(Bloomberg) — Alibaba Team Holding Ltd. has moved a step nearer towards getting booted off US inventory exchanges for American inspectors not becoming capable to entry to economical audits.

Most Browse from Bloomberg

The US Securities and Trade Commission on Friday additional the major US-detailed Chinese firm to a increasing roster of firms that deal with removing because of Beijing’s refusal to permit American officers to overview their auditors’ operate. The publication of the businesses’ names, which was demanded by a 2020 legislation, begins a three-year clock to a closing delisting.

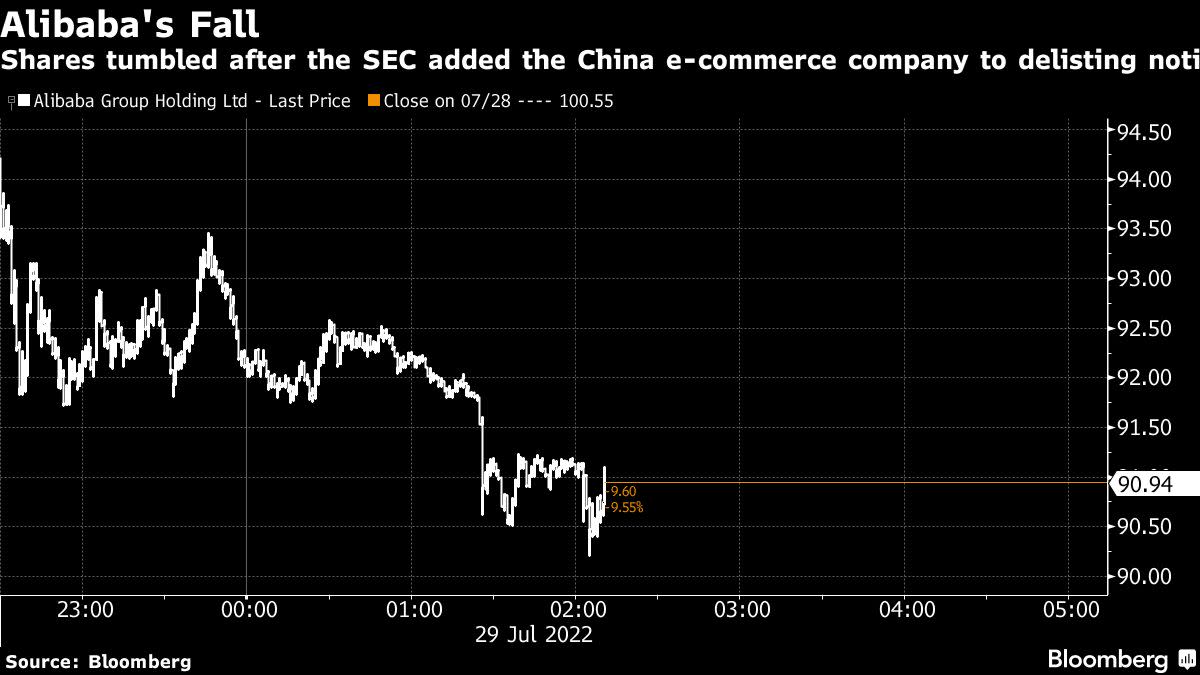

Alibaba extended declines after the SEC’s announcement, falling as much as 10{21df340e03e388cc75c411746d1a214f72c176b221768b7ada42b4d751988996}.

Wall Street’s most important watchdog is cracking down on New York-traded firms with dad or mum businesses based mostly in China and Hong Kong.

Dozens of other nations around the world permit the US audit inspections, offering American officers the go forward to job interview local accountants and scrutinize the documentation fundamental their perform. China and Hong Kong have refused, citing confidentiality laws and countrywide safety issues.

With the clock ticking, some Chinese companies like Alibaba and Kingsoft Cloud Holdings Ltd. claimed this week they are seeking main listings in Hong Kong, becoming a member of Bilibili Inc. and Zai Lab Ltd. which manufactured the go before. The swap could support companies tap far more Chinese buyers while providing a template for other US-shown Chinese corporations that confront delisting really should Washington and Beijing fail to settle audit disputes.

A most important listing is a precursor to becoming a member of the so-referred to as Inventory Connect plan, which will allow thousands and thousands of mainland investors to specifically obtain shares in Hong Kong. That frees up a large new pool of money that may well grow to be especially essential if China’s e-commerce chief will get delisted.

The SEC’s addition of companies from Alibaba to Pinduoduo Inc. to its record subsequent the publication of their 2021 annual fiscal statements has jarred world buyers.

Beijing has mentioned with American regulators the logistics of letting on-web page audit inspections of Chinese corporations stated in New York, Bloomberg Information reported in April, spurring hopes for some sort of offer. But Securities and Trade Fee Chair Gary Gensler has frequently said it is unclear if American and Chinese authorities will occur to an arrangement.

How U.S. Is Focusing on Chinese Firms for Delisting: QuickTake

Alibaba would be by far the most significant Chinese firm to get kicked off US bourses if regulators are unsuccessful to strike a pact. The company has argued that, since its 2014 New York IPO, its accounts have been audited by globally acknowledged accounting companies and need to meet regulatory expectations.

Previously this 7 days, Gensler reiterated that Chinese and American officials have to have to attain a deal “very soon” for the following ways to choose spot to avoid a halt to the corporations buying and selling on US exchanges.

(Updates with share price tag in third paragraph.)

Most Read through from Bloomberg Businessweek

©2022 Bloomberg L.P.