What GAO Observed

To work as successfully and proficiently as doable, Congress, the administration, and federal professionals ought to have completely ready obtain to trusted and total financial and functionality information—both for person federal entities and for the federal federal government as a total. GAO’s report on the U.S. government’s consolidated money statements for fiscal several years 2021 and 2020 discusses progress that has been made but also underscores that significantly work continues to be to strengthen federal money administration and that the federal authorities continues to facial area an unsustainable extended-term fiscal path.

GAO uncovered the pursuing:

- Sure substance weaknesses in inside manage more than money reporting and other limitations resulted in conditions that prevented GAO from expressing an belief on the accrual-dependent consolidated fiscal statements as of and for the fiscal yrs finished September 30, 2021, and 2020.

- Considerable uncertainties, largely related to the achievement of projected reductions in Medicare value development, prevented GAO from expressing an belief on the sustainability fiscal statements, which consist of the 2021 and 2020 Statements of Lengthy-Time period Fiscal Projections the 2021, 2020, 2019, 2018, and 2017 Statements of Social Insurance policies and the 2021 and 2020 Statements of Modifications in Social Insurance policy Quantities. A product weakness in inside control also prevented GAO from expressing an opinion on the 2021 and 2020 Statements of Extensive-Phrase Fiscal Projections.

- Product weaknesses resulted in ineffective interior management around fiscal reporting for fiscal calendar year 2021.

- Product weaknesses and other scope constraints, talked over above, confined exams of compliance with chosen provisions of relevant legislation, restrictions, contracts, and grant agreements for fiscal calendar year 2021.

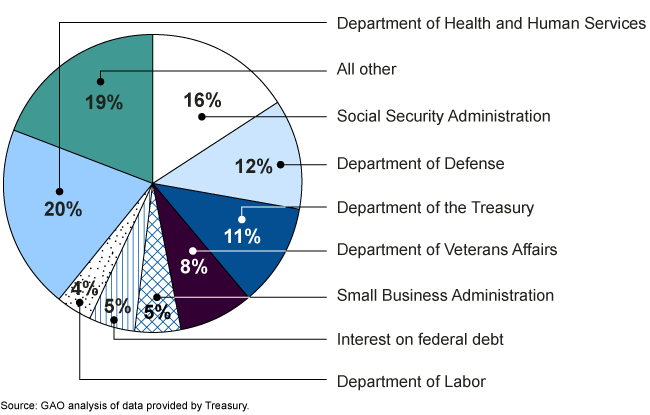

Three significant impediments have ongoing to prevent GAO from rendering an feeling on the federal government’s accrual-centered consolidated financial statements: (1) significant monetary administration problems at the Division of Protection (DOD), (2) the federal government’s inability to adequately account for intragovernmental action and balances amongst federal entities, and (3) weaknesses in the federal government’s approach for getting ready the consolidated financial statements. In addition, the Smaller Company Administration (SBA), which had sizeable action relevant to the COVID-19 pandemic reaction, was unable to get an viewpoint on its fiscal calendar year 2021 and 2020 economic statements, after decades of receiving cleanse thoughts. Efforts are less than way to solve these issues.

The material weaknesses underlying these three major impediments, as perfectly as the weaknesses discovered at SBA, (1) hamper the federal government’s potential to reliably report a considerable part of its property, liabilities, expenditures, and other related facts (2) have an impact on the federal government’s means to reliably evaluate the full price tag, as nicely as the fiscal and nonfinancial performance, of certain packages and routines (3) impair the federal government’s means to sufficiently safeguard important property and effectively report numerous transactions and (4) hinder the federal govt from owning responsible, handy, and well timed economical data to work proficiently and successfully.

GAO also identified two other continuing material weaknesses. These are the federal government’s inability to (1) figure out the comprehensive extent to which improper payments manifest and moderately assure that ideal actions are taken to reduce them and (2) detect and take care of facts stability regulate deficiencies and manage information safety threats on an ongoing basis. The fiscal year 2021 government-wide whole of documented estimated inappropriate payments was $281 billion, but it did not include things like some essential govt applications.

The extensive extensive-phrase fiscal projections introduced in the Assertion of Extensive-Time period Fiscal Projections and associated details show that based mostly on recent income and spending policies, the federal governing administration continues to encounter an unsustainable very long-term fiscal path. Considering that 2017, GAO has stated that a fiscal program is needed to assure that the U.S. remains in a robust economic placement to meet up with its social and safety requirements, as effectively as to protect overall flexibility to handle unforeseen situations like community well being emergencies. Congress and the administration have responded in an unparalleled way to the COVID-19 pandemic and the resulting severe financial repercussions. After the pandemic recedes and as the overall economy carries on to get better, Congress and the administration should swiftly pivot to building a approach to put the federal governing administration on a sustainable extensive-term fiscal route. Even more, GAO has encouraged that Congress consider alternative techniques to the present-day financial debt limit as part of any prolonged-time period fiscal strategy.

In commenting on a draft of this report, Department of the Treasury and Workplace of Management and Finances (OMB) officials presented technological feedback that GAO integrated as appropriate. Treasury and OMB officials expressed their continuing commitment to addressing the challenges this report outlines.

Why GAO Did This Analyze

The Secretary of the Treasury, in coordination with the Director of OMB, is demanded to per year submit audited financial statements for the U.S. government to the President and Congress. GAO is expected to audit these statements. The Government Management Reform Act of 1994 has needed this sort of reporting, masking the executive department of federal government, starting with monetary statements prepared for fiscal 12 months 1997. The consolidated money statements include things like the legislative and judicial branches.

For far more information, get in touch with Dawn B. Simpson at (202) 512-3406 or [email protected] or Robert F. Dacey at (202) 512-3406 or [email protected].