China’s economic markets are nearing “peak stress” ranges, with concerns mounting above its highly leveraged home sector as the saga all around troubled developer China Evergrande Team performs out.

And investors should not count on a sustained bounce in the country’s fairness current market right up until the credit rating cycle turns for the better, explained analysts at Danske Bank.

But belongings indirectly connected to the world’s 2nd-largest economic system have still to feel the spillover consequences of China’s financial slowdown, they also warned, in a Friday observe.

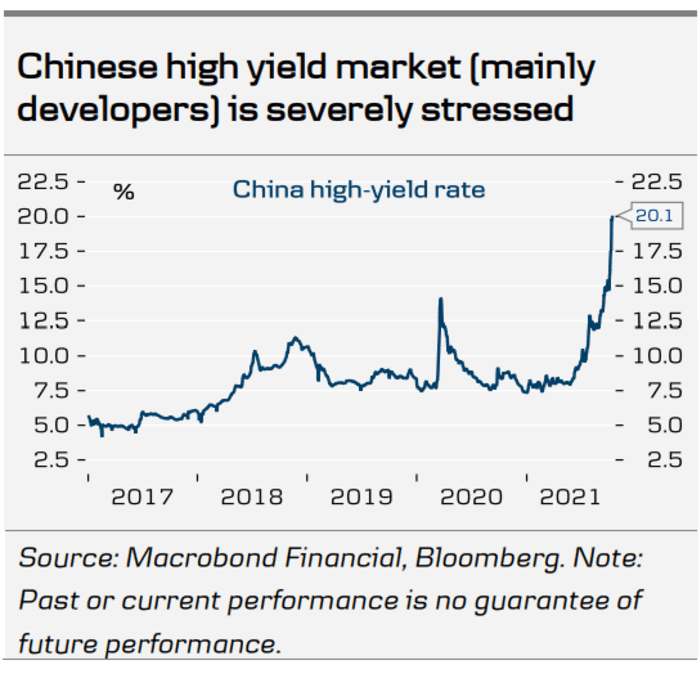

“While Chinese fairness marketplaces have been more stable currently, the worry in credit rating markets for developers have ongoing unabated with rates on large produce credit history achieving new highs by the working day,” wrote Copenhagen-primarily based Allan von Mehren and Lars Sparresø Merklin (see chart down below).

Danske Lender

Evergrande

708,

the highly leveraged developer with a lot more than $300 billion in personal debt, has been in the highlight, reportedly missing numerous coupon payments in modern months and in threat of remaining declared in default as grace intervals for those payments run out. Evergrande’s chief government, Xia Haijun, was holding talks in Hong Kong with lenders and buyers around a restructuring and probable asset revenue, Reuters reported Friday, citing two persons familiar with the make any difference.

A selloff past 7 days for dollar-denominated bonds of Chinese developers was activated immediately after luxury developer Fantasia Holdings Team Co. unsuccessful unexpectedly to repay $206 million in dollar bonds that matured on Oct. 4.

Amid fears of a spillover, China’s central lender on Friday piped up to say that threats to the money system from the residence sector, which are believed to account for practically 30{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} of the country’s gross domestic solution the moment upstream and downstream links are taken into account, had been controllable, The Wall Road Journal claimed, citing condition media outlets.

Zou Lan, head of financial markets at the People’s Financial institution of China, stated officers ended up urging Evergrande to velocity up asset disposals and resume tasks to secure the interests of dwelling purchasers, the report explained. The formal reported economical authorities, the housing ministry and nearby governments would perform alongside one another to offer funding support so stalled jobs could restart.

The Shanghai Composite

SHCOMP,

fell .6{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} this week, whilst the broader CSI 300

000300,

eked out a minor acquire. The Shanghai Composite is up 2.9{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} for the yr to day, but down additional than 4{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} from its 2021 peak set in February. The CSI 300 is down 5.4{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} for the calendar year and has tumbled virtually 17{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} from its 2021 superior.

The big-cap U.S. benchmark S&P 500

SPX,

is up extra than 19{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} so significantly this year, while the blue-chip Dow Jones Industrial Ordinary

DJIA,

has obtained far more than 15{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996}.

The Danske analysts noted that large state financial institutions had been explained to to ease limits on mortgage loan lending and have been allowed to securitize loans once more, in an work to underpin home revenue.

They stated Beijing will most likely choose steps before long to “unfreeze” credit history markets, “as pretty handful of builders can endure this type of funding and liquidity squeeze for extensive.”

Among the selections, the PBOC could slice the reserve need ratio and immediate large point out banks to start out purchasing substantial-yield bonds, they said. The analysts argued that if conditions quiet, obtaining bonds at 20{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} would very likely flip out to be a “quite favorable” investment decision for the financial institutions, while personal traders would also be inspired to get started shopping for if the authorities will get associated.

They also see more direct financial institution lending to builders, with authorities very likely to loosen rules that crimped financial loans previous yr.

On the other hand, the Danske analysts and other China watchers have argued that Evergrande and the residence sector have been not likely to threaten a “Lehman second,” a reference to the 2008 collapse of Lehman Brothers that quickly froze international credit score marketplaces and marked the bleakest stage of the world financial crisis. Which is since the government’s capability to dictate the actions of creditors and many others give Beijing more overall flexibility.

But the crackdown on excesses in the residence sector and other aspects had been continue to possible to make certain a continued slowdown in China’s financial state.

“Even pursuing an orderly restructuring of the worst-affected builders with nominal contagion to the money process, development activity would however just about inevitably gradual a lot further. As we have warned for some time, that’s the sensible consequence of the ‘three crimson lines’ coverage imposed on builders past 12 months, as well as the huge demographic headwinds that the sector faces,” said Oliver Jones, senior markets economist at Funds Economics, in an Oct. 12 take note.

The Danske analysts emphasized that there is a prolonged way to go from peak money stress to restarting the credit rating cycle.

“For Chinese equities, this may simply be a interval of time wherever we see more sideways moves, awaiting the subsequent large cyclical reboot of credit rating,” they wrote. “For assets which are more indirectly connected to Chinese property and the credit score cycle, we suspect this will imply minor.”

For case in point, the euro

EURUSD,

is probably to carry on slipping versus the greenback “as the results of historic Chinese tightening moves as a result of the worldwide production

chains.”