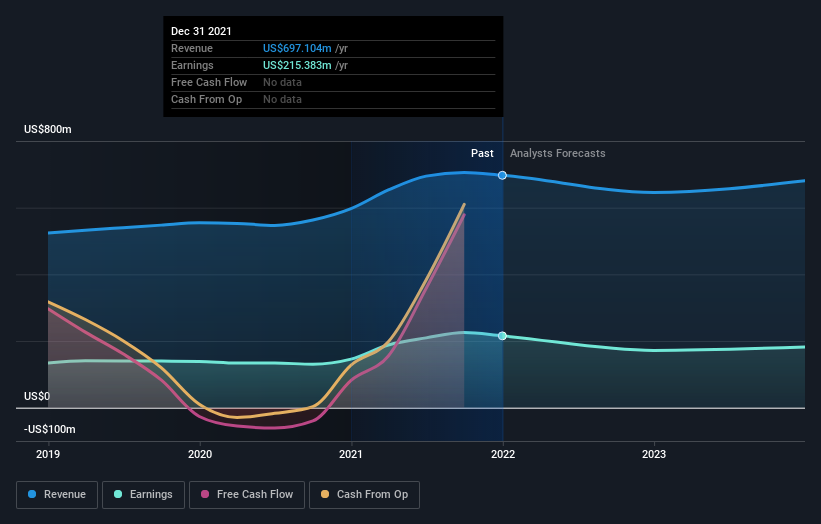

Final 7 days, you may possibly have observed that TowneBank (NASDAQ:City) released its yearly final result to the current market. The early reaction was not positive, with shares down 2.5{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} to US$31.12 in the past 7 days. It was a workmanlike result, with revenues of US$697m coming in 2.7{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} in advance of anticipations, and statutory earnings for each share of US$2.97, in line with analyst appraisals. Earnings are an important time for traders, as they can observe a firm’s functionality, look at what the analysts are forecasting for subsequent yr, and see if you will find been a modify in sentiment towards the business. Audience will be happy to know we have aggregated the most current statutory forecasts to see no matter if the analysts have transformed their mind on TowneBank following the hottest results.

Getting into account the latest success, the latest consensus, from the four analysts masking TowneBank, is for revenues of US$645.8m in 2022, which would reflect a perceptible 7.4{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} reduction in TowneBank’s profits in excess of the previous 12 months. Statutory earnings for every share are anticipated to dive 22{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} to US$2.34 in the identical period of time. Right before this earnings report, the analysts experienced been forecasting revenues of US$645.8m and earnings for every share (EPS) of US$2.34 in 2022. So it is really rather apparent that, whilst the analysts have current their estimates, there’s been no key modify in anticipations for the company following the hottest outcomes.

It will occur as no shock then, to find out that the consensus value target is mainly unchanged at US$35.50. That is not the only summary we can draw from this details on the other hand, as some investors also like to contemplate the distribute in estimates when assessing analyst price targets. There are some variant perceptions on TowneBank, with the most bullish analyst valuing it at US$36.00 and the most bearish at US$35.00 per share. Even so, with a comparatively close grouping of estimates, it appears like the analysts are rather self-assured in their valuations, suggesting TowneBank is an quick small business to forecast or the the analysts are all working with comparable assumptions.

A single way to get extra context on these forecasts is to appear at how they compare to both equally previous performance, and how other providers in the same business are accomplishing. These estimates indicate that product sales are anticipated to gradual, with a forecast annualised income decline of 7.4{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} by the conclusion of 2022. This suggests a considerable reduction from annual growth of 11{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} more than the final five decades. Review this with our info, which suggests that other corporations in the same market are, in mixture, expected to see their income mature 4.8{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} per 12 months. It really is rather very clear that TowneBank’s revenues are expected to complete substantially even worse than the wider business.

The Base Line

The most noticeable summary is that you can find been no key adjust in the business’ potential clients in modern situations, with the analysts holding their earnings forecasts continual, in line with former estimates. On the furthermore side, there ended up no significant adjustments to earnings estimates despite the fact that forecasts suggest revenues will complete even worse than the broader industry. There was no genuine change to the consensus price goal, suggesting that the intrinsic price of the business enterprise has not been through any major variations with the newest estimates.

With that said, the long-time period trajectory of the company’s earnings is a large amount extra critical than next year. We have forecasts for TowneBank likely out to 2023, and you can see them no cost on our system right here.

You should really always consider about challenges however. Situation in position, we’ve spotted 2 warning indicators for TowneBank you should really be knowledgeable of, and 1 of them is a little bit regarding.

Have comments on this posting? Anxious about the articles? Get in touch with us directly. Alternatively, e mail editorial-group (at) simplywallst.com.

This posting by Merely Wall St is basic in mother nature. We provide commentary based on historical info and analyst forecasts only utilizing an unbiased methodology and our articles are not supposed to be economical information. It does not constitute a recommendation to buy or provide any inventory, and does not acquire account of your targets, or your fiscal scenario. We purpose to deliver you extensive-expression centered investigation pushed by essential details. Observe that our examination may not element in the most recent cost-delicate company announcements or qualitative material. Only Wall St has no place in any shares pointed out.

The views and thoughts expressed herein are the sights and views of the author and do not automatically reflect individuals of Nasdaq, Inc.