Shares of AMD (NASDAQ: AMD) have dropped 36.9{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} this year, even as the desire for its goods remains robust and the enterprise sent spectacular Q1 benefits. The semiconductor giant mostly delivers x86 microprocessors, server and embedded processors, growth solutions, and technological innovation for gaming consoles and semi-personalized Process-on-Chip (SoC) merchandise.

Very last week, the firm hosted its Monetary Analyst Working day, which left Rosenblatt Securities analyst Hans Mosesmann impressed. The analyst came away bullish and reiterated a Road significant price target of $200 on the inventory subsequent the analyst working day presentation. Mosesmann’s value goal implies an upside prospective of 110.93{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} at existing degrees.

Allow us appear at the reasons behind analyst Mosesmann’s bullish stance.

The organization unveiled some important engineering and portfolio updates on Analyst Working day. This involves the Zen 4 core processor expected to be launched later this 12 months and the Zen 5 main processor that is likely to be released in 2024.

AMD also unveiled “an expanded portfolio of significant-efficiency, subsequent-generation CPUs, accelerators, knowledge processing models (DPUs), and adaptive computing products and solutions optimized for various workloads.”

Fiscal Updates

The semiconductor large announced that starting up with the Q2 final results, AMD will be updating its organization reporting segments that will be aligned with its close markets. These new company segments will be data facilities, embedded small business, consumer end markets, and gaming.

AMD current its money targets about the following 3 to four decades (very long expression) and now expects its revenues to develop at a Compounded Once-a-year Growth Amount (CAGR) of 20{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} and gross margin to exceed 57{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} as the company appears at a richer item blend and charge efficiencies.

The enterprise targets an operating margin in the mid-30s percentage in excess of the extensive time period and a totally free income move margin of extra than 25{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996}.

AMD believes these prolonged-time period targets are really a lot achievable looking at the total addressable sector is well worth $300 billion for its solutions.

As Dr. Lisa Su, AMD Chair and CEO pointed out in its Analyst Working day push release, “The shut of our transformational acquisition of Xilinx and our expanded portfolio of leadership compute engines supply AMD with sizeable alternatives to provide ongoing powerful income growth with powerful shareholder returns as we capture a bigger share of the diverse $300 billion market for our superior-functionality and adaptive solutions.”

Wall Street’s Choose

Analyst Mosesmann believes that “AMD warrants a premium P/E [price-to-earnings] various on the premise of a CPU/GPU share obtain, the addition of Xilinx’s wide-primarily based portfolio of FPGAs/IP [field programmable gate array /internet protocol] and a dollar content growth tale, which is multi-yr in mother nature.”

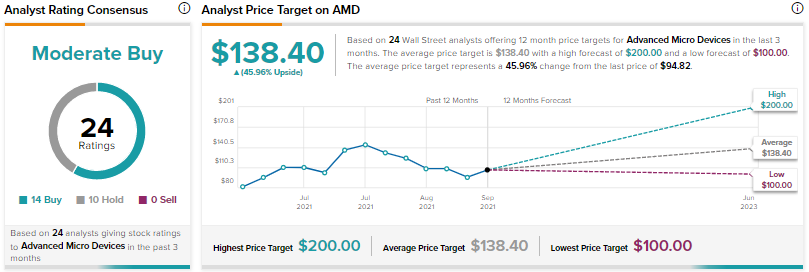

The relaxation of the analysts on the Avenue, nonetheless, are cautiously optimistic with a consensus score of Moderate Get based mostly on 14 Purchases and 10 Holds. The normal AMD rate goal is $138.40, which implies a 45.9{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996} upside potential to latest concentrations.

Base Line

AMD is seeing sturdy underlying demand from customers for its solutions, and analysts, which includes Mosesmann, are of the perspective that AMD will chip away at Intel’s market place share about the subsequent two to 3 several years. Considering this scenario, AMD inventory could soar bigger.

What is extra, the chip maker also scores a “Perfect 10” on the TipRanks Intelligent Score process, indicating that the inventory is highly likely to outperform the current market. The TipRanks Clever Rating system is a info-pushed, quantitative scoring program that analyses stocks on eight significant parameters and arrives up with a Clever Score ranging from 1 to 10. The higher the rating, the more most likely is the stock to outperform the market place.

Browse comprehensive Disclosure.