Industry forces rained on the parade of Very first National Financial Corporation (TSE:FN) shareholders right now, when the analysts downgraded their forecasts for future year. Profits estimates have been reduce sharply as analysts signalled a weaker outlook – maybe a sign that buyers should mood their anticipations as effectively.

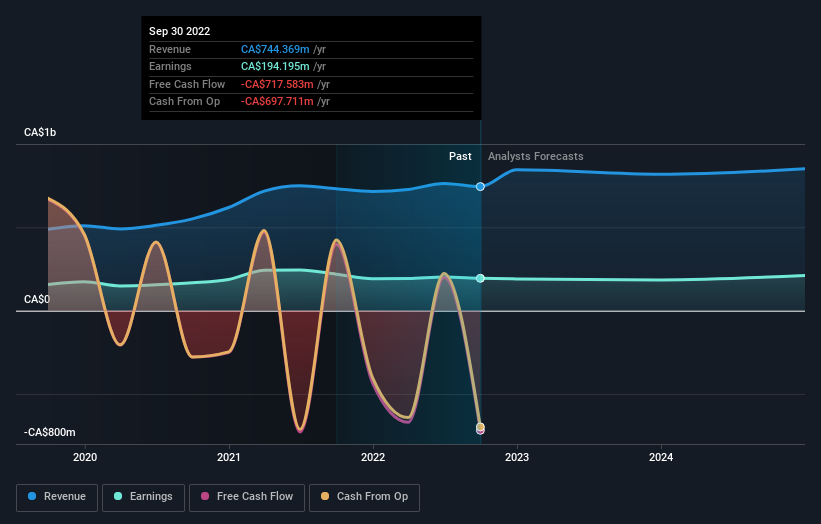

Soon after the downgrade, the four analysts covering To start with Countrywide Fiscal are now predicting revenues of CA$818m in 2023. If achieved, this would replicate a good 9.9{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} improvement in profits in contrast to the very last 12 months. Statutory earnings for each share are expected to shrink 8.1{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} to CA$2.98 in the identical time period. Previously, the analysts had been modelling revenues of CA$1.0b and earnings for each share (EPS) of CA$3.16 in 2023. It appears to be like analyst sentiment has fallen somewhat in this update, with a significant drop in revenue estimates and a tiny dip in earnings for every share figures as perfectly.

Test out our most recent assessment for 1st Countrywide Financial

Analysts built no major modifications to their cost focus on of CA$35.83, suggesting the downgrades are not envisioned to have a lengthy-time period influence on Very first Nationwide Financial’s valuation. Fixating on a one selling price goal can be unwise even though, because the consensus focus on is successfully the common of analyst price targets. As a result, some buyers like to glimpse at the vary of estimates to see if there are any diverging opinions on the company’s valuation. The most optimistic Very first National Monetary analyst has a value concentrate on of CA$40.00 per share, while the most pessimistic values it at CA$33.00. Even now, with these types of a limited array of estimates, it implies the analysts have a rather fantastic plan of what they consider the organization is worthy of.

Having a glimpse at the bigger picture now, one particular of the techniques we can have an understanding of these forecasts is to see how they assess to both equally past effectiveness and industry advancement estimates. It really is really crystal clear that there is an expectation that Initially Nationwide Financial’s profits expansion will slow down considerably, with revenues to the conclusion of 2023 expected to show 7.9{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} expansion on an annualised foundation. This is in comparison to a historical development level of 11{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} about the past five years. Assess this from other firms (with analyst forecasts) in the market, which are in aggregate anticipated to see profits expansion of 12{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} annually. Factoring in the forecast slowdown in development, it would seem obvious that Initially Nationwide Economic is also envisioned to mature slower than other sector contributors.

The Bottom Line

The most critical detail to just take away is that analysts lower their earnings per share estimates, anticipating a crystal clear decline in small business problems. Regrettably analysts also downgraded their profits estimates, and business info suggests that Very first Countrywide Financial’s revenues are predicted to improve slower than the wider market place. Often, 1 downgrade can set off a daisy-chain of cuts, specifically if an field is in decrease. So we would not be stunned if the sector grew to become a great deal additional cautious on 1st National Financial following right now.

However, the extended-time period prospective buyers of the enterprise are substantially much more relevant than up coming year’s earnings. We have estimates – from various 1st Nationwide Fiscal analysts – going out to 2024, and you can see them totally free on our system here.

A different way to search for appealing organizations that could be reaching an inflection stage is to monitor no matter if administration are shopping for or marketing, with our no cost checklist of escalating organizations that insiders are getting.

Valuation is complicated, but we are helping make it basic.

Find out whether or not Initially Countrywide Economical is perhaps about or undervalued by examining out our thorough investigation, which contains honest benefit estimates, hazards and warnings, dividends, insider transactions and money health.

Perspective the Free Assessment

Have feedback on this report? Worried about the information? Get in touch with us straight. Alternatively, e-mail editorial-team (at) simplywallst.com.

This article by Just Wall St is general in mother nature. We supply commentary primarily based on historical information and analyst forecasts only using an impartial methodology and our content articles are not meant to be financial advice. It does not represent a advice to invest in or market any stock, and does not just take account of your goals, or your financial predicament. We intention to carry you lengthy-expression centered evaluation driven by elementary details. Take note that our assessment might not aspect in the hottest rate-delicate corporation announcements or qualitative product. Basically Wall St has no placement in any shares outlined.