This is a time of year when quite a few farms concentration on the fiscal elements of their organizations.

The focus can be huge ranging from finding economical statements back from accountants, to getting ready facts to file tax returns and to furnishing information and facts to lenders. For a excellent number of farms, focusing on monetary management is not something they glance ahead to.

Having said that, there are a lot of farms that are truly fascinated in seeking at techniques in which they can acquire a better knowing of their farm’s monetary functionality and linked toughness and weaknesses. I’m heading to share some of my feelings on monetary administration competencies.

Advancing monetary management competencies can be considered of as a move-by-move developmental strategy. Do this, then do that, for example, but normally doing work towards a better comprehending.

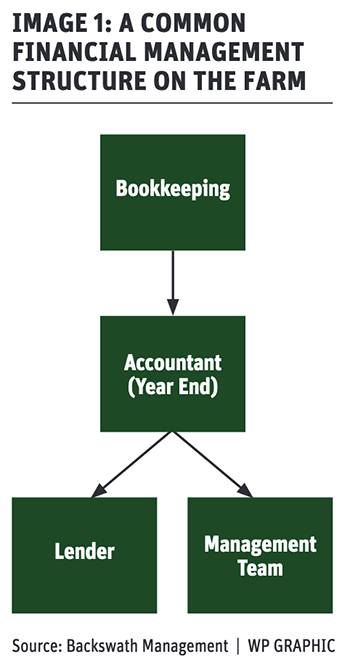

Graphic 1 signifies a common fiscal administration structure on the farm, in which a bookkeeper (both inside or external) documents transactions in an accounting program and submits a year-conclude file to an accountant. The accountant then gives fiscal statements utilised by each the administration team on the farm as nicely as the lending institutions.

Impression 2 would be the most popular procedure stream. Monetary data is to start with captured at the bookkeeping functionality and then used as necessary to support budgeting, actual-to-spending budget assessment by the year and for reporting to loan providers and the entrepreneurs/management group.

Two queries are foundational to a deeper being familiar with of economical overall performance:

- How do you use the economical info readily available to your farm’s best pursuits?

- What does your financial performance need to look like in the future (a stage of time to be described) to be certain that house owners and stakeholders are in a position to make the demanded expense conclusions?

In other phrases, what are you controlling toward monetarily?

Critical to the inquiries higher than is alignment in just your fiscal administration procedures. This is crucial and refers to the fiscal info remaining captured at the administrative (bookkeeping) degree and used by:

- Accountants for compliance (reporting and tax) requirements.

- Loan companies for borrowing and overall performance critique demands.

- House owners and professionals.

They are utilised for:

- Effectiveness assessment evaluate historic and long term concentrated.

- Financial investment and financing decisions.

- Operational conclusions.

If there are gaps within the alignment, indicating that diverse fiscal information is being employed for distinct reasons by various folks, critical being familiar with can get lost in translation. The possibility is that decisions then aren’t based mostly on superior and stable details.

To utilize this idea on the farm, overview and adjust your present chart of accounts to best empower effectiveness and precision in aligning bookkeeping capabilities and associated money management procedures as identified earlier mentioned.

Generate processes that you can use to allow quarterly (could be regular in the upcoming as demanded) 12 months-to-day money stories and utilize price range-to-real examination.

The purpose is to be able to critique your economic effectiveness during the calendar year. The objective is to choose mid-yr effectiveness and through assessment and investigation, adjust in which feasible to produce the greatest yr-finish numbers doable. Of course, the moment your calendar year is complete, mid-calendar year adjustments are no for a longer period possible and the year’s effects are the final results.

The quarterly reports need to include equilibrium sheets and money statements so maintaining exact accounts payable, receivable and in particular inventories are vital.

Build economical targets and investment rules for your farm. This information is made use of to “test” true economical functionality against a level of time in the upcoming. It assists you to identify if you are making progress or if changes may be needed.

Just one-year earnings statement, balance sheet and cash move projections need to be created. These are the budgets versus which you will assess development during the year.

The budget-to-real examination referenced previously mentioned uses spending budget information captured in the projections.

A rolling five-yr capital spending plan should really be produced.

Overview the most the latest year’s economical overall performance by calculating important ratios. Ideally, five decades of ratios should really be utilised so that trarticle_paragraphs can be analyzed.

The approach outlined previously mentioned yields information and facts that you can use to acquire a greater comprehending of your farm’s economical strengths and weaknesses.

I have an understanding of that there will be other ways that you could seem at for advancing your farm’s economical management competency.

The technique described above is the framework that I use when doing the job with farm families who want to advance their skills in fiscal administration.

Terry Betker, PAg, is a farm management expert centered in Winnipeg. He can be reached at 204-782-8200 or [email protected].