We can easily recognize why traders are attracted to unprofitable companies. For instance, biotech and mining exploration businesses normally eliminate income for a long time in advance of discovering achievement with a new treatment or mineral discovery. But even though the successes are perfectly recognized, buyers should not dismiss the very quite a few unprofitable firms that basically burn off as a result of all their money and collapse.

Given this chance, we believed we would choose a search at regardless of whether Cognition Therapeutics (NASDAQ:CGTX) shareholders ought to be nervous about its dollars melt away. In this report, we will take into consideration the company’s annual adverse no cost hard cash stream, henceforth referring to it as the ‘cash burn’. Let us commence with an assessment of the business’ hard cash, relative to its dollars burn.

Look at out our most recent examination for Cognition Therapeutics

Does Cognition Therapeutics Have A Extensive Cash Runway?

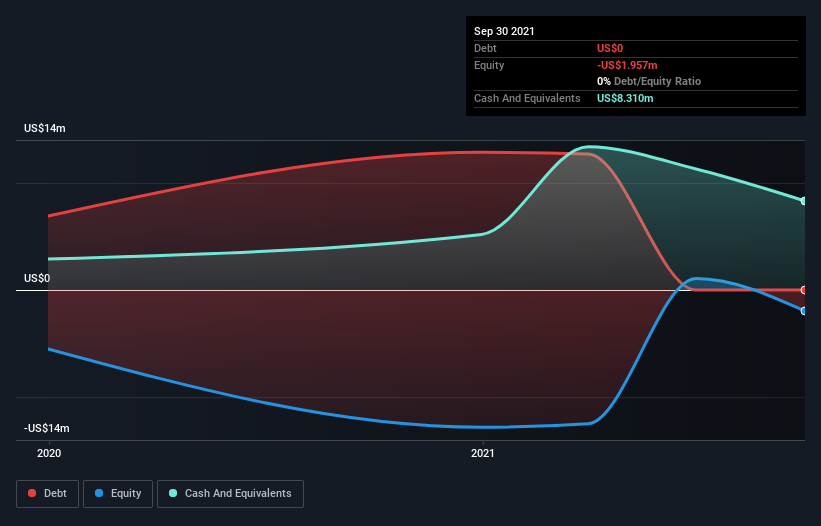

You can work out a firm’s funds runway by dividing the amount of hard cash it has by the rate at which it is paying out that hard cash. In September 2021, Cognition Therapeutics had US$8.3m in cash, and was credit card debt-free. Searching at the last calendar year, the company burnt via US$4.2m. For that reason, from September 2021 it experienced 2. a long time of funds runway. When that funds runway isn’t as well concerning, smart holders would be peering into the length, and thinking of what transpires if the firm operates out of funds. Depicted below, you can see how its money holdings have modified about time.

How Is Cognition Therapeutics’ Income Burn off Transforming About Time?

Cognition Therapeutics didn’t file any revenue about the last year, indicating that it truly is an early phase organization even now developing its organization. So whilst we can’t glance to sales to fully grasp development, we can search at how the money melt away is switching to fully grasp how expenditure is trending above time. Around the last year its money burn actually improved by 24{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996}, which implies that administration are escalating expense in long run expansion, but not far too swiftly. Nevertheless, the firm’s correct money runway will for that reason be shorter than suggested over, if shelling out proceeds to enhance. When the past is normally really worth finding out, it is the long run that issues most of all. For that motive, it helps make a large amount of perception to just take a look at our analyst forecasts for the business.

How Challenging Would It Be For Cognition Therapeutics To Elevate Much more Cash For Progress?

Supplied its funds burn up trajectory, Cognition Therapeutics shareholders could want to think about how conveniently it could raise far more funds, inspite of its sound funds runway. Businesses can increase cash by means of possibly financial debt or fairness. Quite a few organizations end up issuing new shares to fund future expansion. By looking at a firm’s hard cash burn off relative to its marketplace capitalisation, we acquire insight on how substantially shareholders would be diluted if the enterprise required to elevate more than enough dollars to address a different year’s money burn.

Because it has a marketplace capitalisation of US$127m, Cognition Therapeutics’ US$4.2m in funds melt away equates to about 3.3{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} of its market price. Provided that is a somewhat small percentage, it would possibly be truly straightforward for the firm to fund one more year’s progress by issuing some new shares to traders, or even by getting out a personal loan.

How Dangerous Is Cognition Therapeutics’ Funds Burn Predicament?

It may perhaps already be evident to you that we’re somewhat snug with the way Cognition Therapeutics is burning as a result of its funds. For example, we assume its dollars burn up relative to its industry cap indicates that the company is on a superior path. Even though its raising money burn up was not great, the other things mentioned in this write-up far more than make up for weak point on that measure. Based mostly on the aspects pointed out in this short article, we feel its income melt away circumstance warrants some consideration from shareholders, but we really don’t feel they should be fearful. On a further note, we performed an in-depth investigation of the enterprise, and discovered 6 warning signs for Cognition Therapeutics (4 can not be dismissed!) that you really should be knowledgeable of in advance of investing right here.

Of class, you may well come across a wonderful financial investment by seeking somewhere else. So take a peek at this free checklist of companies insiders are purchasing, and this record of stocks expansion stocks (according to analyst forecasts)

Have comments on this posting? Anxious about the information? Get in contact with us directly. Alternatively, e mail editorial-group (at) simplywallst.com.

This article by Just Wall St is basic in mother nature. We deliver commentary centered on historic knowledge and analyst forecasts only using an impartial methodology and our posts are not supposed to be monetary guidance. It does not constitute a suggestion to invest in or sell any stock, and does not take account of your objectives, or your monetary scenario. We aim to provide you extended-phrase centered assessment pushed by basic details. Note that our analysis may perhaps not variable in the latest price-sensitive company bulletins or qualitative substance. Merely Wall St has no position in any shares described.