 months, “still has the possible to result in sizeable commodity rate volatility, which could have an affect on the outlook equally for earnings and for financial coverage (by boosting or cooling inflation),” Mathews stated.

Furthermore, China’s COVID-19 lockdowns are rippling all over the globe, putting a damper on international-development potential clients, and aggravating inflation pressures mainly because of the Asian country’s function as a producing powerhouse and resource of numerous of the world’s goods.

“The confluence of occasions (inflation and the effects of plan responses to deal with it, the war, China’s zero-COVID policy and broader offer issues) may signify volatility persists in the in the vicinity of phrase as we get extra info on development made on every single,” Andrew Patterson, a senior global economist at The Vanguard Group, reported in an e-mail to MarketWatch.

Cryptocurrency

Past week’s crash of the stablecoin TerraUSD is elevating issue in a number of corners of the market that stablecoins as a full could destabilize and set off a systemic hazard.

Which is the scenario even though Treasury Secretary Janet Yellen has tried to dispel the notion of a risk to economical balance, although nonetheless acknowledging the challenges. Regulators are concerned and, at the really least, current market contributors may question whether or not a lot more idiosyncratic operates on stablecoins are in retail store, if there’s contagion hazards, and what the implications could possibly be on broader cash marketplaces.