AppleInsider is supported by its audience and may earn fee as an Amazon Associate and affiliate partner on qualifying buys. These affiliate partnerships do not affect our editorial content material.

Apple broke its possess quarterly document for revenue in the September quarter, but it fell quick of what Wall Street was predicting mainly simply because of provide chain constraints influencing the full field. Here’s what analysts experienced to say about the outcomes.

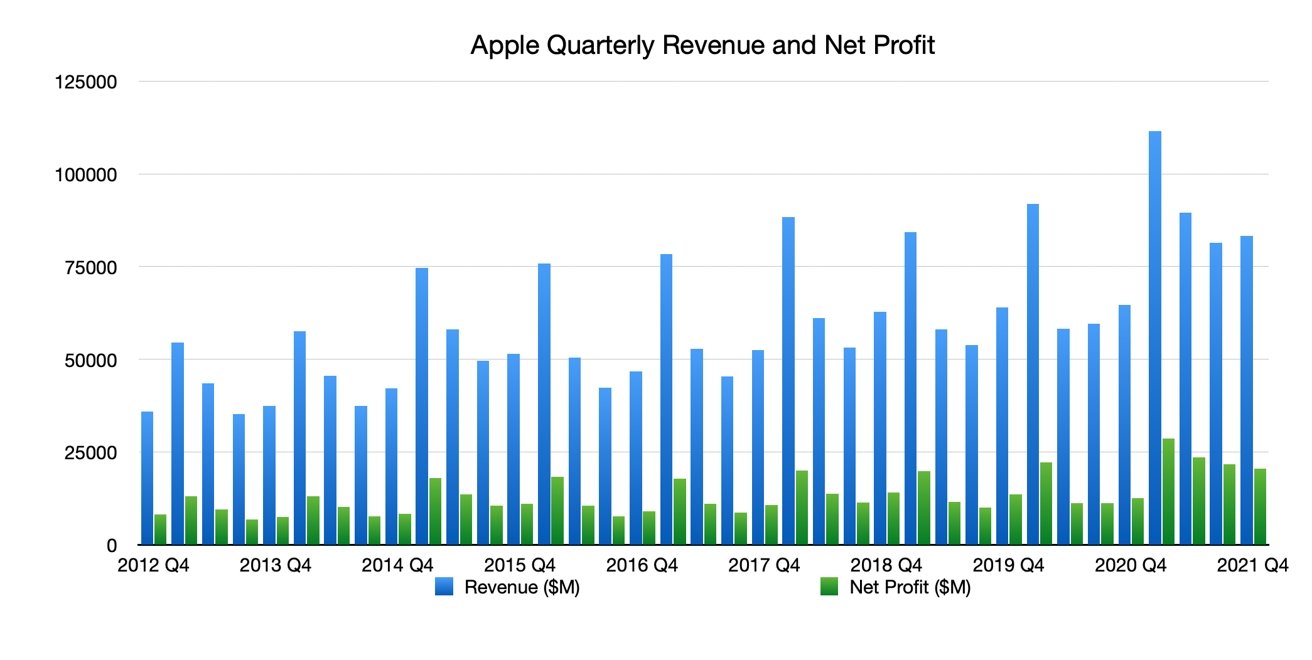

The Cupertino tech huge noted quarterly revenue of $83.4 billion, missing Wall Avenue expectations of $85. Apple attributed the earnings skip to chip lack and manufacturing issues, which the corporation says cost it $6 billion.

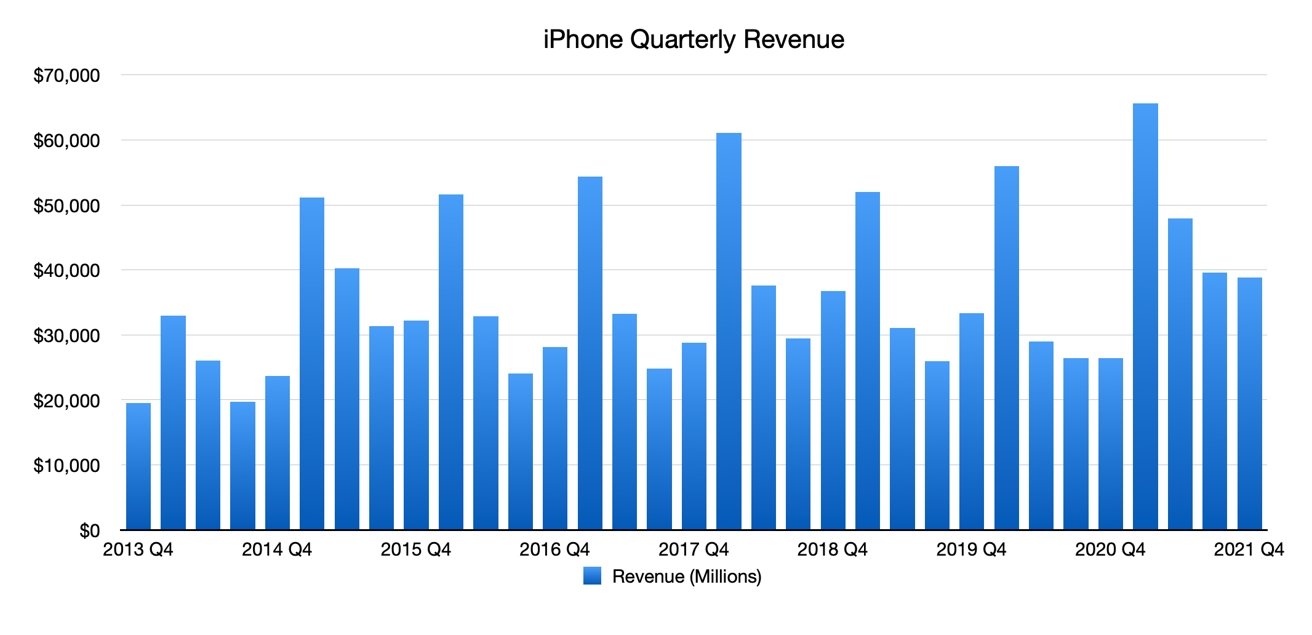

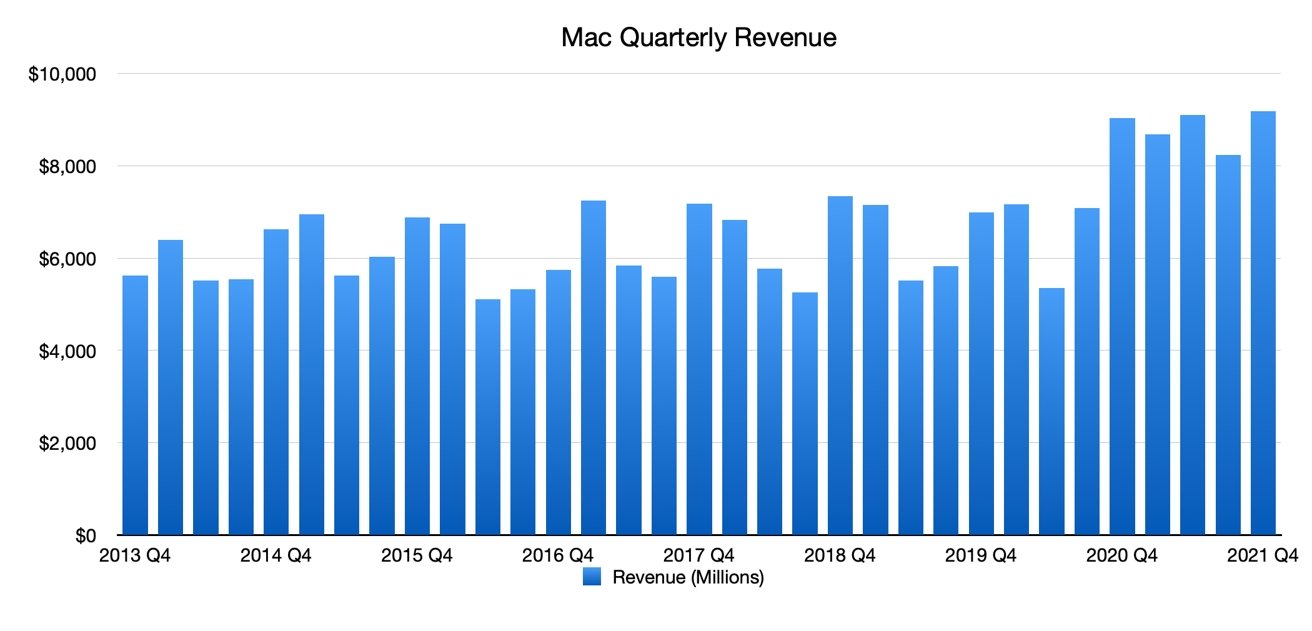

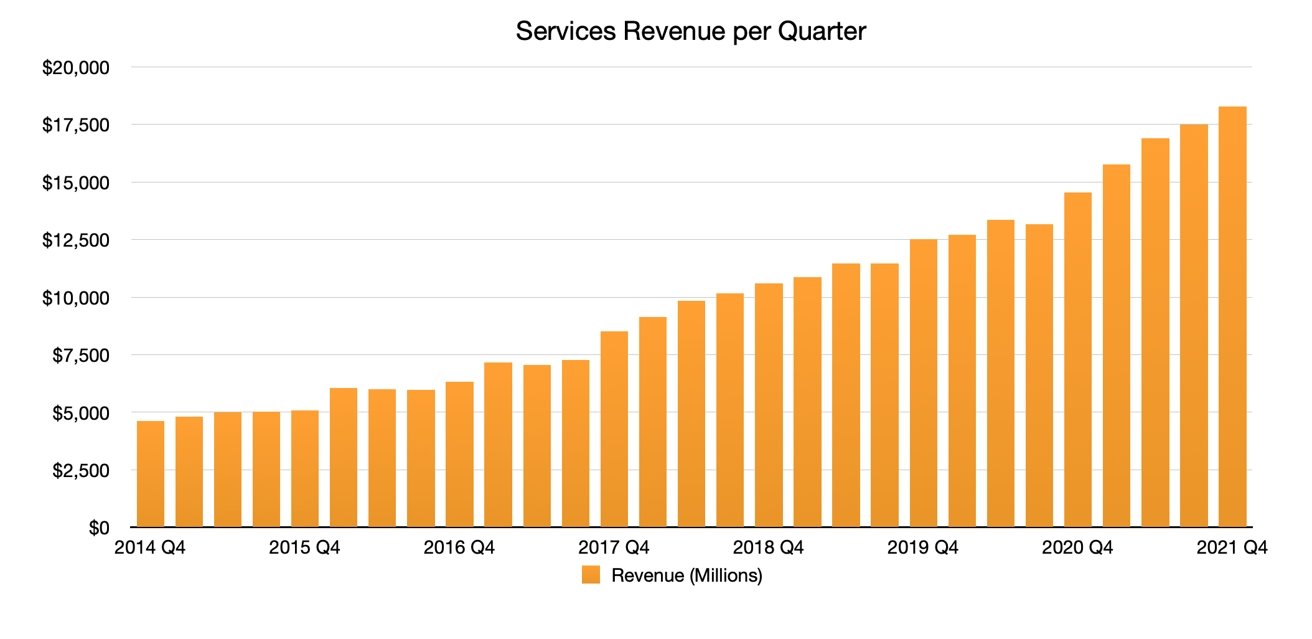

Even with the in general earnings miss out on, many of Apple’s other products strike or exceeded expectations. Even though Iphone profits also missed analyst targets, it was still a hefty raise around 2020. Apple’s iPad, Mac, and Expert services profits also rose 12 months-about-yr, with the latter two product or service classes achieving all-time highs.

Annually, Apple reported complete 2021 profits of $365.8 billion, up a enormous 33{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} from $274.5 billion the former 12 months. Although the organization did not offer official revenue assistance for the December quarter, it claimed it however expects healthier desire.

Here’s what money analysts assumed about Apple’s revenue pass up, and what they believe the firm’s upcoming will seem like in the next quarters.

Katy Huberty, Morgan Stanley

Apple’s September quarter was in-line with anticipations “under the hood,” in accordance to Morgan Stanley’s Katy Huberty. That is the moment you just take into account the source chain headwinds Apple faced during the quarter, she claims.

Whilst offer chain problems will likely dominate headlines, Huberty claims the much more vital elements to the Apple stock are robust Providers advancement, steering suggesting an in-line December quarter, Chinese demand outpacing other regions, and signals that issue towards a stronger-than-seasonal March quarter.

On the back again of the income miss and ongoing provide snarls, Huberty has reduced her 2022 revenue and earnings-for each-share estimates to $387.7 billion and $5.76, respectively.

Her 12-thirty day period Apple cost concentrate on has also fallen to $164, from $166. On the other hand, she maintains her Over weight rating of the Apple stock.

Daniel Ives, Wedbush

The primary concern affecting Apple is not demand for its merchandise, but its ability to meet up with that demand with supply, claims Wedbush analyst Daniel Ives. The analyst calls the present offer chain condition a “black cloud” that’s influencing just about every tech, vehicle, and purchaser company.

Ives thinks Apple is viewing need outstrip offer by about 10 million Apple iphone models globally. Nonetheless, over and above the full profits and Iphone income, the analyst notes that Apple’s other products and its Products and services company nonetheless arrived out in advance of his anticipations.

The analyst believes the troubles are transitory, and in no way has an effect on his long-term bullish see on Apple. Ives continue to expects the organization to hit a $3 trillion market place capitalization in 2022.

Ives maintains his 12-thirty day period Apple selling price focus on of $185 and his Outperform score for the inventory.

Krish Sankar, Cowen

Apple’s fiscal results for the September quarter were “overshadowed” by the $6 billion income overlook, and a identical effects on the December quarter will most likely be a most important aim likely forward. In spite of that, Krish Sankar of Cowen believes that sturdy demand can still travel healthier development.

The company’s income outcomes were 2{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} down below anticipations, although EPS was in-line with Wall Street anticipations. Sankar notes that the $6 billion in lost profits was greater than supply constraint estimates of about $3 billion, and mainly impacted the Apple iphone, iPad, and Mac.

Despite all of that, Sankar believes that strong buyer need and a greater common promoting rate (ASP) can continue to development 7{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} calendar year-in excess of-yr expansion in the fourth calendar quarter of 2021, which corresponds to Apple’s initially quarter of the calendar year and the busy getaway searching season.

Sankar has revised his December quarter sales estimate to $119.1 billion, and his EPS forecast to $1.90. He maintains his 12-month Apple price concentrate on of $180.

Samik Chatterjee, JP Morgan

Apple skipped both consensus earnings anticipations and JP Morgan’s Wall Avenue-significant forecast. Having said that, guide analyst Samik Chatterjee suggests that Apple’s steerage of a “quite stable” advancement in the December quarter should really notify investors that the consequences are only momentary.

Far more than that, the offer constraints will possible only thrust the timing in income and desire into foreseeable future quarters, Chatterjee says. He believes that the ingredient pressures usually are not probably to have an impact on overall desire for the Iphone or Mac.

To reflect that, Chatterjee has raised his quarterly earnings and earnings estimates for the impending fiscal intervals, unique Q1 2022. While the timing of the potent Apple iphone 13 cycle has been delayed, the analyst believes the magnitude of upside on Apple’s stock stays unchanged.

Chatterjee maintains his Leading Select rating for Apple and 12-month value concentrate on of $180.

Severe Kumar, Piper Sandler

Apple’s earnings overlook in the September quarter is a rare incidence, says Harsh Kumar of expense financial institution Piper Sandler. In spite of the supply chain constraints bleeding into the December quarter, Kumar still thinks Apple is very well-positioned to see calendar year-in excess of-calendar year development and profits data.

While the provide issues ended up greater than envisioned in Apple’s Q4 2021, there are signals that it will have a comparatively moderate effect on the company. Kumar points towards the better-than-anticipated Companies earnings, as well ongoing solid need for its hardware merchandise.

Kumar suggests that Apple’s aim on the purchaser, as evidenced by CEO Tim Cook’s solutions to analyst issues, is why the firm’s set up foundation grows each individual quarter. It is really also why he believes that demand from customers for the firm’s items is not going to perish amid the provide snarls. In other terms, the profits pass up will not have a “substance influence” on Apple’s company.

The analyst maintains his 12-thirty day period Apple price tag focus on of $175, and suggests the company is a customer on any Apple stock weakness.

Gene Munster, Loup Ventures

Stripping out the sound of provide difficulties reveals a sustainable expansion pattern for Apple, suggests Gene Munster, analyst and companion at Loup Ventures. He claims the quarterly earnings performed out as expected, with favorable demand from customers muted by tight offer.

Even so, at the rear of the headline news of the complications continuing into the December quarter is the reality that “Apple’s small business and outlook are more robust than ever,” Munster claims. He believes Apple will improve easily ahead of Wall Road anticipations in 2022.

Normalizing for supply headwinds, Munster states Apple is observing underlying progress in the mid-teens. Due to the fact of all those components, the analyst thinks the massive image of Apple driving the electronic acceleration is not likely to alter.

Munster maintains his 12-thirty day period to 24-month Apple value target of $200.