The dramatic moves to isolate Russia from the international financial technique have proficiently frozen securities worth much more than $500 billion.

At the conclusion of last year, overseas buyers held $62 billion in sovereign personal debt, two thirds of which was denominated in rubles, in accordance to Central Lender of Russia info. The nominal foreign credit card debt of Russian banks and companies totaled $381 billion, the central lender data present.

Foreigners held Russian equities valued at $86 billion, the Economical Situations documented, citing Moscow Trade information.

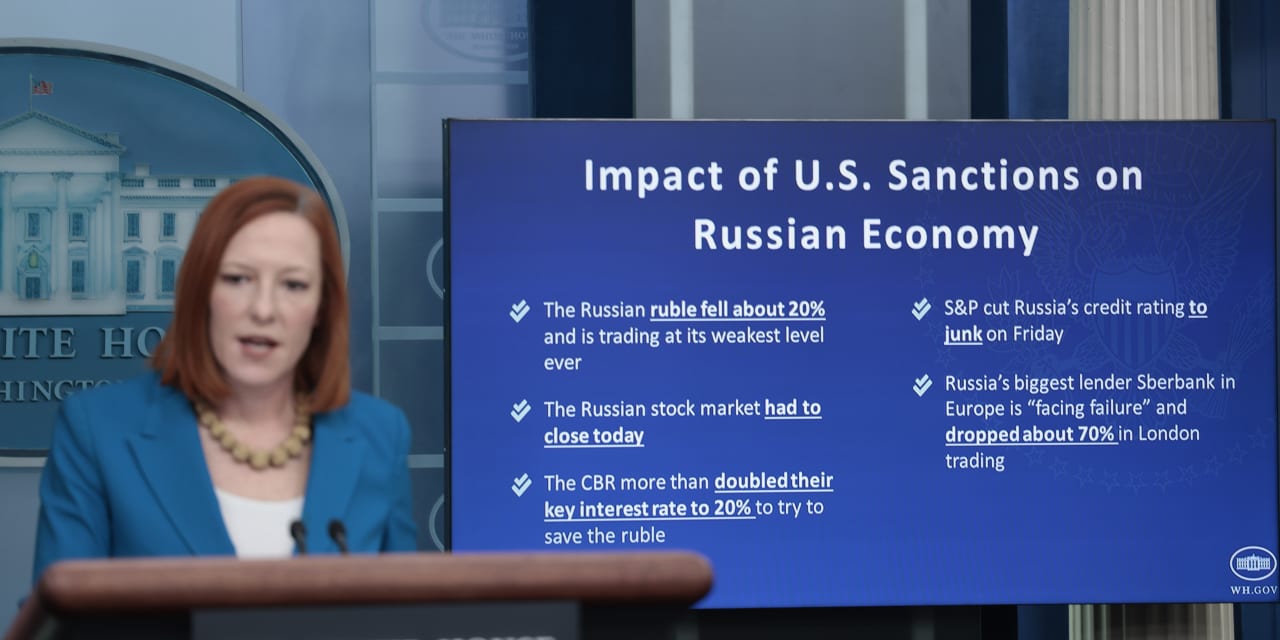

The U.S. and its western allies have reduce some Russian banking companies from the SWIFT messaging technique, as the U.S. barred any transactions with Russia’s central bank. On Tuesday, the U.K. reported it’s including Sberbank to its record of sanctioned entities.

The clearing properties Euroclear and Clearstream are shifting to prevent clearing ruble-denominated securities, and MSCI mentioned it may reclassify Russia as a “standalone” current market, from its present emerging-marketplace position. JPMorgan froze two resources that spend in Russia, The Wall Road Journal claimed.

The moves aren’t just 1 way — Russia is blocking payments to establishments exterior the nation. Bloomberg News noted the place is not specially blocking debt repayment, having said that. Russia’s inventory market place has been shut for two days, and some world wide inventory marketplaces are restricting investing in Russian securities, although a lot of organizations proceed to trade on the London Inventory Trade.

Gustavo Medeiros, head of global macro investigate at rising-marketplaces investor Ashmore, stated there is a chance of a significant liquidity shock.

“If Russian banking institutions are not able to get well their claims or fork out their liabilities to the relaxation of the earth the world-wide monetary technique may encounter shockwaves of liquidity events (due to the fact unpaid transactions beget far more failures), probably top to a liquidity crisis as opposed with the liquidity shock in March 2020 or even the default of Lehman Brothers in 2008,” he claimed in a be aware to clients.

Economical markets, nevertheless, are not pricing in these types of a circumstance.

“The sanctions began to bite in Russia yesterday but the affect somewhere else in the earth was remarkably gentle, almost certainly due to the fact the sanctions appear to be carving out an exception for the country’s electricity exports and as a result are likely to have an effect on the rest of the globe by much less than anticipated,” stated Marshall Gittler, head of investment decision research at BDSwiss Keeping.

U.S. inventory futures

ES00,

declined on Tuesday after a reasonably moderate .2{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} drop for the S&P 500

SPX,

on Monday, the first trading working day soon after the sanctions have been announced.