Obtaining a business that has the probable to improve significantly is not quick, but it is attainable if we glimpse at a few critical monetary metrics. To start with, we’d want to discover a growing return on capital employed (ROCE) and then together with that, an ever-growing foundation of capital employed. Place basically, these kinds of enterprises are compounding equipment, this means they are continually reinvesting their earnings at ever-greater charges of return. Even so, just after briefly on the lookout more than the quantities, we you should not imagine NVIDIA (NASDAQ:NVDA) has the makings of a multi-bagger going ahead, but let’s have a appear at why that may perhaps be.

Comprehending Return On Capital Employed (ROCE)

If you haven’t worked with ROCE before, it measures the ‘return’ (pre-tax revenue) a business generates from capital employed in its organization. The system for this calculation on NVIDIA is:

Return on Capital Employed = Earnings Ahead of Interest and Tax (EBIT) ÷ (Full Assets – Existing Liabilities)

.16 = US$5.6b ÷ (US$41b – US$6.6b) (Based mostly on the trailing twelve months to January 2023).

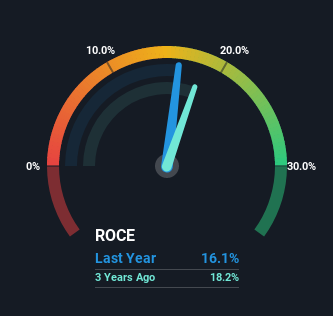

So, NVIDIA has an ROCE of 16{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996}. Which is a relatively regular return on funds, and it really is close to the 14{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} generated by the Semiconductor industry.

Check out our most up-to-date assessment for NVIDIA

In the over chart we have measured NVIDIA’s prior ROCE from its prior performance, but the foreseeable future is arguably additional crucial. If you might be fascinated, you can look at the analysts predictions in our free of charge report on analyst forecasts for the enterprise.

The Development Of ROCE

On the surface, the trend of ROCE at NVIDIA isn’t going to inspire confidence. About the last five a long time, returns on funds have lessened to 16{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} from 32{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} 5 yrs in the past. Having said that it looks like NVIDIA may possibly be reinvesting for long term expansion because even though cash employed has amplified, the company’s gross sales have not altered a lot in the past 12 months. It is really worthy of keeping an eye on the company’s earnings from listed here on to see if these investments do finish up contributing to the base line.

The Bottom Line

Bringing it all together, even though we’re rather encouraged by NVIDIA’s reinvestment in its possess company, we are knowledgeable that returns are shrinking. However to prolonged term shareholders the stock has gifted them an amazing 372{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} return in the very last five a long time, so the market place appears to be rosy about its potential. Even so, except these fundamental trends convert far more good, we wouldn’t get our hopes up much too superior.

If you want to proceed researching NVIDIA, you may possibly be interested to know about the 3 warning indications that our examination has learned.

If you want to research for strong providers with great earnings, check out this cost-free listing of corporations with excellent harmony sheets and spectacular returns on fairness.

Have opinions on this post? Worried about the information? Get in contact with us right. Alternatively, e mail editorial-team (at) simplywallst.com.

This post by Basically Wall St is general in character. We give commentary centered on historic data and analyst forecasts only applying an impartial methodology and our articles are not intended to be money tips. It does not constitute a recommendation to purchase or sell any inventory, and does not choose account of your goals, or your economic situation. We intention to convey you prolonged-phrase concentrated examination pushed by elementary data. Observe that our assessment might not element in the most current rate-sensitive organization announcements or qualitative material. Basically Wall St has no placement in any shares described.

Join A Compensated User Study Session

You are going to acquire a US$30 Amazon Reward card for 1 hour of your time though aiding us establish greater investing instruments for the unique buyers like your self. Sign up in this article