The new yr is approximately on us, and one particular plan for where by to spend is the banking sector, whose margins reward from the superior desire costs, at not terribly demanding valuations.

That claim could shock those who believe the U.S. banking field has some $2.2 trillion in money. But he whittles that figure in quite a few strategies. First, he notes, there is a distinction among book equity and tangible fairness, the latter of which is made use of by banking regulators to consider solvency. It’s a narrower definition, excluding things like goodwill and deferred tax property, that provides the complete down to $1.49 trillion from $2.22 trillion.

Then, drawing on Federal Deposit Coverage Corp. knowledge, he subtracts what is called accumulated other comprehensive income. “Thanks to QE and now QT, all types of property have turn out to be detrimental return propositions for banks and nonbanks alike. If the coupon pays fewer than the funding expenditures, you are getting rid of revenue,” he claims. That requires capital down to $1.23 trillion.

Now comes the extra controversial portion. Initial he marks to marketplace losses on financial loans and securities created for the duration of 2020 and 2021, for the impact of this year’s Fed amount hikes. That appropriate there is sufficient to thrust financial institutions into insolvency, with some $1.74 trillion of losses from marking to sector.

Another $794 billion losses comes if lender holdings of U.S. Treasury securities, mortgage-backed securities and condition and municipal securities also are marked to market. Set it all alongside one another, on Whalen’s calculations, and banks have a $1.3 trillion shortfall as of the 2nd quarter.

Granted, and this is quite crucial, financial institutions never have to mark their assets to market. So what is the be concerned? That exception isn’t infinite — banks are permitted to ignore mark-to-sector losses so extended as they have the capacity and intent to do so. “Even if the financial institution holds these very low-coupon property made throughout 2020-2021 in portfolio to maturity, dollars flow losses and bad returns could ultimately power a sale,” Whalen says.

He done a similar examination on JPMorgan Chase

JPM,

which he calls 1 of the superior managed banking institutions. Jamie Dimon’s bunch has a $16 billion shortfall as of the second quarter — and a $58 billion deficit if the mark-to-market adjustment is a steeper 17.5{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} — on Whalen’s numbers.

The even larger question is when all those asset gross sales could perhaps come about. “Sales of property will arise gradually but creditors could drive concern on collateral that is 20pts underwater,” he told MarketWatch in an email. And what’s unsustainable now is established to get even worse. “Higher costs just make eventual mess greater,” Whalen included.

The industry

U.S. stock futures

ES00

NQ00

ended up pointing better in early action. Commodities ended up going up, with gains for equally oil

CL

and gold

GC00.

The dollar

DXY

was reduced.

For more current market updates moreover actionable trade concepts for stocks, solutions and crypto, subscribe to MarketDiem by Investor’s Enterprise Every day.

The buzz

Fed Chair Jerome Powell is scheduled to speak at 1:30 p.m. at the Brookings Institution, the current employer of previous Fed Chair Ben Bernanke. “We see hawkish risk from Powell’s responses now which may possibly reinforce his November FOMC message that policy charges may perhaps will need rise to increased ranges and that a slowdown to a 50bp hike is not a dovish pivot,” stated economist at Citi. There are two other Fed speakers as nicely, with Gov. Michelle Bowman thanks to speak about banking institutions, as Gov. Lisa Prepare dinner speaks at the Detroit Financial Club.

Private-sector occupation development slowed to 129,000 in November, ADP estimated, in what it said was the weakest work growth given that Jan. 2021. In the meantime, the Commerce Division upped its estimate of 3rd-quarter progress to 2.9{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} from 2.6{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996}. The state-of-the-art trade in merchandise report confirmed a 7.7{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} increase in the items deficit, a .8{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} raise in wholesale inventories but a .2{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} drop in retail inventories.

Nevertheless to arrive are Chicago PMI, work openings and pending household revenue all are due for release, with the Beige Book of financial anecdotes because of at 2 p.m.

In the eurozone, calendar year-over-calendar year inflation slowed to 10{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} in November from 10.6{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996}.

CrowdStrike Holdings

CRWD

slumped right after the cybersecurity agency guided for slowing subscription income expansion.

Horizon Therapeutics

HZNP

rallied right after the Irish drugmaker mentioned it is in talks to be bought, with weighty hitters together with Amgen

AMGN,

Johnson & Johnson

JNJ

and Sanofi

FR:SAN

circling the firm.

An Alzheimer’s drug from Biogen

BIIB

and Eisai

JP:4523

moderately decreased cognitive decline but also will come with aspect effect.

Walt Disney

DIS

mentioned its returning CEO, Bob Iger, will initiate corporation and operational alterations that could result in impairment charges. It flagged the Disney Media and Entertainment Division, which includes its streaming expert services, for improvements.

Greatest of the net

What China’s young protesters want.

Conveying America’s shortfall of EV charging stations.

The whole annotation of the racist Los Angeles metropolis council audio that has thrown America’s second-greatest metropolis into turmoil.

Top tickers

Right here are the most active stock-market tickers as of 6 a.m. Japanese.

| Ticker | Safety identify |

| TSLA | Tesla |

| GME | GameStop |

| NIO | Nio |

| AMC | AMC Enjoyment |

| MULN | Mullen Automotive |

| BABA | Alibaba |

| XPEV | XPeng |

| OTIC | Otonomy |

| CRWD | CrowdStrike Holdings |

| APE | AMC Leisure preferreds |

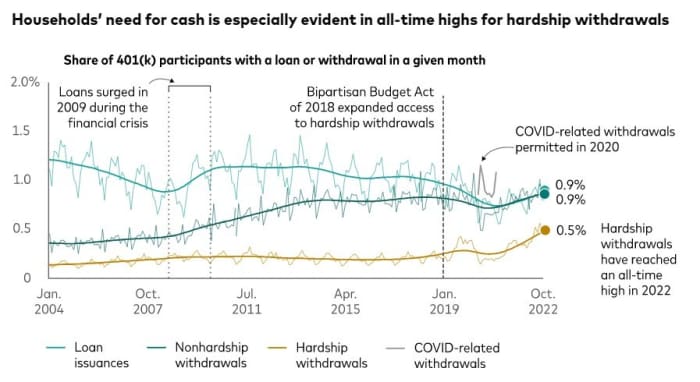

The chart

Vanguard

Hardship withdrawals have reached an all-time significant, according to details from Vanguard. This kind of withdrawals are only permitted for an fast and weighty fiscal require and matter to income taxes and a 10{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} early withdrawal penalty.

Random reads

This 22-year-old sells human bones for a living.

There’s yet another World Cup going on in Qatar — for camels.

Lobsta Mickey — a huge Mickey Mouse statue with lobster claws — is back in Boston.

Have to have to Know starts early and is current until finally the opening bell, but sign up in this article to get it sent after to your electronic mail box. The emailed edition will be sent out at about 7:30 a.m. Japanese.

Listen to the Best New Concepts in Income podcast with MarketWatch reporter Charles Passy and economist Stephanie Kelton