(Bloomberg) — Signal up for the New Overall economy Day by day publication, observe us @economics and subscribe to our podcast.

Most Study from Bloomberg

The swiftest inflation in a long time and the resulting rush by central banks to increase desire rates are stoking recession fears in fiscal marketplaces — problems that are being compounded by the effect of aggressive coronavirus lockdowns in China and the war in Ukraine.

In the last 7 days by yourself, the the U.S. and U.K. logged inflation accelerating the most considering the fact that the early 1980s and the central banking companies of Canada and New Zealand offered a model for the U.S. Federal Reserve and other people by hiking prices 50 basis details for the first time in 22 many years.

Lender of The united states Corp. documented fund managers have been the most bearish they’d ever been about the outlook for progress and JPMorgan Chase & Co. boosted its reserves to insulate itself in opposition to an economic deterioration.

Meantime, Sri Lanka and Pakistan fell further into crises as the United Nations warned of a “perfect storm” for building international locations as commodity price ranges surge, the Environment Trade Firm reduce its outlook for commerce and queries for “recession” on Google and the Bloomberg Terminal spiked.

In opposition to these a backdrop, coverage makers head to Washington this week for meetings of the Intercontinental Monetary Fund and Environment Financial institution. The Fund is currently declaring the war implies it will downgrade its forecasts for 143 economies this yr — accounting for 86{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} of world gross domestic item.

“We are struggling with a disaster on leading of a crisis,” explained IMF Taking care of Director Kristalina Georgieva.

What Bloomberg Economics States…

“For the world wide financial system, the merged effect of war and coronavirus will be a year of decreased growth, bigger inflation and elevated uncertainty. To get to economic downturn, we’d will need to see even further shocks. Russia slicing off Europe’s fuel source or China’s lockdown growing from Shanghai to other important metropolitan areas are achievable catalysts.”

— Tom Orlik, chief economist

But there are also motives to imagine resilience, albeit with a contact of stagflation instead than world-wide recession, might be the get of the day, at minimum for abundant nations.

Many thanks to pandemic-period stimulus, households in developed markets even now have 11{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} to 14{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} of money in cost savings, according to a JPMorgan Chase investigation sent to shoppers last 7 days.

Leverage is at multi-decade lows and income is advancing at an annual amount of about 7{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} amid tightening labor markets, catalysts for a probable rebound in the next half of the 12 months. In the U.S., studies past 7 days on retail profits and consumer sentiment made available hope all people aren’t pulling back in spite of cost shocks.

“I see more factors for the world financial system to sluggish than for it to re-speed up,” stated Stephen Jen, who operates Eurizon SLJ Money, a hedge fund and advisory firm in London. “However, whether or not it will slide into a recession is a entire various tale, only simply because the abatement of Covid about the environment must unleash large pent-up need, helping to offset a good portion of the headwinds.”

Nevertheless, that robustness is heading to be examined.

The quickest inflation in a long time close to the earth is presently starting up to flip off many shoppers, particularly these witnessing better meals and gas costs. About 84{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} of Us citizens program to slash again on investing mainly because of higher charges, according to a Harris Poll for Bloomberg News.

Central bankers are also pushing up desire prices with the Fed now more possible than not to improve its benchmark by a 50 {21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996}-position upcoming month for the initial time due to the fact May perhaps 2000 and commence lowering its portfolio of bonds. Chairman Jerome Powell is predicted to tackle the outlook in an look on Thursday.

Just one hazard is that plan makers flip from reacting also late to climbing inflation to tightening as well a lot as their economies weaken or if inflation turns out to be pushed by provide chain woes that financial policy can’t deal with. The fund managers surveyed by BofA saw an 83{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} danger of a policy mistake.

“The explanation we’re seeking at a great deal slower development is that central banks need to answer by tightening policy from its at this time incredibly simple point out these kinds of that economical disorders will tighten and that will restrain demand,” stated Karen Dynan, Senior Fellow at the Peterson Institute for International Economics.

In a precursor of the IMF’s new economic outlook to be launched on Tuesday, Dynan believed world-wide expansion will slow to 3.3{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} this 12 months and subsequent, in contrast with 5.8{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} in 2021.

The major advanced economies will grow only reasonably this calendar year and weaken more in 2023, she reported. Significant rising marketplaces deal with a “divergent” outlook with India improving upon and China grappling with lockdowns and a home downturn.

The speed of developments this calendar year has caught policymakers off guard.

The White House’s prime financial adviser Brian Deese mentioned previous week that the U.S. faces a large amount of uncertainty. China’s Premier Li Keqiang said there’s an urgent will need for government stimulus.

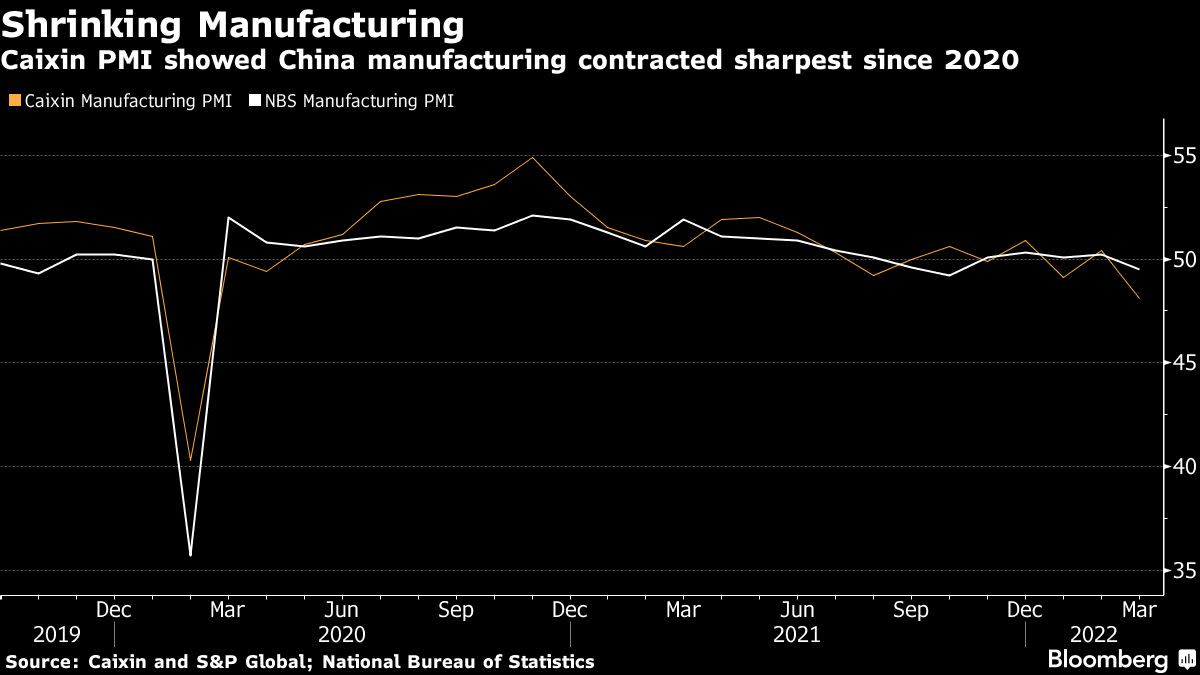

Russia’s invasion of Ukraine has overshadowed a deepening slowdown in China as the governing administration proceeds with its “dynamic zero” solution to controlling Covid-19, a coverage that has stalled creation in producing and monetary hubs Shenzhen and Shanghai and saved tens of millions of folks at household.

That solution, nevertheless, is very likely to thrust expansion down to 5{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} this year, underneath the official focus on of close to 5.5{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996}.

Global source lines that were continue to recovering from the pandemic may also undergo a more setback if China doesn’t handle the virus shortly.

Giant Producing Co. is between the producers emotion disruption. It’s ready as extensive as two several years for bicycle pieces, Chairperson Bonnie Tu advised Bloomberg Television.

“It is a hell of career,” she explained.

Most Read through from Bloomberg Businessweek

©2022 Bloomberg L.P.