Wall Avenue hit pause on a number of property bond discounts this week supplying buyers slices of the New York City skyline and other massive metropolitan areas as Russia’s intensifying war in Ukraine rattles world financial markets.

The most substantial-profile offer caught up in current volatility has been the $1.5 billion funding of Deutsche Bank’s new headquarters in Columbus Circle in Manhattan, which bankers opted to hold off just after setting up to drum up fascination from prospective buyers.

“This transaction was being pre-promoted but was not introduced to sector,” explained Jon Laycock, director of media relations at Deutsche Lender, in a statement. “The offer was postponed for the reason that of volatile current market circumstances but will be executed in thanks training course when ailments are extra constructive.”

It is rare for banking institutions to postpone business bond discounts outside of extraordinary instances, which include the onset of the 2008 international fiscal disaster or in 2011 when S&P Worldwide built a past-moment overview of its bond-score requirements.

It is pretty uncommon, not unheard of,” stated Jen Ripper, an expense expert focused on commercial assets bonds at Penn Mutual Asset Administration, noting that a few business mortgage loan offers had been reportedly in limbo, in a cellphone connect with Friday.

“I would think about they would wait for a calmer time,” Ripper claimed. “But I’m not positive when that could be at the instant, provided the point out of the earth circumstance.”

Russia has intensified its war in Ukraine, threatening to lower it off from international shipping and delivery lanes in the south and getting control of a large nuclear electricity plant on Friday, igniting a fireplace in the procedure that has been extinguished.

Wall Street has remained on edge about the conflict’s opportunity to spread over and above Ukraine’s borders, with additional than 1.2 million refugees by now fleeing to neighboring nations and as Moscow increasingly feels the fiscal squeeze of harsh sanctions.

Sparsely employed office structures in the coronary heart of huge American cities were a concern currently, with bonds backed by these kinds of properties coming below force lately.

“Right now, non-trophy offices, specially in central-enterprise-districts in New York and San Francisco, are out of favor,” claimed Dave Goodson, head of securitized credit history at Voya Investment decision Management, by mobile phone.

“We need to have additional unfold to enjoy there,” Goodson explained. “We never see default hazards, but we definitely see rocky headlines, such as as the pandemic arrives to an end and we determine out a far more normal semblance of existence once more. We really don’t nevertheless know what that implies in phrases of back to the office environment.”

One more delayed industrial home bond offer stems from Pacific Investment Administration Co.’s agreement to consider New York City-office environment REIT Columbia Assets Belief non-public, in accordance to Bloomberg Information, which earlier this 7 days also reported on the holdup on the bonds tied to Deutsche Bank’s new property.

The delinquency charges on commercial home finance loan bonds in the so-identified as one-asset, one-borrower (SASB) sector have remained reduced at 1{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996}, in accordance to the Barclays Credit history Study group led by Lea Overby, in a weekly customer notice.

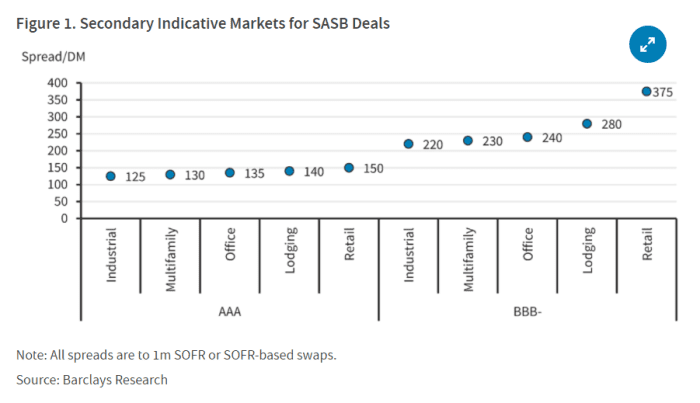

Despite the fact that, the group also claimed new issuance volumes have slowed in February and spreads, or the high quality paid to investors previously mentioned possibility-no cost Treasurys

TMUBMUSD10Y,

widened about 20-35 foundation points across commercial assets kinds, which factors to marketplace jitters.

Spreads on large professional bond discounts widen on market place jitters

Barclays Investigate

“In the secondary market place, you are having additional fascination at wider levels type traders,” Ripper reported.

Related: Credit history marketplaces even now cautiously open to U.S. companies as Russia-Ukraine war escalates