A coalition of point out fiscal officers, many from resource-rich states and all Republicans, is pushing back from local climate change-combating banking institutions that have adopted corporate procedures chopping off funding for the coal, oil, and organic gasoline industries.

“These industries – which are engaged in properly authorized actions – provide employment, paychecks and rewards to countless numbers of tricky-operating people in our states and we will not stand idly by and permit our peoples’ livelihoods to be ruined to progress a radical social agenda,” claimed West Virginia Condition Treasurer Riley Moore. “I’m not heading to let woke capitalism wipe out the careers and the overall economy of West Virginia.”

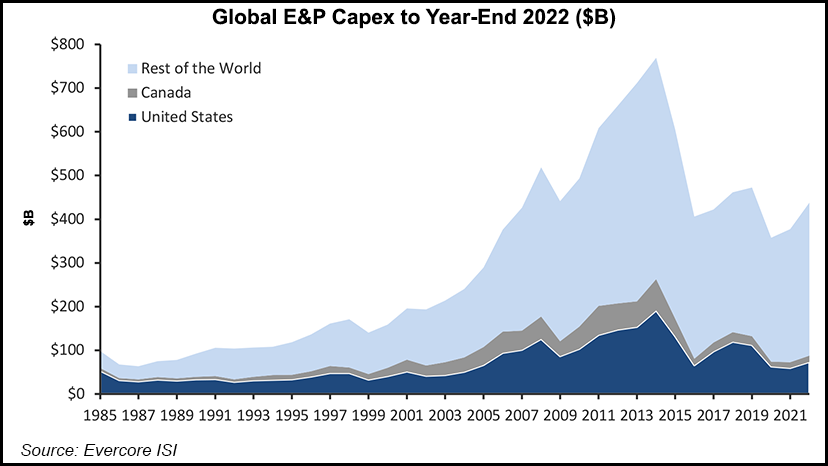

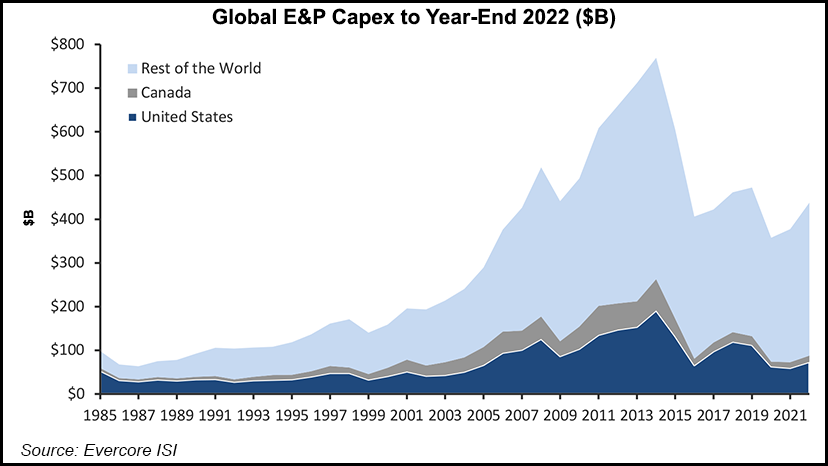

Capital paying by U.S. exploration and manufacturing (E&P) companies is projected to improve 23.5{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} yr/year in 2022.

Under the auspices of the United Nations, the world wide Web-Zero Banking Alliance consists of banks that commit “to aligning their lending and investment decision portfolios with web-zero emissions by 2050,” according to the alliance website. As of Dec. 21, U.S. financial institutions that were users of the alliance provided Amalgamated Bank, Financial institution of The us, Citi, J.P. Morgan Chase & Co., Morgan Stanley, The Goldman Sachs Team Inc., and Wells Fargo & Co.

In accordance to a 2021 report by the Rainforest Motion Community, the Sierra Club, Oil Alter Worldwide, and other activist teams, the higher than banking institutions – with the exception of Amalgamated and Goldman Sachs – alongside one another have furnished virtually $1.1 trillion in financing to oil, gasoline, and coal shoppers considering the fact that 2016.

Moore spearheaded the development of a coalition of point out economical officers in 15 states who have pledged to “scrutinize or likely curtail long run business” with banking companies that have procedures in opposition to funding for the coal, oil, and gas sectors. Moore instructed NGI that this kind of boycotts are tantamount to a presumption of guilt for the industries.

“Here’s the crux of the concern: How can I get tax bucks produced from the coal and fuel industries and then give” that revenue to financial institutions opposing individuals industries crucial to the point out, mentioned Moore.

In an open letter dealt with to the U.S. banking sector, the condition treasurers, auditors, and comptrollers pledged to “take concrete measures inside our respective authority to select economic institutions that assistance a cost-free marketplace and are not engaged in destructive fossil gasoline sector boycotts for our states’ monetary services contracts.”

Associates of the coalition mentioned they signify more than $600 billion in general public property beneath administration. Joining West Virginia in the multistate work are Alabama, Arizona, Arkansas, Idaho, Kentucky, Louisiana, Missouri, Nebraska, North Dakota, South Carolina, South Dakota, Texas, Utah, and Wyoming.

“Corporate agendas that attack our oil and fuel sector, which has been so crucial to our condition, should be called out…I will stand with other fiscal officers to battle against these occupation-killing insurance policies that hurt our economic climate,” claimed Louisiana Treasurer John Shroder.

Moore instructed NGI that his peers in another source-rich point out, Alaska, have expressed curiosity in the coalition.

“It sounds like they’ll be part of as well,” he mentioned. With additional states, “I think it’s going to expand and I assume we’re likely to have much more leverage.”

A Amount Playing Area

Coalition customers reported they “simply want monetary institutions to evaluate fossil fuel businesses as other lawful organizations – without having prejudice or choice.”

Moore informed NGI that states “contract out in essence all of our economic providers and have all of our assets parked” in financial institutions. Though agreement frameworks differ by state, Moore claimed that in West Virginia the point out can frequently opt out of contracts with 30 days of notice.

“We are switching our contracting process” in West Virginia, stated Moore. Banking companies are “going to have to be equipped to certify they are not going to boycott the fossil gas market. To be distinct, what we’re endeavor in this article is our choices in the current market. I’m not a current market regulator. I’m a marketplace participant…and these are West Virginia’s tastes in the industry.”

[In the Know: Better information empowers better decisions. Subscribe to NGI’s All News Access and gain the ability to read every article NGI publishes daily.]

Utah Point out Auditor John Dougall said banks and investors need to focus on how well businesses can potentially “provide elevated shareholder benefit, somewhat than favoring sure partisan agendas, especially at the price of shareholders. Energy organizations of all styles need to have unfettered access to cash and lending marketplaces.”

Arizona Treasurer Kimberly Yee mentioned “it is significant to carefully scrutinize the monetary establishments Arizona does business enterprise with, specially those that are engaged in politically inspired assaults on legit corporations, which are essential to our nation’s financial system and electrical power independence.”

The 15-condition coalition issued its letter to the banking market in November. Moore explained to NGI last week that his office has because obtained feed-back from banking institutions. Some of the banking companies have said “they are not going to get concerned in what I perspective as a boycott/denial of access to cash for the fossil gasoline marketplace,” explained Moore.

He added that banks opting in opposition to earning oil, gasoline, and coal organizations financing pariahs might also choose to compete for big condition banking contracts.

“These are sweet contracts,” Moore mentioned, outlining that they are low-hazard and “look fantastic on a balance sheet.”

Moore said he hopes the coalition’s endeavours finally will encourage banks to “come to their senses and…want to act like a bank…and be associated in funding. If they want to get involved in politics, they are heading to find out it’s a full-make contact with activity.”

Earlier this yr, Riley and other point out fiscal officials sent a letter to John Kerry, the U.S Department of State’s unique presidential envoy for climate, expressing “deep concern” amid experiences that he and other Biden administration officers have been “privately pressuring U.S. banking companies and financial institutions to refuse to lend to or spend in coal, oil, and organic gasoline organizations.”

Samantha Galvez, press secretary for Pennsylvania’s GOP Treasurer Stacy Garrity, explained to NGI that Garrity “is strongly opposed to the Biden administration’s initiatives to pressure monetary establishments into divesting from coal, oil, and all-natural gas providers.”

On Dec. 6, Garrity sent a letter to economic establishments carrying out business with Pennsylvania’s Treasury Department advising them her division “has a powerful interest” to know irrespective of whether establishments it will work with are “engaged in strength policies harmful to the state’s financial state and, consequently, its residents.”

Citing U.S. Strength Information Administration figures, Garrity observed that Pennsylvania is the United States’ next-major organic fuel producer, its 3rd-major coal producer, its 2nd-premier coal exporter, and the third-premier web strength supplier to other states.

As a outcome, Garrity wrote that her office will “carefully assess its relationships” with monetary institutions with which it does company. She reported that an illustration of such an assessment would be obtaining establishments entire “due diligence questionnaires” to gauge whether they “are engaged in insurance policies which would be dangerous to the dependable strength firms which are so important to the inhabitants of Pennsylvania.”

For their part, officials with U.S. oil and gas business groups have pointed out the sector is advancing initiatives to suppress its emissions. E&P and midstream providers are also significantly trying to get environmental certification for purely natural fuel.